Last Update 20 Sep 25

Fair value Increased 4.50%Despite ongoing challenges in mortgage origination and limited near-term sector catalysts, Radian Group’s balanced business model and strong operating trends have led analysts to raise their price target modestly from $37.00 to $38.67.

Analyst Commentary

- Challenging mortgage origination environment persists, impacting growth outlook.

- Balanced business models with meaningful servicing segments are favored for resilience.

- Strong operating trends among mortgage insurers have been maintained year-to-date.

- Lack of near-term positive catalysts limits upside potential in the sector.

- Modest increase in credit risk anticipated as home price appreciation slows in the latter half of 2025, keeping valuations range-bound.

What's in the News

- Board approved amendment to bylaws implementing Delaware forum selection for internal corporate claims and exclusive federal court jurisdiction for Securities Act claims.

- Announced divestiture of Mortgage Conduit, Title, and Real Estate Services businesses from the "All Other" segment, with board approval and expected completion by Q3 2026; affected businesses to be reported as discontinued operations.

- Completed repurchase of 6,957,942 shares (4.93%) for $223.06 million as part of ongoing buyback, totaling 25,725,683 shares (17.33%) for $787.63 million under the January 2023 program.

- No shares repurchased under the buyback program announced on May 21, 2025.

Valuation Changes

Summary of Valuation Changes for Radian Group

- The Consensus Analyst Price Target has risen slightly from $37.00 to $38.67.

- The Future P/E for Radian Group has risen slightly from 9.65x to 10.09x.

- The Discount Rate for Radian Group remained effectively unchanged, moving only marginally from 7.77% to 7.79%.

Key Takeaways

- High housing demand and tight supply, combined with favorable legislation, are driving increased demand for Radian's mortgage insurance, supporting revenue growth and portfolio stability.

- Operational efficiency, data-driven risk management, and prudent capital allocation are strengthening earnings and expanding net margins for the company.

- Heavy dependence on mortgage insurance and slow diversification efforts increase vulnerability to market shifts, regulatory changes, and ongoing profitability challenges across non-core segments.

Catalysts

About Radian Group- Engages in the mortgage and real estate services business in the United States.

- The ongoing entry of millennials and first-time homebuyers into the housing market is driving persistently strong housing demand, which is reflected in Radian's all-time high mortgage insurance in force and continued growth in new insurance written-supporting future revenue growth.

- Housing supply constraints and elevated home prices are resulting in higher loan-to-value ratios, which increases the need for private mortgage insurance providers like Radian and bolsters the long-term stability of premium revenue and portfolio persistency.

- Radian's use of proprietary data analytics and risk-based pricing allows for dynamic portfolio management and efficient underwriting, which improves loss ratios and helps maintain or expand net margins over time.

- The passage of legislation making mortgage insurance premiums tax-deductible further incentivizes consumers to utilize private mortgage insurance, potentially driving higher demand and positively impacting revenue growth in the coming years.

- The company's ongoing operational efficiency initiatives, including an 8% reduction in annual operating expenses, combined with prudent capital allocation and robust liquidity, support stronger earnings, improved net margins, and enhanced return of capital to shareholders.

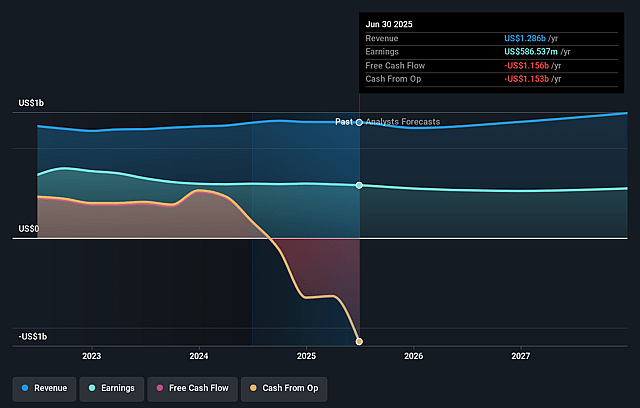

Radian Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Radian Group's revenue will grow by 2.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 45.6% today to 37.7% in 3 years time.

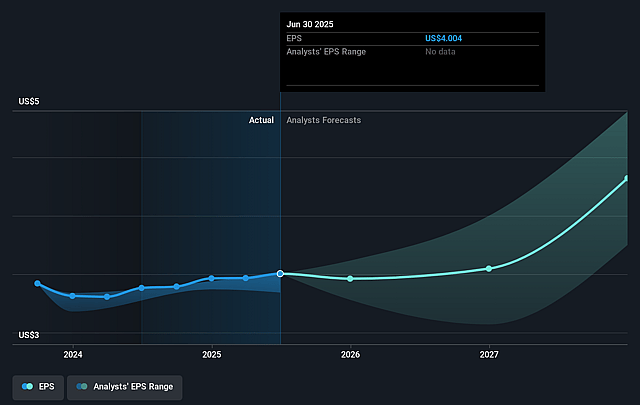

- Analysts expect earnings to reach $518.3 million (and earnings per share of $4.82) by about September 2028, down from $586.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.6x on those 2028 earnings, up from 8.0x today. This future PE is lower than the current PE for the US Diversified Financial industry at 16.5x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.77%, as per the Simply Wall St company report.

Radian Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued heavy reliance on the mortgage insurance business, with limited diversification and ongoing losses in "All Other" segments, exposes Radian Group to heightened earnings volatility and top-line revenue risk if mortgage origination volumes slow or industry dynamics shift unfavorably.

- Discontinuation of technology investment in the Real Estate Tech (formerly Home Genius) business and restructuring of non-core segments signal challenges in achieving meaningful diversification and risk missing out on fintech-driven efficiencies, potentially affecting future net margins and competitive positioning.

- Mark-to-market volatility and sustained operating losses in the Mortgage Conduit business, as well as sluggish growth in non-insurance subsidiaries, highlight execution risk and could continue to be a drag on company-wide profitability and net earnings.

- Persistent housing affordability challenges, driven by high home prices and elevated interest rates, may suppress first-time homebuyer activity-a key demographic for Radian's mortgage insurance products-posing structural headwinds to future revenue growth.

- Dependence on regulatory and statutory net income from Radian Guaranty to fund holding company dividends and liquidity heightens sensitivity to potential regulatory changes or economic downturns; tighter capital requirements or adverse credit cycle developments could constrain capital distributions and negatively affect shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $37.0 for Radian Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $518.3 million, and it would be trading on a PE ratio of 9.6x, assuming you use a discount rate of 7.8%.

- Given the current share price of $34.83, the analyst price target of $37.0 is 5.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Radian Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.