Last Update07 May 25Fair value Increased 0.16%

Key Takeaways

- Accelerated international expansion, advanced fintech platforms, and deep AI integration are fueling stronger margins, recurring revenue, and improved earnings quality.

- Strategic M&A and growing financial institution partnerships are strengthening product reach, boosting revenue stability, and enhancing long-term growth potential.

- Legacy technology reliance, fintech competition, regulatory burdens, client concentration, and acquisition risks threaten revenue growth, margins, and long-term competitiveness.

Catalysts

About Fiserv- Provides payments and financial services technology solutions in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally.

- The accelerating international expansion of Clover, Fiserv's point-of-sale platform, into key markets such as Brazil, Australia, Mexico, Singapore, and across Europe expands the company’s global footprint and exposes it to rising digital transaction volumes as economies progressively shift to cashless payment models. This broadening addressable market is expected to provide a sustained boost to top-line revenue growth and to further improve margins as new markets scale and value-added services attach.

- Fiserv's continued investment in advanced cloud-based, API-driven fintech platforms positions the company as a critical infrastructure provider for banks and merchants undergoing digital transformation. As financial institutions seek scalable, secure, and integrated payment solutions, Fiserv’s cloud offerings (such as Finxact and CoreAdvance) are poised to drive higher recurring software and platform fees, improving long-term earnings quality and supporting net margin expansion.

- The deep integration of artificial intelligence and data analytics throughout Fiserv’s merchant and banking platforms (including new authorization optimization tools, data-as-a-service, and risk scoring for credit solutions) is beginning to deliver improved authorization rates, cross-selling opportunities, and operational efficiency. These enhancements should raise both revenue per client and net margins over time.

- Strategic M&A, illustrated by recent acquisitions of companies like Payfare, CCV Group, Pinch Payments, and Money Money, is strengthening Fiserv’s product suite and market reach, particularly in embedded finance and omnichannel payments. As these acquisitions mature and are fully integrated, they are expected to be accretive to revenue and earnings, supporting long-term EPS growth above current expectations.

- The company’s expanding network of financial institution partnerships—evidenced by the rapid increase in new bank and credit union signings, and deepening cross-Fiserv bundle adoption—is cementing Fiserv’s role at the intersection of banking and commerce. This growing, recurring client base underpins revenue stability, while the ability to offer bundled solutions increases average contract value and supports strong adjusted operating margin expansion.

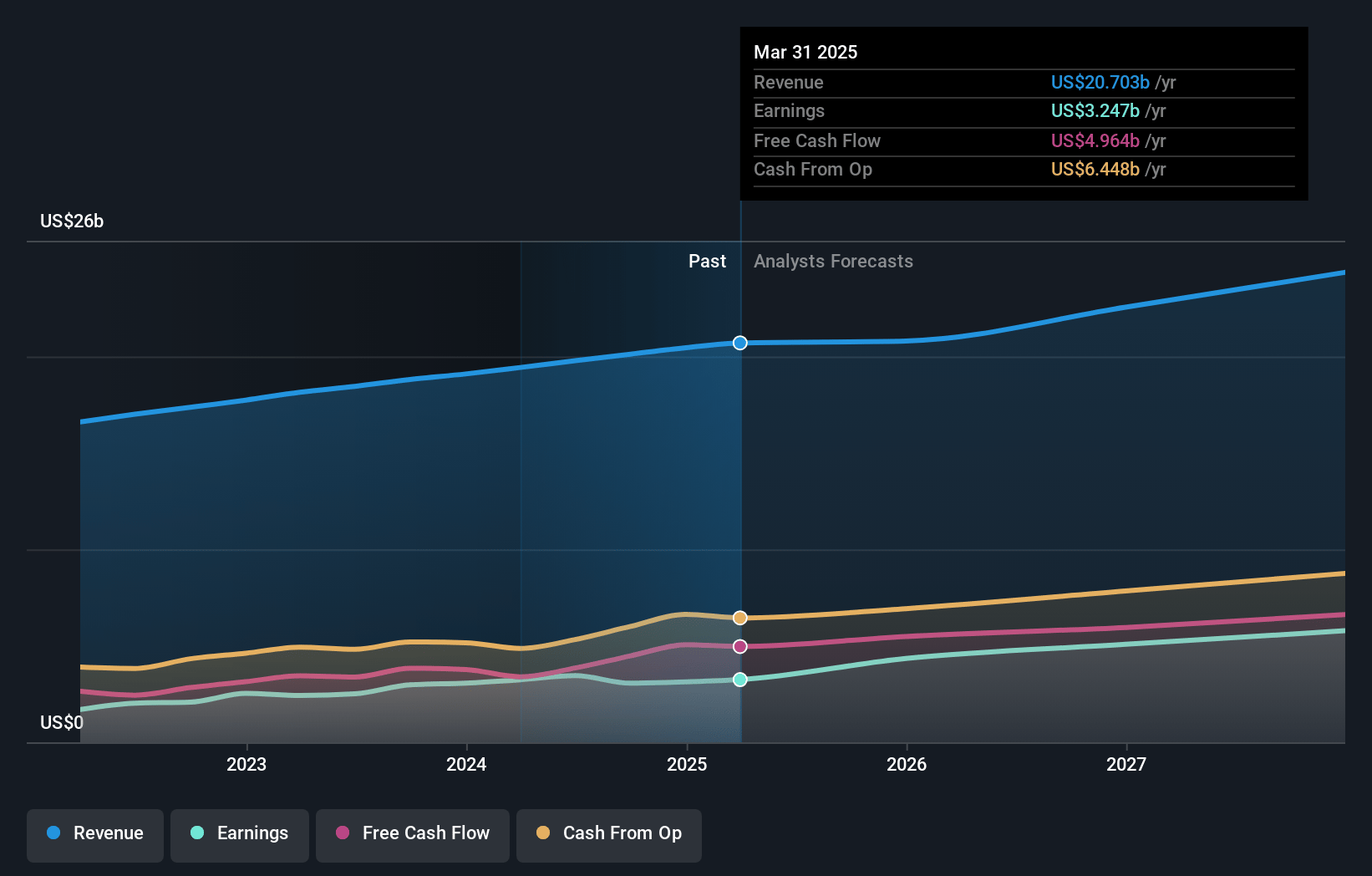

Fiserv Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Fiserv compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Fiserv's revenue will grow by 7.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 15.7% today to 24.4% in 3 years time.

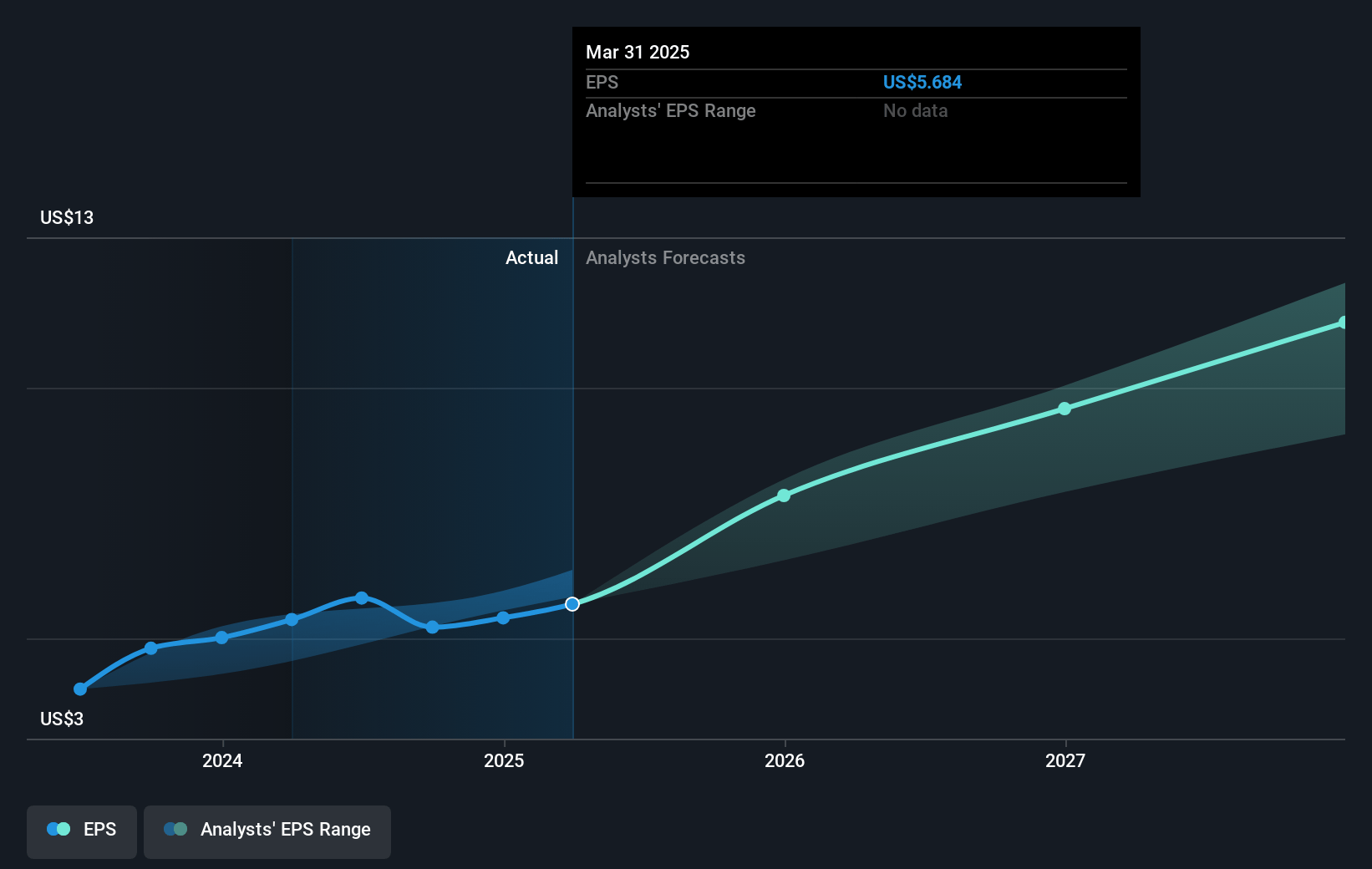

- The bullish analysts expect earnings to reach $6.2 billion (and earnings per share of $12.13) by about May 2028, up from $3.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 25.6x on those 2028 earnings, down from 31.6x today. This future PE is greater than the current PE for the US Diversified Financial industry at 14.2x.

- Analysts expect the number of shares outstanding to decline by 5.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.51%, as per the Simply Wall St company report.

Fiserv Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Fiserv’s core business faces long-term pressure from the rapid adoption of alternative payment platforms, such as real-time payments, mobile wallets, and cryptocurrencies, which could divert transaction volumes away from its legacy systems and reduce future revenue growth.

- Increasing global regulatory scrutiny and evolving data privacy laws add compliance costs and operational complexity, potentially compressing Fiserv's operating margins and impacting net earnings over time.

- Heavy reliance on legacy technology and a slower pace of cloud modernization may hinder Fiserv’s ability to compete with more agile fintechs, limiting ability to win new deals and slowing revenue growth in the long term.

- Customer concentration in the banking and credit union verticals leaves Fiserv vulnerable to client loss, pricing renegotiations, or fintech disintermediation, which could reduce predictable revenue streams and directly impact net margins.

- Frequent acquisitions and integration of diverse businesses introduce operational inefficiencies and increasing debt service costs, potentially reducing net earnings and constraining free cash flow available for future investments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Fiserv is $270.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Fiserv's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $270.0, and the most bearish reporting a price target of just $145.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $25.3 billion, earnings will come to $6.2 billion, and it would be trading on a PE ratio of 25.6x, assuming you use a discount rate of 7.5%.

- Given the current share price of $184.95, the bullish analyst price target of $270.0 is 31.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.