Key Takeaways

- Regulatory scrutiny and industry competition threaten to increase costs and compress margins, making it harder to sustain historical revenue and earnings growth.

- Shifts toward passive investing, changing client demographics, and reliance on private credit expose Blue Owl to ongoing fundraising and earnings headwinds.

- Stable, fee-driven revenues and strategic diversification position Blue Owl Capital for resilient growth, enhanced profitability, and market share gains in evolving private market environments.

Catalysts

About Blue Owl Capital- Operates as an alternative asset manager in the United States.

- Persistent, intensifying regulatory scrutiny on alternative asset managers poses a growing risk to Blue Owl's long-term expansion plans, potentially resulting in materially higher compliance costs and constraints on fee-generating activities, which could depress net margins and earnings growth.

- The accelerating shift toward passive, low-fee investment strategies and exchange-traded funds threatens to reduce overall allocations to actively managed private market vehicles, causing a structural headwind for Blue Owl's fundraising pipeline, fee revenue, and fee-related earnings over the coming years.

- An overreliance on private credit strategies exposes Blue Owl to heightened credit risk; any normalization of credit conditions, increase in borrower defaults, or macroeconomic downturn could lead to substantial loan losses, write-downs, and a compression of net margins, directly reducing future earnings and undermining the durability narrative.

- As demographic trends like aging populations or pension fund de-risking progress, core clients could shift away from higher-yield, less liquid investments, causing long-term pressure on fundraising activities, assets under management growth, and ultimately, recurring management fee streams.

- Intensifying competition from traditional asset managers ramping up their presence in alternatives, as well as new fintech entrants, is likely to erode pricing power and fee structures across the industry, resulting in ongoing margin compression and amplified difficulty in sustaining historical revenue and earnings growth rates for Blue Owl Capital.

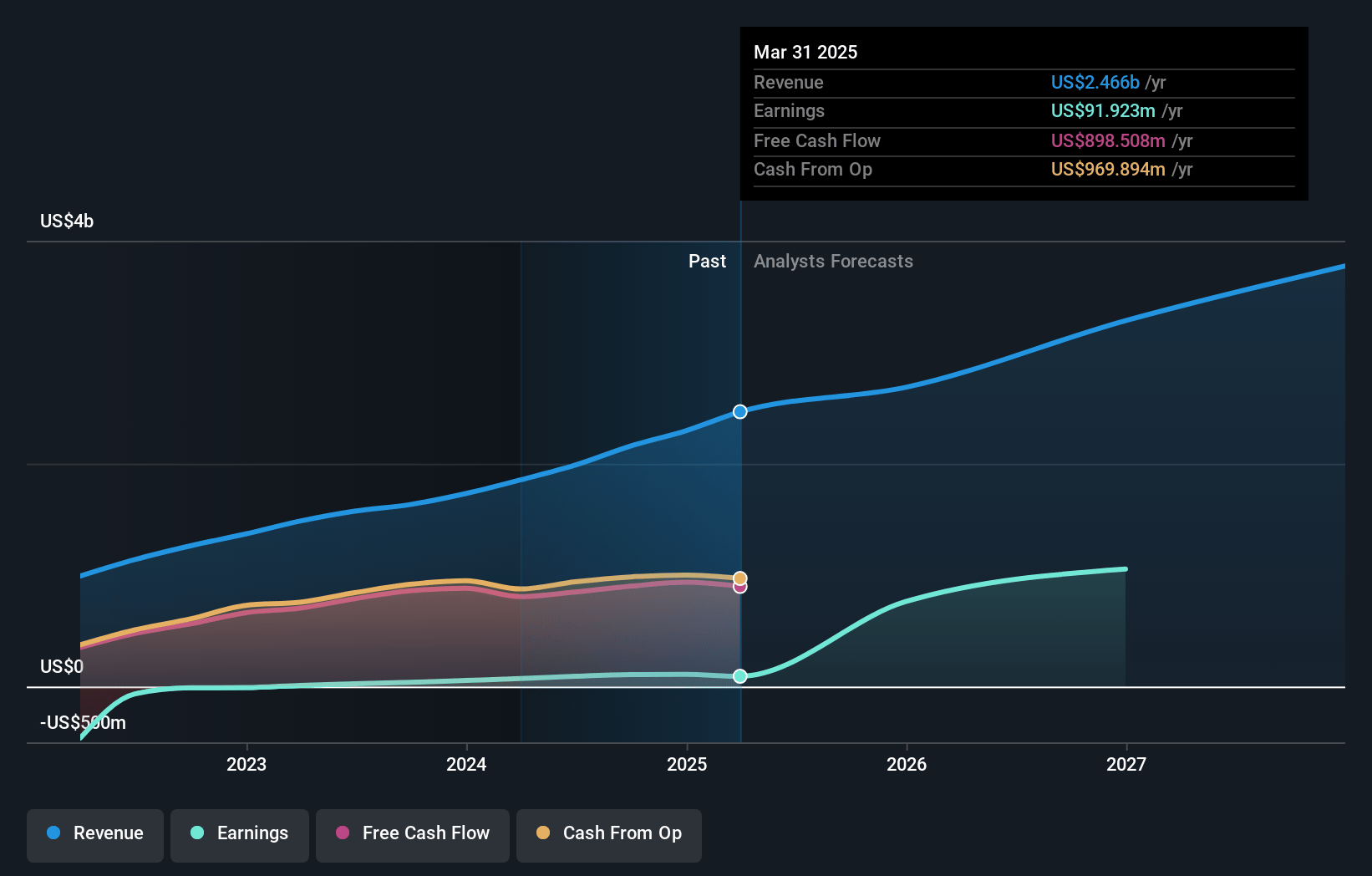

Blue Owl Capital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Blue Owl Capital compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Blue Owl Capital's revenue will grow by 17.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.7% today to 51.3% in 3 years time.

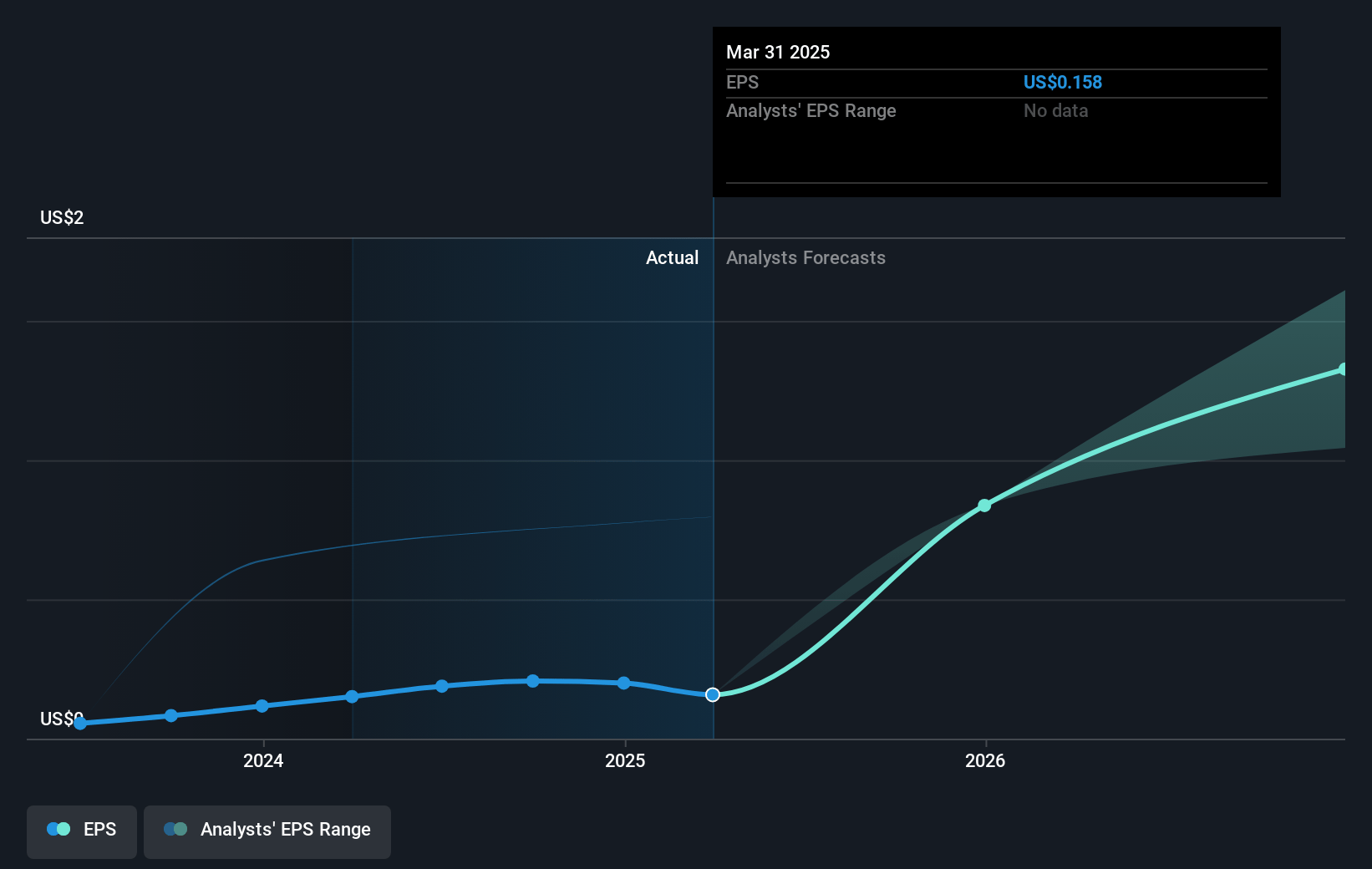

- The bearish analysts expect earnings to reach $2.1 billion (and earnings per share of $2.68) by about July 2028, up from $91.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 20.9x on those 2028 earnings, down from 141.6x today. This future PE is lower than the current PE for the US Capital Markets industry at 28.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.86%, as per the Simply Wall St company report.

Blue Owl Capital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Blue Owl Capital benefits from highly resilient, fee-driven revenue streams with approximately 90 percent of management fees tied to permanent capital vehicles, which supports revenue stability and earnings predictability even during volatile market periods.

- Long-term secular demand for private credit, alternatives, and private wealth products remains robust, with strong inflows from both institutional and retail investors-supported by low penetration rates in large addressable markets such as wealth management channels-providing significant runway for future AUM, revenue, and net margin expansion.

- The company's ongoing innovation and diversification of strategies-including expansion into digital infrastructure, net lease, real estate credit, and GP stakes-enables it to capture outsized growth in sectors with favorable secular demand, leading to enhanced fee-related earnings, recurring revenues, and operating leverage over time.

- During periods of public market dislocation or reduced activity in syndicated markets, Blue Owl gains market share as borrowers increasingly turn to direct lending and private markets, allowing for higher spreads and better risk-adjusted returns, which can result in stronger net margins and earnings growth.

- Blue Owl's consistent record of double-digit annual management fee and fee-related earnings growth over multiple years, including through periods of inflation, rising rates, and geopolitical instability, demonstrates the durability of its business model and positions the company for continued long-term improvement in revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Blue Owl Capital is $17.36, which represents two standard deviations below the consensus price target of $22.73. This valuation is based on what can be assumed as the expectations of Blue Owl Capital's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $17.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $4.0 billion, earnings will come to $2.1 billion, and it would be trading on a PE ratio of 20.9x, assuming you use a discount rate of 7.9%.

- Given the current share price of $20.8, the bearish analyst price target of $17.36 is 19.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.