Narratives are currently in beta

Key Takeaways

- New platforms and strategic expansion in high-potential markets aim to drive revenue growth and enhance noninterest income, thus boosting margins.

- Increased corporate deposits and focus on higher noninterest income aim to sustain profitability and reduce funding costs, supporting stable earnings growth.

- Competitive lending environment, political risks, and operational costs could negatively impact Bladex's margins, profitability, and overall revenue growth.

Catalysts

About Banco Latinoamericano de Comercio Exterior S. A- Banco Latinoamericano de Comercio Exterior, S.

- Implementation of two new platforms to support trade finance and treasury business, expected to enhance noninterest income by digitalizing the letters of credit unit and offering derivatives, should significantly boost revenue and margins as these capabilities gradually roll out.

- Bladex's ongoing deposit growth trend, driven by increased corporate client deposits and strategic cross-selling, is set to sustain and potentially reduce funding costs, positively impacting net margins as deposits are a lower-cost funding source compared to other alternatives.

- Continued focus on expansion in underrepresented, high-potential markets like Brazil and strategic Central American and Caribbean countries, coupled with new product rollouts, are projected to drive commercial portfolio growth, thus increasing overall revenue.

- Progress in their strategic 5-year plan's expansion phase, transitioning from optimization and unlocking further product offering potential, will likely contribute to ongoing top-line growth and higher earnings.

- The strategic shift towards higher noninterest income, aiming to increase it from 13% to 18% of total revenues by 2026, is expected to stabilize earnings and mitigate sensitivity to interest rate fluctuations, thus supporting sustained profitability.

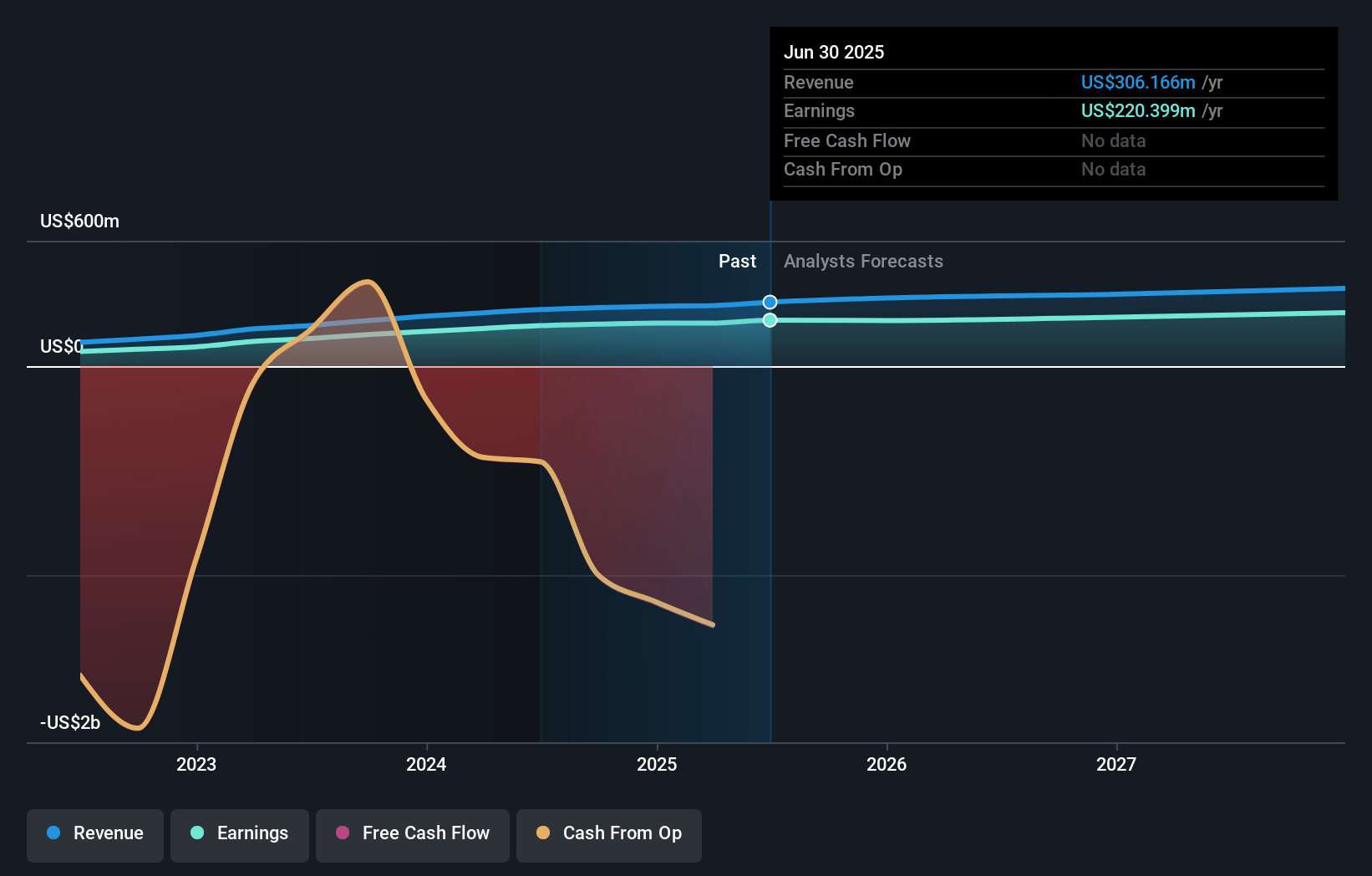

Banco Latinoamericano de Comercio Exterior S. A Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Banco Latinoamericano de Comercio Exterior S. A's revenue will grow by 10.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 71.8% today to 65.0% in 3 years time.

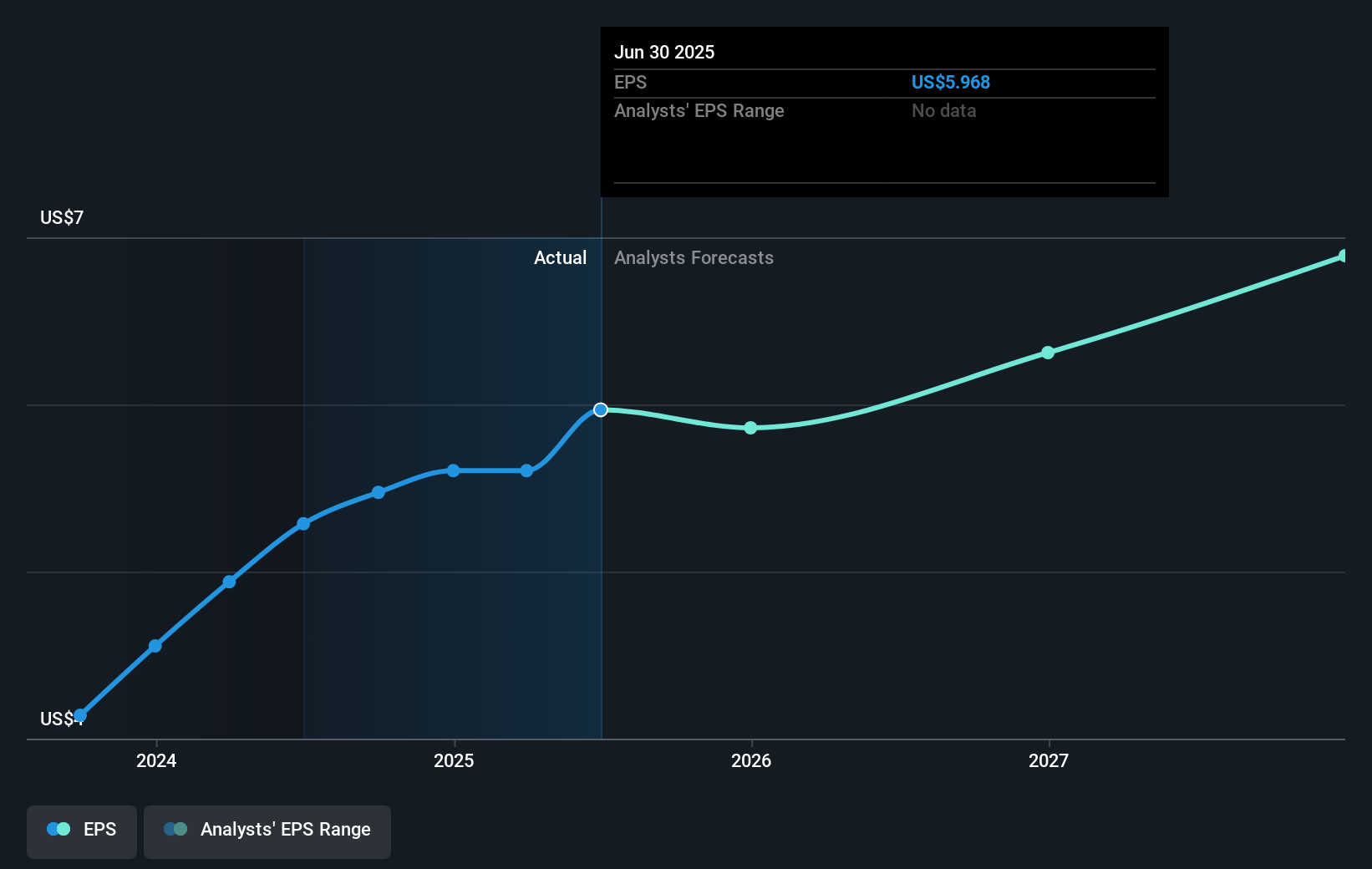

- Analysts expect earnings to reach $242.1 million (and earnings per share of $6.58) by about December 2027, up from $200.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.6x on those 2027 earnings, up from 6.5x today. This future PE is lower than the current PE for the US Diversified Financial industry at 17.9x.

- Analysts expect the number of shares outstanding to grow by 0.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.03%, as per the Simply Wall St company report.

Banco Latinoamericano de Comercio Exterior S. A Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The competitive lending environment in Latin America due to increased dollar liquidity and widely open debt capital markets could impact Bladex's ability to maintain lending margins and net interest income.

- Pressure on loan spreads in countries like Brazil, due to high competition from international players, can lead to a spread compression, impacting revenue and net interest margins adversely.

- Changes in U.S. interest rates, such as rate cuts by the Fed, could negatively affect Bladex's net interest margins, as indicated by the bank's sensitivity to rate movements, potentially impacting profitability.

- Political risks, such as potential geopolitical tensions arising from changes in U.S. administration, may affect trade volumes in Latin America, impacting Bladex's commercial portfolio and overall revenue.

- The increased operational costs aligned with the strategic expansion phase and higher headcount expenses could pressure the bank's efficiency ratio and net margins, especially if revenue growth does not outpace these growing expenses.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $43.5 for Banco Latinoamericano de Comercio Exterior S. A based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $50.0, and the most bearish reporting a price target of just $37.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $372.3 million, earnings will come to $242.1 million, and it would be trading on a PE ratio of 8.6x, assuming you use a discount rate of 10.0%.

- Given the current share price of $35.72, the analyst's price target of $43.5 is 17.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives