Key Takeaways

- Strong fundraising efforts and strategic acquisitions in AI and digital infrastructure position DigitalBridge for sustainable revenue and earnings growth.

- Significant investments in data centers and towers are expected to boost future earnings and enhance fee-related earnings margins.

- Shifts towards co-investment capital and macroeconomic uncertainties pose challenges to revenue growth and strategic scalability, impacting near-term earnings and long-term business perceptions.

Catalysts

About DigitalBridge Group- DigitalBridge is an infrastructure investment firm specializing in digital infrastructure assets.

- DigitalBridge's investment platform continues to scale, delivering significant growth in fee-related earnings (FRE) — up 42% year-on-year — and expanding FRE margins by 500 basis points to 34%, indicating potential future increases in net margins.

- The company is on track to exceed its $7 billion annual fundraising target, with $6.1 billion raised by Q3 2024 and plans to close deals on another 30 to 40 global logos by the end of the year, suggesting strong future revenue streams.

- Significant capital deployment into growth opportunities in data centers and tower verticals, including investments in DataBank, Vertical Bridge, Yondr, and JTower, is expected to drive future increases in earnings.

- The company is accelerating fundraising commitments, with a focus on private wealth channels predicted to raise over $1 billion, offering a new revenue stream and improving overall revenue growth prospects.

- Strategic acquisitions and investments in AI-enabled digital infrastructure are aligning with increasing LP interest, thereby positioning the business for sustainable revenue and earnings growth as infrastructure demand rises.

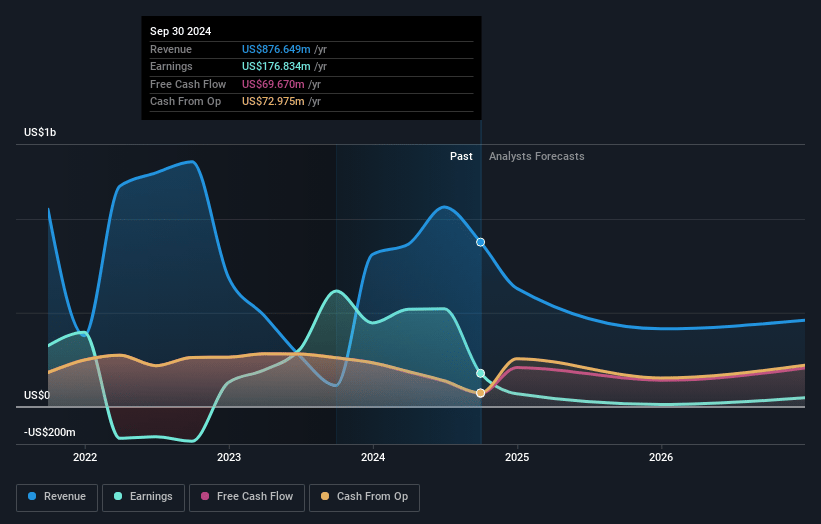

DigitalBridge Group Future Earnings and Revenue Growth

Assumptions

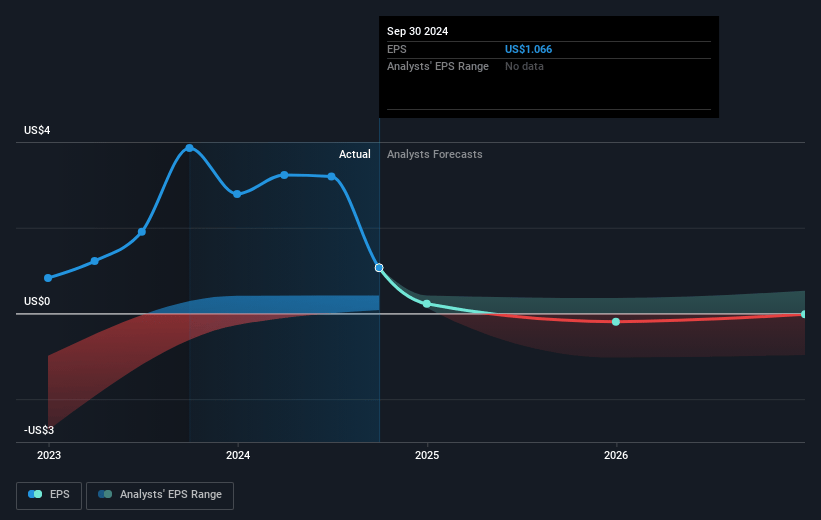

How have these above catalysts been quantified?- Analysts are assuming DigitalBridge Group's revenue will decrease by -16.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 20.2% today to 10.8% in 3 years time.

- Analysts expect earnings to reach $56.4 million (and earnings per share of $0.25) by about January 2028, down from $176.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $106.4 million in earnings, and the most bearish expecting $26.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 82.8x on those 2028 earnings, up from 10.3x today. This future PE is greater than the current PE for the US Capital Markets industry at 23.1x.

- Analysts expect the number of shares outstanding to grow by 6.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.16%, as per the Simply Wall St company report.

DigitalBridge Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The timing and composition of committed capital this year have implications for when fee-related earnings (FRE) are realized, which may result in lower FRE for 2024 as some fees are delayed into 2025, impacting short-term revenue forecasts.

- A significant mix shift towards co-investment capital, which has a lower fee structure and activates fees on invested rather than committed capital, challenges the expectation for near-term revenue growth, potentially affecting fee revenue and earnings guidance.

- Investor fatigue and scrutiny over the shift to co-investments may result in questions about the scalability and profitability of the business model beyond flagship funds, potentially impacting longer-term strategic growth perceptions and revenue.

- Ongoing changes in global macroeconomic conditions and private market trends, such as the fundraising environment and interest rates, add uncertainties to capital formation efforts, affecting projections for future revenue.

- Execution risks, particularly surrounding new large-scale investments in regions like Japan and new initiatives such as private wealth channels, may lead to unforeseen costs or integration challenges, affecting net margins and future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.78 for DigitalBridge Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $520.1 million, earnings will come to $56.4 million, and it would be trading on a PE ratio of 82.8x, assuming you use a discount rate of 7.2%.

- Given the current share price of $10.46, the analyst's price target of $16.78 is 37.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives