Narratives are currently in beta

Key Takeaways

- Strategic focus on core assets and international expansion are expected to drive revenue growth and improve operational efficiency.

- Divestiture of non-core assets and cloud modernization enhance potential for increased earnings and shareholder returns.

- Uncertain macroeconomic conditions and strategic divestitures may limit Global Payments' short-term revenue growth as it refocuses on its core businesses.

Catalysts

About Global Payments- Provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific.

- Global Payments is simplifying and streamlining its business by refocusing its strategy and consolidating its POS assets under the Genius brand, enhancing growth and efficiency, and expected to increase return on invested capital, thereby impacting operating margins and revenue.

- The company's international expansion of POS offerings and its entry into new markets such as Germany, Mexico, and other European countries is expected to drive revenue growth through increased market share internationally.

- The ongoing transformation efforts, including the unification of teams and capabilities, is projected to enhance Global Payments' operational performance and expand net margins due to improved efficiency and scale.

- The divestiture of non-core assets like AdvancedMD helps simplify Global Payments’ operations, allowing the company to focus on high-growth potential areas, expected to positively impact earnings and accelerate capital returns to shareholders.

- Cloud modernization in Issuer Solutions with new product offerings and strategic renewal of top clients is anticipated to provide greater revenue stability and growth, while also offering improvements in operating margins through enhanced operational efficiencies.

Global Payments Future Earnings and Revenue Growth

Assumptions

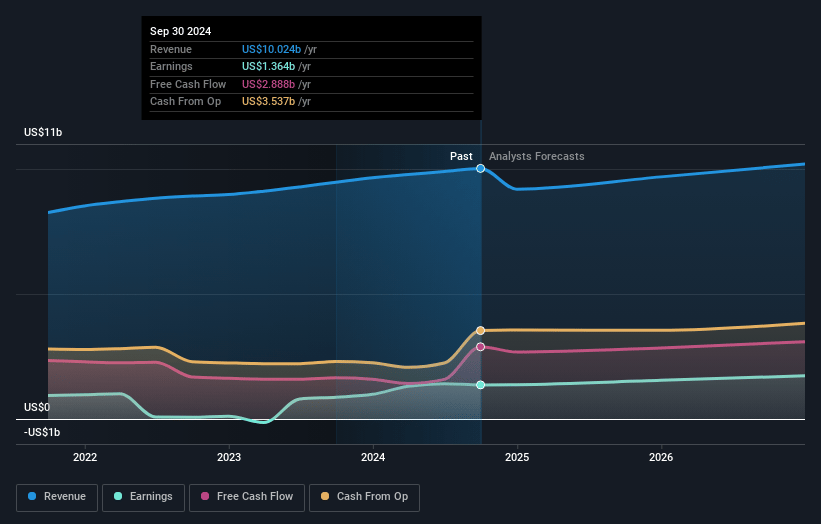

How have these above catalysts been quantified?- Analysts are assuming Global Payments's revenue will grow by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.6% today to 17.9% in 3 years time.

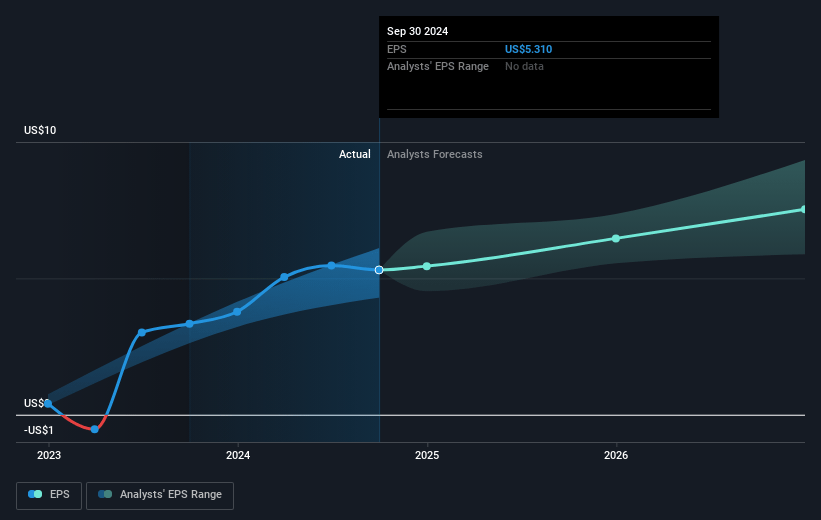

- Analysts expect earnings to reach $1.9 billion (and earnings per share of $8.51) by about January 2028, up from $1.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.2 billion in earnings, and the most bearish expecting $1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.5x on those 2028 earnings, down from 20.6x today. This future PE is greater than the current PE for the US Diversified Financial industry at 18.5x.

- Analysts expect the number of shares outstanding to decline by 4.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.99%, as per the Simply Wall St company report.

Global Payments Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The uncertain macroeconomic environment has led to softer-than-expected volumes, particularly in commercial card transactions and related issuer businesses, which could slow down revenue and earnings growth in the near term.

- Economic conditions affecting consumer and commercial spending may impact the company's core payments, issuer solutions, and SMB volumes, potentially limiting revenue growth.

- Regulatory and compliance complexities, particularly in the healthcare sector, have prompted the sale of the AdvancedMD business, which may affect revenue and margins.

- The strategic divestitures, including the planned exit from certain smaller international geographies and lines of business, could lead to a reduction in total revenue in the short term as the company focuses on its core business.

- Delays in product and project investments by financial institution partners, given macro uncertainty, could impact revenue growth in the Issuer Solutions segment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $132.32 for Global Payments based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $172.57, and the most bearish reporting a price target of just $92.83.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $10.6 billion, earnings will come to $1.9 billion, and it would be trading on a PE ratio of 19.5x, assuming you use a discount rate of 8.0%.

- Given the current share price of $110.38, the analyst's price target of $132.32 is 16.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

MA

Maxell

Community Contributor

Global Payments will reach new heights with a 34% upside potential

EXECUTIVE SUMMARY 12-Month Price Target: $142 Current Price: $105.71 Implied Upside: 34.3% Rating: STRONG BUY Risk Assessment: MODERATE INVESTMENT THESIS Global Payments (GPN) presents a compelling investment opportunity at current levels, with three key catalysts driving potential outperformance in 2025: Q4 2024 momentum in Merchant Solutions with strong POS adoption (added ~3,000 new locations) Strategic sale of AdvancedMD for $1.125 billion at attractive multiple with $700M earmarked for shareholder returns Successful integration of EVO Payments enhancing B2B capabilities and geographic reach VALUATION METHODOLOGY Our $142 price target reflects: Forward P/E multiple of 13x (below historical average, reflecting current market dynamics) applied to our 2025 EPS estimate of $10.92 EV/EBITDA multiple of 11x on projected 2025 EBITDA, reflecting recent sector compression DCF analysis using 9.5% WACC (adjusted for higher rate environment) and 3% terminal growth KEY GROWTH DRIVERS Recent Performance Highlights Q3 2024 adjusted net revenue increased 6% to $2.36 billion Adjusted operating margin expanded 40 basis points to 46.1% Added 92 new software partners in Q3, up 60% year-over-year Macro Environment U.S. GDP growth projected at 2.4% for 2025, supporting payment volumes Fed funds rate expected to decrease to 3.88%, reducing funding costs Resilient high-income consumer spending evidenced by recent holiday data RISK FACTORS Near-term margin pressure from technology investments and compensation costs Integration execution risk from recent acquisitions Increasing competition in digital payments space Potential policy changes under new administration FINANCIAL METRICS Key Financial Metrics for Q4 2024E: Revenue Growth: 5-6% Operating Margin: 46.1% EPS Growth: 11-12% Free Cash Flow Conversion: 92% Projected Metrics for 2025E: Revenue Growth: 8-9% Operating Margin: 46.6% EPS Growth: 13-14% Free Cash Flow Conversion: 93% STRATEGIC POSITIONING Recent developments reinforce GPN's leadership in: Integrated payments with strong new partner acquisition B2B payments expansion through EVO integration Software-driven solutions with continued innovation International market penetration RECOMMENDATION RATIONALE Our STRONG BUY recommendation at current price of $105.71 is based on: Current valuation represents significant discount to intrinsic value Strong Q3 2024 execution with improving operating leverage Strategic initiatives creating clearer growth path Robust free cash flow generation supporting shareholder returns

View narrativeUS$142.00

FV

20.5% undervalued intrinsic discount13.04%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

13users have followed this narrative

13 days ago author updated this narrative