Key Takeaways

- Strategic investments and technological advancements position Walker & Dunlop for increased market presence, impacting revenue, efficiency, and margins positively.

- Strong GSE activity and HUD lending growth expected to enhance transaction volumes, net margins, and future earnings.

- Exposure to interest rate volatility, credit risks, and heavy reliance on GSEs threatens Walker & Dunlop's revenue, while competition pressures net margins.

Catalysts

About Walker & Dunlop- Through its subsidiaries, originates, sells, and services a range of multifamily and other commercial real estate financing products and services for owners and developers of real estate in the United States.

- Walker & Dunlop's strategic investments in their workforce, brand, and technology position the company to increase revenues and expand market presence as the commercial real estate market continues to recover. This is expected to positively impact revenue and earnings.

- The company anticipates a strong finish for 2024 with the Government-Sponsored Enterprises (GSEs), Fannie Mae and Freddie Mac, due to their regained market activity and capacity. This presence should drive higher transaction volumes and improve net margins and earnings.

- There is potential for increased mortgage servicing rights (MSRs) revenue due to higher GSE loan volumes, anticipated reversion to higher servicing fees, and longer loan durations as interest rates stabilize. These factors are expected to boost future cash earnings and adjusted EBITDA.

- Walker & Dunlop has capitalized on growth in HUD lending volumes, ascending to the second-largest HUD multifamily lender, with affordable housing being a focal point for future growth. This should enhance revenue streams and margins given the demand in this sector.

- Technological advancements, including the use of AI and data analytics, have improved operational efficiencies and customer service. This technological edge is expected to drive up transaction volumes and scale operations without a proportional increase in costs, thereby increasing net margins and earnings.

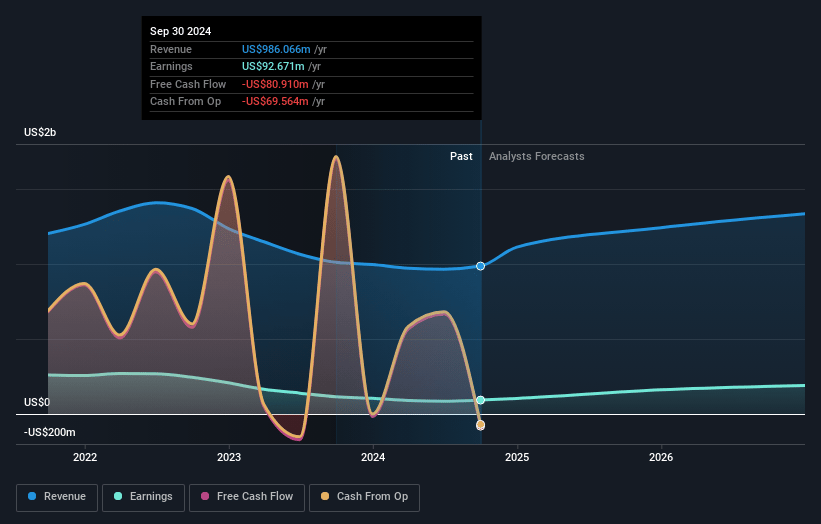

Walker & Dunlop Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Walker & Dunlop's revenue will grow by 12.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.4% today to 16.2% in 3 years time.

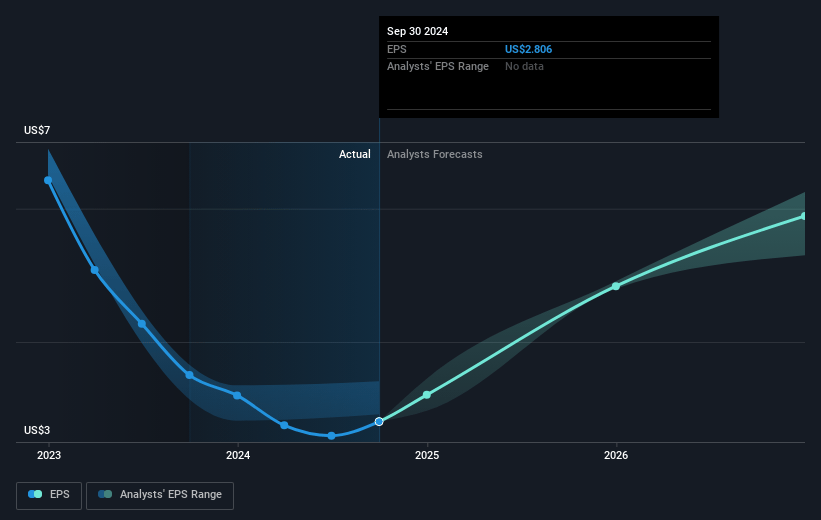

- Analysts expect earnings to reach $226.6 million (and earnings per share of $6.73) by about January 2028, up from $92.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.9x on those 2028 earnings, down from 35.0x today. This future PE is greater than the current PE for the US Diversified Financial industry at 18.5x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.07%, as per the Simply Wall St company report.

Walker & Dunlop Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Exposure to interest rate volatility: Changes in long-term interest rates could impact Walker & Dunlop’s transaction volumes and refinancing activities, potentially affecting their revenue and net earnings.

- Credit risk and loan defaults: Increases in provisions for credit losses and defaults on loans within their at-risk portfolio could affect their net margins and financial stability.

- Dependence on GSEs: Potential operational slowdowns or policy changes at Fannie Mae and Freddie Mac could limit Walker & Dunlop's ability to process loans, impacting revenue.

- Slow growth in affordable equity revenues: Declines in syndication and asset dispositions due to external market factors could negatively affect revenue from affordable housing segments.

- Competition and fee pressure: Aggressive competition in large transactions might lead to reduced fee income, affecting net margins even as transaction volumes rise.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $116.67 for Walker & Dunlop based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $226.6 million, and it would be trading on a PE ratio of 20.9x, assuming you use a discount rate of 7.1%.

- Given the current share price of $96.07, the analyst's price target of $116.67 is 17.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives