Last Update07 May 25Fair value Decreased 8.92%

Key Takeaways

- Merging OTF and OTF II solidifies Blue Owl's leadership in technology-focused BDCs and boosts future revenue through increased management fees.

- Strong fundraising and focus on high-growth sectors like digital infrastructure support earnings growth, while a fee-driven model offers stability and predictable revenue.

- Reliance on the U.S. market and management fees may constrain growth amid market volatility and tightening institutional fundraising conditions.

Catalysts

About Blue Owl Capital- Operates as an alternative asset manager in the United States.

- The completion of the merger of OTF and OTF II is expected to make OTF the largest technology-focused BDC in the public market, driving an additional $135 million of incremental annual management fees, boosting future revenue and earnings.

- The company has over $23 billion of AUM that will begin to pay management fees once fully deployed, potentially increasing management fee revenue by $290 million or 13% growth off current fees, enhancing future revenue.

- Blue Owl's continued success in fundraising, with nearly $30 billion raised in equity over the last 12 months, shows a 76% increase from the previous year’s numbers; this positions the company for continued growth in earnings through increased AUM and associated management fees.

- The successful closing of Digital Infrastructure Fund III at its $7 billion hard cap demonstrates Blue Owl's ability to capitalize on demand in high-growth sectors like digital infrastructure, indicating potential earnings growth from management fees and deployment opportunities.

- Blue Owl's highly defensive, management fee-driven business model with approximately 90% of fees from permanent capital provides stability and predictability in volatile markets, suggesting potential margin expansion and steady revenue streams moving forward.

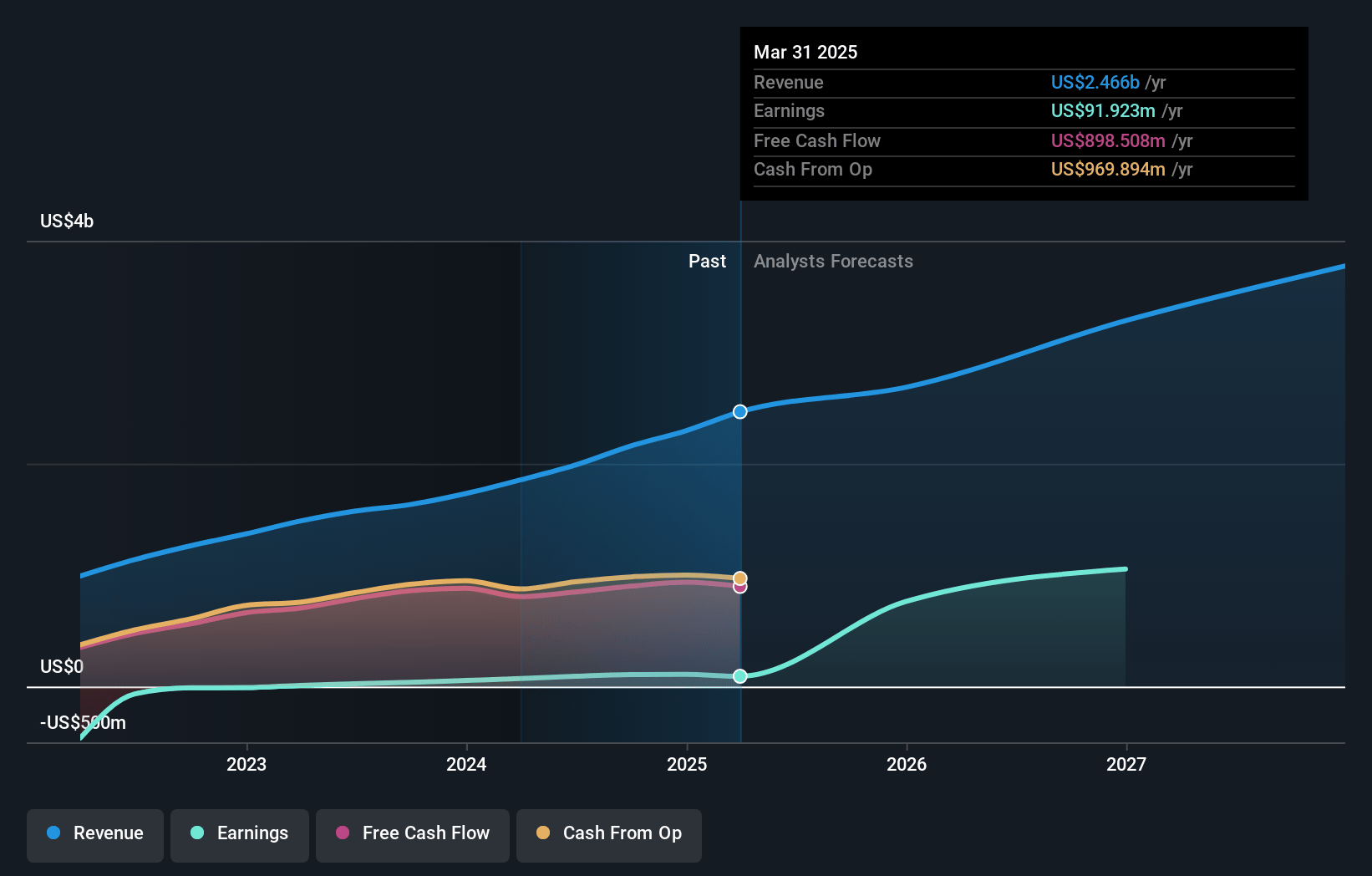

Blue Owl Capital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Blue Owl Capital's revenue will grow by 17.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.7% today to 87.2% in 3 years time.

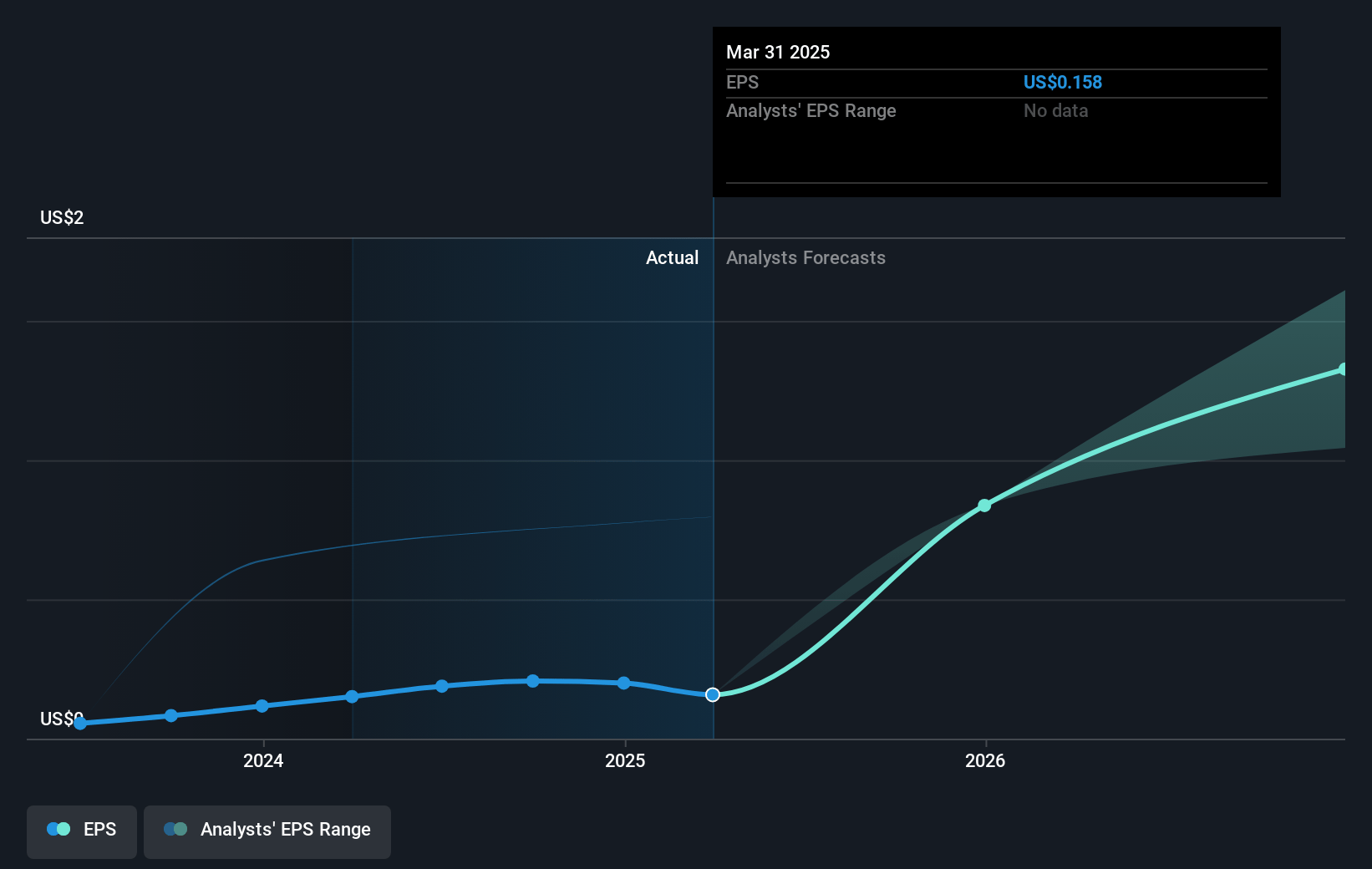

- Analysts expect earnings to reach $3.5 billion (and earnings per share of $1.18) by about May 2028, up from $91.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.6x on those 2028 earnings, down from 121.5x today. This future PE is lower than the current PE for the US Capital Markets industry at 25.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.42%, as per the Simply Wall St company report.

Blue Owl Capital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- High levels of market volatility and uncertainties, such as geopolitical tensions, potential recessions, and global tariffs, could impact consumer demand and economic growth, which may adversely affect revenue growth.

- Blue Owl Capital's dependence on the U.S. market, while largely shielding it from tariff impacts, limits its geographical diversification, potentially constraining revenue growth and exposing it to domestic economic downturns.

- As the environment tightens for institutional fundraising, particularly with reducing global economic growth, the expected acceleration in institutional capital inflows might not materialize as predicted, impacting revenue and earnings growth projections.

- Dependence on management fees for predictable earnings might limit upside potential when market conditions improve, potentially impacting earnings growth if market participants shift towards equity-driven or performance fee models.

- The assumption of continued growth in market share amidst declining M&A activity could prove overly optimistic, affecting net margins and revenue progression if market competition or economic conditions do not favor private lending.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $21.672 for Blue Owl Capital based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $17.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.0 billion, earnings will come to $3.5 billion, and it would be trading on a PE ratio of 14.6x, assuming you use a discount rate of 7.4%.

- Given the current share price of $17.85, the analyst price target of $21.67 is 17.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.