Narratives are currently in beta

Key Takeaways

- Diversification of product suite through co-brand partnerships aims to stabilize revenue and improve net margins with diversified income streams.

- Strategic debt reduction and favorable funding mix are expected to enhance capital efficiency, lower funding costs, and strengthen net interest margins.

- Bread Financial faces challenges from natural disasters, regulatory changes, and macroeconomic pressures, potentially impacting revenue, net margins, and interest margins.

Catalysts

About Bread Financial Holdings- Provides tech-forward payment and lending solutions to customers and consumer-based industries in North America.

- The launch of the Saks Fifth Avenue and Hard Rock credit card programs is anticipated to drive future loan growth and increased credit sales, benefiting revenue by expanding the customer base.

- Bread Financial’s shift towards a diversified product suite and co-brand partnerships is expected to enhance their loan portfolio and credit risk profile, potentially leading to improved revenue stability and better net margins due to diversified income streams.

- The ongoing strategic initiatives to refinance and reduce parent debt by 62% over three years aim to strengthen the balance sheet, improve capital efficiency, and subsequently enhance earnings by reducing interest expenses.

- The strategy to increase direct-to-consumer deposits while reducing wholesale deposit funding indicates a more favorable funding mix that could positively impact net interest margins by lowering funding costs.

- Implementation of various pricing changes, such as increased APRs and statement fees, aimed at mitigating the impact of potential regulatory changes on credit card late fees, is expected to bolster net margins and drive EPS growth despite regulatory uncertainties.

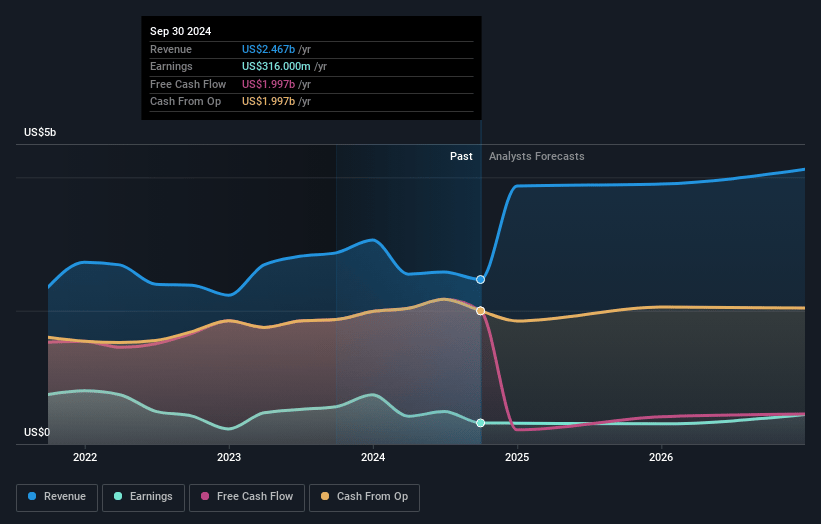

Bread Financial Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bread Financial Holdings's revenue will grow by 20.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.8% today to 8.8% in 3 years time.

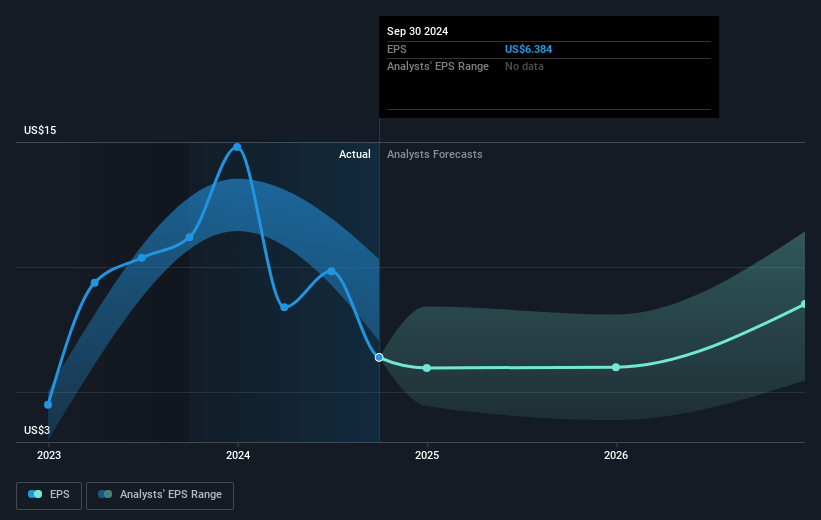

- Analysts expect earnings to reach $379.4 million (and earnings per share of $7.58) by about December 2027, up from $316.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $660 million in earnings, and the most bearish expecting $304 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.9x on those 2027 earnings, up from 9.9x today. This future PE is lower than the current PE for the US Consumer Finance industry at 11.5x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.99%, as per the Simply Wall St company report.

Bread Financial Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The impact of recent hurricanes may lead to short-term financial pressure, as Bread Financial is offering payment accommodations and experiencing timing differences in losses, which could temporarily affect earnings and increase net loss rates.

- With credit card late fees potentially restricted by CFPB regulations, Bread Financial's gradual shift in product mix away from private label cards may initially lead to lower billed late fees and merchant discount fees, negatively affecting revenue.

- The company's delinquency and net loss rates are relatively high, demonstrating vulnerability to macroeconomic changes. Despite mitigations, increased losses could continue to pressurize net margins if consumer financial health does not improve as anticipated.

- Bread Financial is seeing moderating consumer spending and increasing gross credit losses, which may reduce overall revenue and profit if consumer financial pressure persists longer than expected.

- Interest rate sensitivity in a declining rate environment might lead to pressure on Bread Financial's net interest margin, which could further affect its earnings projections negatively if interest rates fall more rapidly than expected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $62.08 for Bread Financial Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $88.0, and the most bearish reporting a price target of just $34.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $4.3 billion, earnings will come to $379.4 million, and it would be trading on a PE ratio of 10.9x, assuming you use a discount rate of 10.0%.

- Given the current share price of $62.95, the analyst's price target of $62.08 is 1.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives