Key Takeaways

- Stabilization in asset cap rates and increased property acquisitions could drive revenue growth by boosting transaction volume.

- Restructuring CLO transactions with favorable pricing may reduce borrowing costs, enhancing net margins and earnings stability.

- High-risk loans, uncertain policies, and reliance on the multifamily market could threaten Lument Finance Trust's earnings, profitability, and growth.

Catalysts

About Lument Finance Trust- A real estate investment trust, focuses on investing in, financing, and managing a portfolio of commercial real estate (CRE) debt investments in the United States.

- The stabilization in asset cap rates and an increase in property acquisition activity could lead to revenue growth as more deals are closed, boosting transaction volume.

- The ability to pursue and close attractive lending opportunities, despite current investment capacity limits, positions the company for revenue growth through increased loan origination.

- Potential recapitalization or restructuring of existing CLO transactions with favorable new pricing could reduce borrowing costs, potentially improving net margins and earnings stability.

- The positive resolution on riskier loans and preventing additions to loss reserves indicates strong asset management capability, which could protect or enhance net margins by minimizing potential write-offs or losses.

- Proactive management and selective leveraging of available extensions on loans may extend portfolio terms productively, maintaining interest income levels and positively impacting earnings stability.

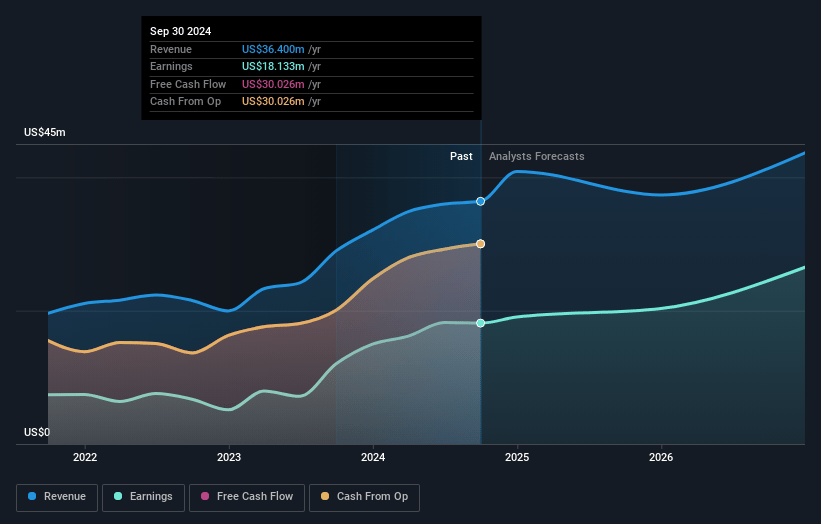

Lument Finance Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lument Finance Trust's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 49.8% today to 65.5% in 3 years time.

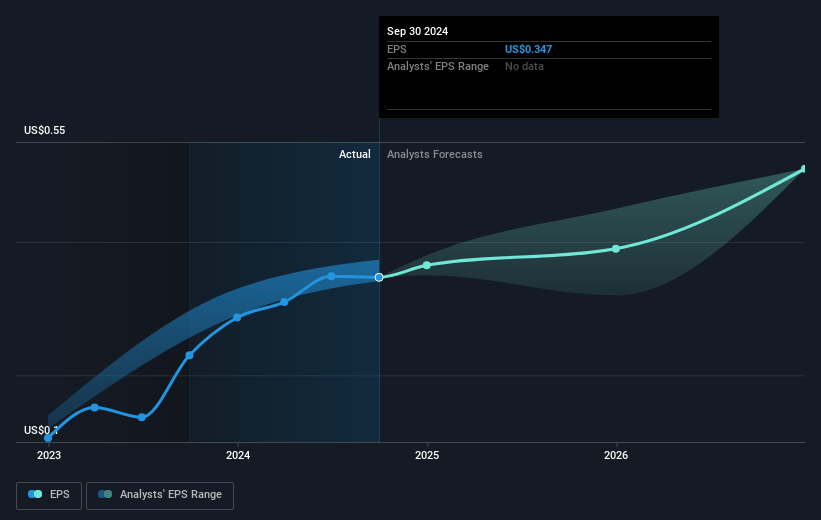

- Analysts expect earnings to reach $28.2 million (and earnings per share of $0.54) by about January 2028, up from $18.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.2x on those 2028 earnings, down from 7.5x today. This future PE is lower than the current PE for the US Mortgage REITs industry at 11.4x.

- Analysts expect the number of shares outstanding to decline by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.18%, as per the Simply Wall St company report.

Lument Finance Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The continued high-risk rating of certain loans, including multiple loans rated as 5 due to defaults, poses a risk to the company's credit quality, potentially impacting net margins and earnings if losses occur.

- The uncertainty around government policies, which could affect economic conditions, may impact the performance of the real estate market, thereby affecting Lument Finance Trust's revenue from loans and investments.

- Limited reinvestment capacity due to fully deployed financing and the deleveraging of an existing CLO without a reinvestment period may constrain revenue growth unless new financing is secured.

- The company's reliance on the multifamily market means any downturn or unexpected issues in this sector could affect its earnings and profitability, particularly if rents do not grow as anticipated.

- Potential delays in refinancing or recapitalizing existing financial structures, such as the CLO, amidst market uncertainties, could affect the firm's ability to manage its portfolio efficiently, impacting both earnings and book value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $3.0 for Lument Finance Trust based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $43.1 million, earnings will come to $28.2 million, and it would be trading on a PE ratio of 7.2x, assuming you use a discount rate of 10.2%.

- Given the current share price of $2.59, the analyst's price target of $3.0 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives