Key Takeaways

- Strategic focus on high-yielding loan portfolios and securitizations supports growth in revenue, net margins, and earnings.

- Refinancing and diversified product sourcing enhance profitability and capital efficiency, indicating long-term earnings expansion.

- Increasing leverage and a strategic shift toward non-agency loans could heighten risk exposure and earnings instability amid market fluctuations and rising competition.

Catalysts

About Ellington Financial- Through its subsidiary, Ellington Financial Operating Partnership LLC, acquires and manages mortgage-related, consumer-related, corporate-related, and other financial assets in the United States.

- The company's expansion in high-yielding loan portfolios, particularly non-QM, RTL, commercial mortgage bridge, HELOC, and closed-end second lien loans, indicates a strategic focus on higher-margin and growth-oriented segments, which is expected to positively impact future revenue and earnings.

- The robust performance of the Longbridge segment, especially the increase in adjusted distributable earnings contribution, showcases potential for profitability and dividend coverage improvements as the segment stabilizes, impacting net margins and earnings.

- Successful securitization efforts, including non-QM and proprietary reverse mortgage securitizations, provide stable, long-term, and cost-effective financing options, resulting in increased capital efficiency which could improve net margins and earnings over time.

- The company's refinancing initiatives aimed at replacing high-cost debt with lower-cost financing, including leveraging new financing lines, are expected to be accretive to earnings, thus positively affecting net margins and overall profitability.

- The development of sourcing channels for products like HELOCs and second lien loans, combined with versatile financing and securitization options, indicates continued growth in diversified, high-margin areas, contributing to revenue, ROI, and long-term earnings expansion.

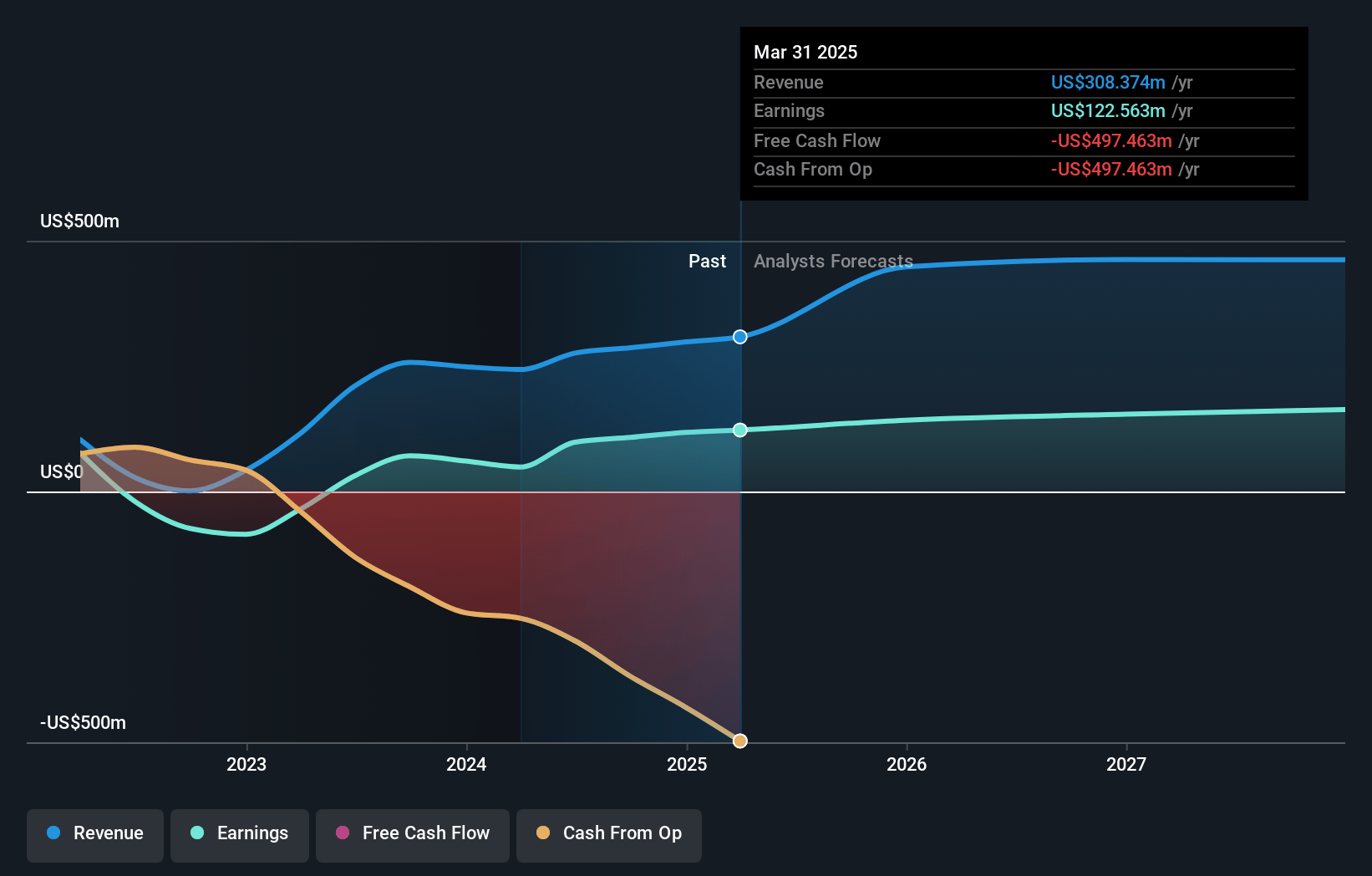

Ellington Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ellington Financial's revenue will grow by 23.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 37.2% today to 32.3% in 3 years time.

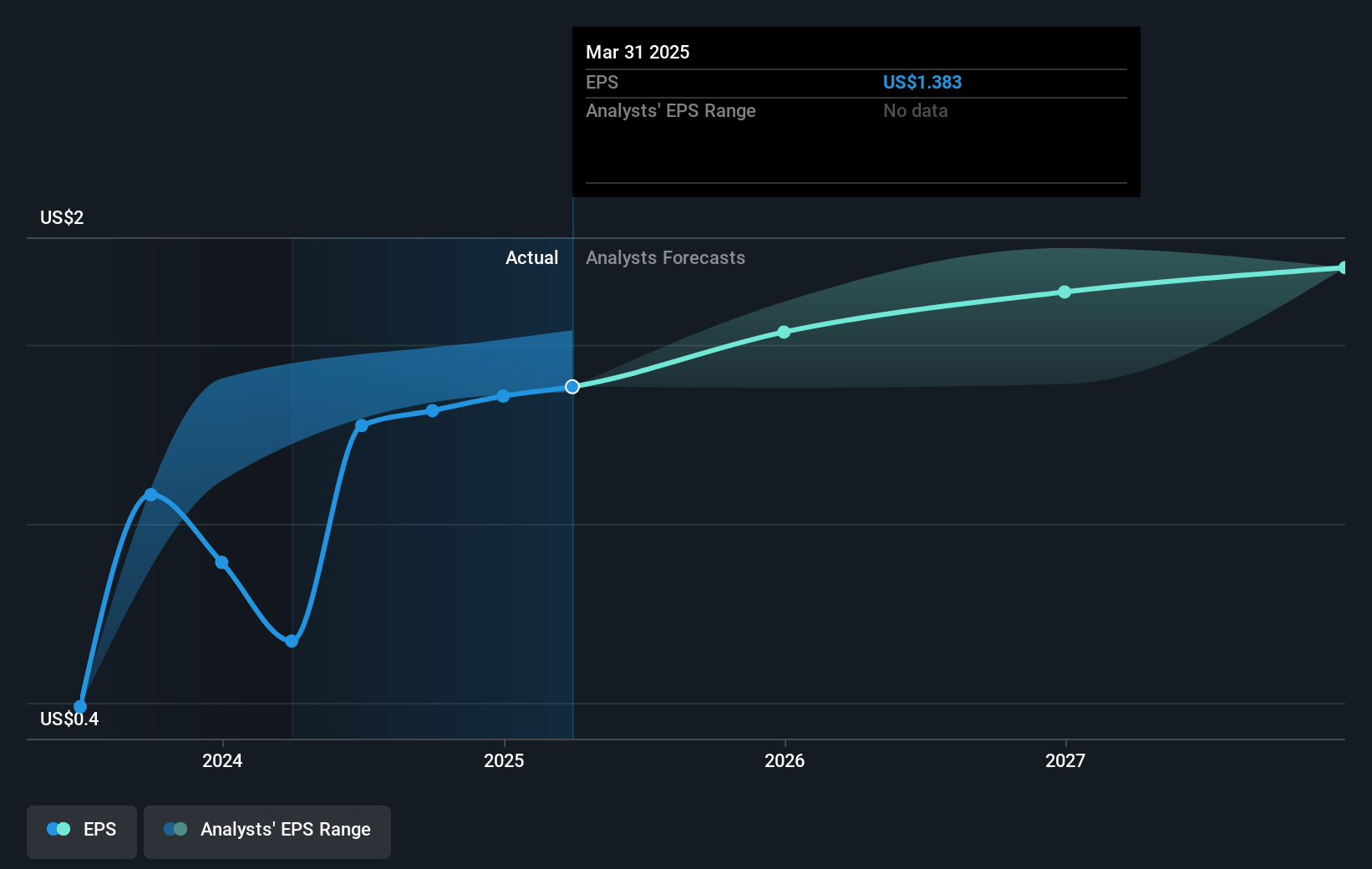

- Analysts expect earnings to reach $176.8 million (and earnings per share of $1.89) by about January 2028, up from $107.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.5x on those 2028 earnings, down from 10.7x today. This future PE is lower than the current PE for the US Mortgage REITs industry at 11.4x.

- Analysts expect the number of shares outstanding to grow by 0.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.39%, as per the Simply Wall St company report.

Ellington Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rise in overall leverage from 1.6x to 1.8x due to the expansion of high-yielding loan portfolios, including non-QM and second lien loans, could increase risk exposure, impacting net margins and potentially affecting earnings if the leveraged assets underperform.

- Shrinking agency portfolio and a focus on non-agency loan products could limit income diversification. This shift may expose Ellington Financial to higher volatility in net interest margins and revenue, especially if non-QM loan demand wanes or if interest rates fluctuate unpredictably.

- Profits from the Longbridge segment, despite contributing to the adjusted distributable earnings, showed a GAAP net loss of $0.03 per share due to interest rate hedging losses. Continued sensitivity to interest rate changes could negatively affect earnings stability and dividend coverage.

- Operating expenses increased by 18%, driven in part by nonrecurring items like employee option redemption at Longbridge. Without careful management and control, continued expense growth could pressure future profits and reduce net margins.

- Increased competition, particularly from insurance companies in the non-QM market, may lead to tighter yield spreads and impact loan pricing, potentially compressing revenue growth and affecting the profitability of Ellington's core strategies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.75 for Ellington Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $546.6 million, earnings will come to $176.8 million, and it would be trading on a PE ratio of 9.5x, assuming you use a discount rate of 9.4%.

- Given the current share price of $12.68, the analyst's price target of $13.75 is 7.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives