Key Takeaways

- Digital and technology investments are boosting efficiency, expanding services, and supporting sustainable earnings growth through fee-based and advisory offerings.

- Diversification across loans, funding sources, and products enhances resilience, asset quality, and mitigates risks from market and rate volatility.

- Geographic and market concentration, regulatory pressures, digital disruption, and shifting trade dynamics heighten risk and threaten future profitability and growth prospects.

Catalysts

About Banco Latinoamericano de Comercio Exterior S. A- Banco Latinoamericano de Comercio Exterior, S.

- Rapid growth in Latin American trade flows and supply chain realignment are expected to further expand demand for cross-border financing and trade-related products; this directly supports ongoing, robust growth in loan volumes, off-balance sheet exposures like letters of credit, and fee revenue.

- Significant investments in digital infrastructure are beginning to drive operational efficiency, enhance scalability, and expand market reach, which should result in structurally lower cost-to-income ratios and improved net margins over time.

- Growing demand for infrastructure, energy, and sustainability projects across Latin America is feeding a healthy pipeline of medium-to-long-term deals; as these higher-margin and fee-generating structured finance transactions materialize, they are set to boost both net interest income and noninterest revenue.

- Ongoing diversification of both the loan portfolio and funding sources across countries, clients, and products reduces risk concentration, supports asset quality, and underpins resilience in net income and return on equity even in volatile environments.

- Expansion of fee-based and advisory services—enabled by technology investments and a growing client base—will further increase noninterest income, help offset pressure on margins from interest rate cycles, and support higher, more consistent earnings growth.

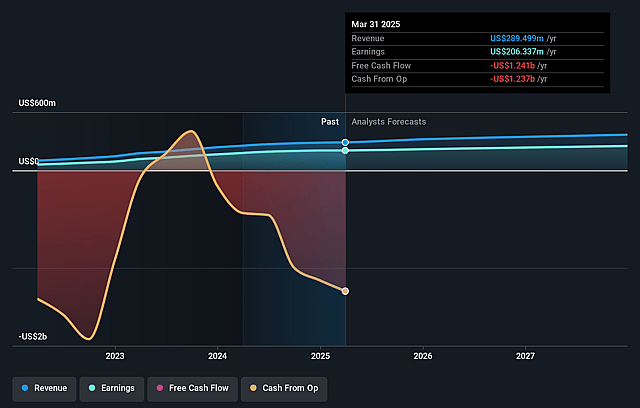

Banco Latinoamericano de Comercio Exterior S. A Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Banco Latinoamericano de Comercio Exterior S. A compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Banco Latinoamericano de Comercio Exterior S. A's revenue will grow by 9.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 71.3% today to 68.1% in 3 years time.

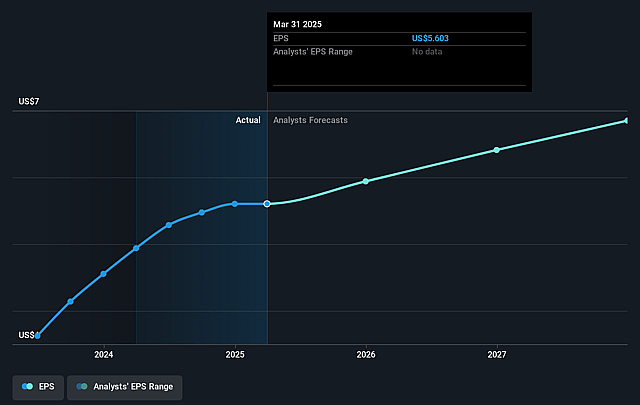

- The bullish analysts expect earnings to reach $261.5 million (and earnings per share of $7.11) by about July 2028, up from $206.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.5x on those 2028 earnings, up from 7.6x today. This future PE is lower than the current PE for the US Diversified Financial industry at 17.5x.

- Analysts expect the number of shares outstanding to grow by 1.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.41%, as per the Simply Wall St company report.

Banco Latinoamericano de Comercio Exterior S. A Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy geographic concentration in Latin America continues to expose Banco Latinoamericano de Comercio Exterior S. A. to risks from political instability, economic volatility, and currency fluctuations in the region, which could drive up loan loss provisions and reduce net earnings over time.

- Rising global interest rate volatility and the bank’s reliance on short-term wholesale funding increase the risk of higher funding costs, which may compress net interest margins and erode profitability, especially if interest rates move unexpectedly or remain unpredictable.

- The long-term shift toward deglobalization and protectionist trade policies threatens Latin American cross-border trade volumes, which could directly impact demand for the bank’s core trade finance products and constrain revenue growth in coming years.

- Increasing regulatory scrutiny, ESG pressures, and higher compliance costs in global banking—particularly for institutions exposed to traditional trade and commodities—may require greater investment in systems and processes, leading to higher expenses and potentially lower net margins.

- The ongoing digital disruption in global financial services and entry of large multinational banks and fintechs into the Latin American trade finance space may commoditize services, intensify competition, and put sustained downward pressure on fees and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Banco Latinoamericano de Comercio Exterior S. A is $50.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Banco Latinoamericano de Comercio Exterior S. A's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $50.0, and the most bearish reporting a price target of just $37.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $384.0 million, earnings will come to $261.5 million, and it would be trading on a PE ratio of 9.5x, assuming you use a discount rate of 10.4%.

- Given the current share price of $42.5, the bullish analyst price target of $50.0 is 15.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.