Narratives are currently in beta

Key Takeaways

- Strong growth in loan originations and credit quality improvements position Sallie Mae for enhanced future revenue and margins.

- Shareholder returns through buybacks and dividends signal a strategic focus on increasing earnings per share.

- Despite growth, SLM faces net loss risks due to increased allowances, credit losses, and potential challenges in credit performance affecting margins and earnings.

Catalysts

About SLM- Through its subsidiaries, originates and services private education loans to students and their families to finance the cost of their education in the United States.

- Sallie Mae experienced a 13% year-over-year growth in private education loan originations during the third quarter, indicating potential for increased future revenue streams through sustained origination growth.

- Improvements in credit quality, including higher cosigner rates and average FICO scores, could lead to reduced net charge-offs and enhanced net margins over time.

- The company’s enhanced payment and loss mitigation programs are showing positive results, which might lead to a further decrease in delinquencies, impacting net margins favorably.

- Continued share buybacks and increased dividends highlight SLM’s commitment to returning capital to shareholders, potentially leading to increased earnings per share as a forward strategy.

- The procedural refinements in loan modification programs are stabilizing borrower repayment behavior, which could significantly improve future earnings by reducing credit loss provisions relative to growth in reserves.

SLM Future Earnings and Revenue Growth

Assumptions

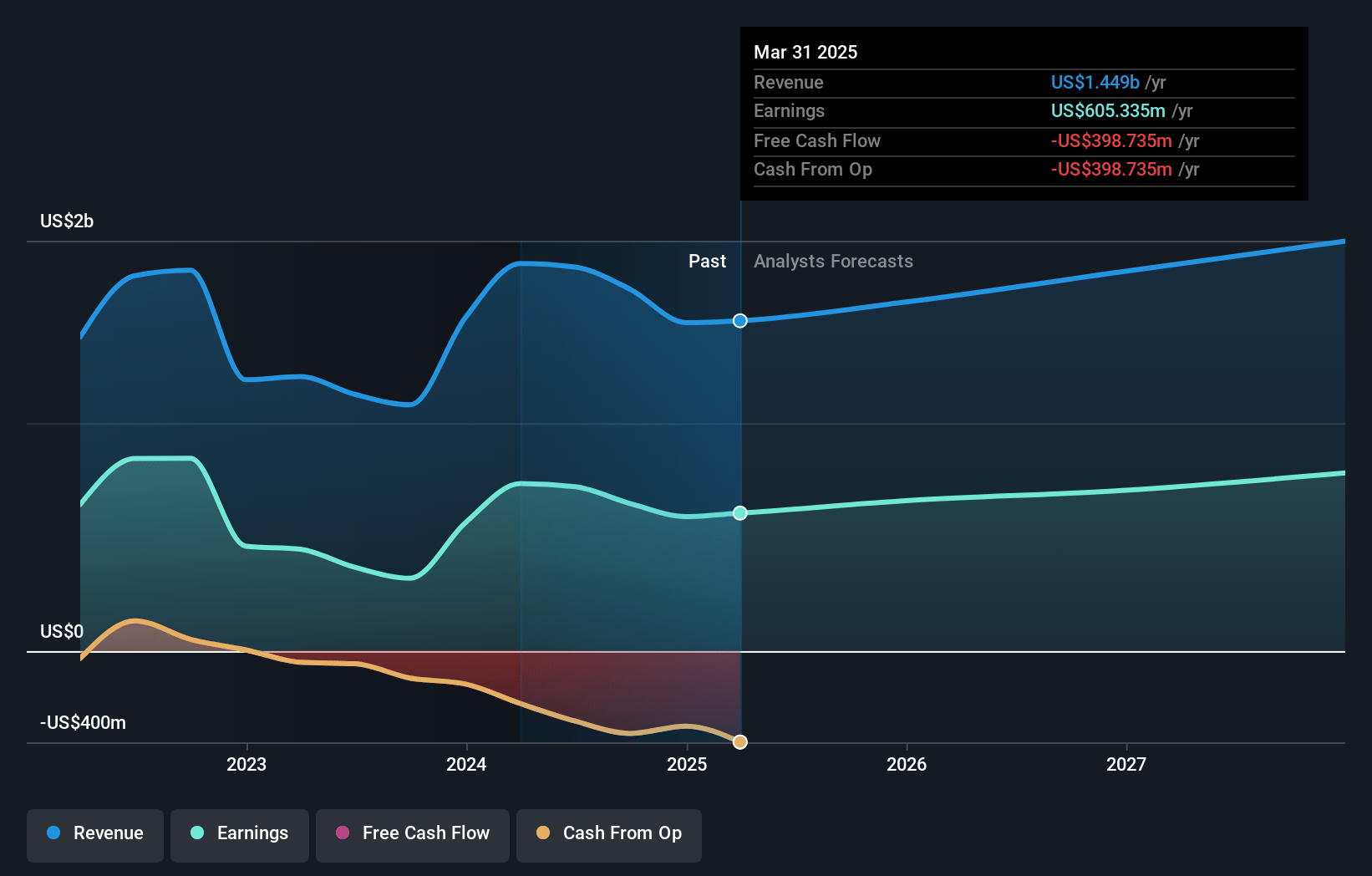

How have these above catalysts been quantified?- Analysts are assuming SLM's revenue will grow by 2.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 40.8% today to 36.0% in 3 years time.

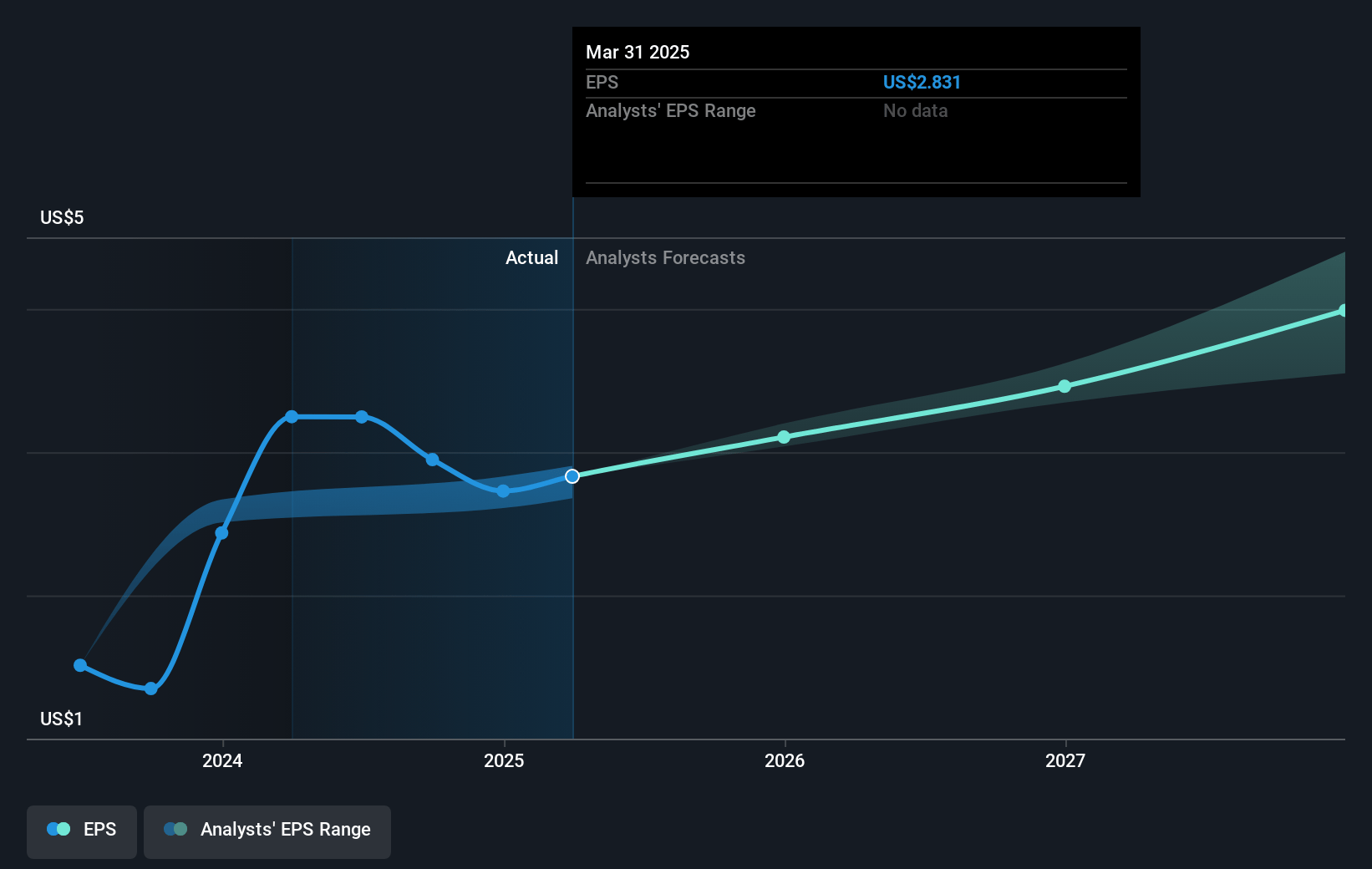

- Analysts expect earnings to reach $610.1 million (and earnings per share of $3.4) by about November 2027, down from $646.6 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $681.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.2x on those 2027 earnings, up from 7.9x today. This future PE is lower than the current PE for the US Consumer Finance industry at 12.3x.

- Analysts expect the number of shares outstanding to decline by 5.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.18%, as per the Simply Wall St company report.

SLM Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite strong origination growth, Sallie Mae reported a GAAP net loss per share in the third quarter, primarily due to increased allowances for new commitments. This could impact net margins and earnings.

- The net interest margin (NIM) for the quarter was at 5%, lower than previous quarters, with expectations of continued pressure due to rising funding rates. This could negatively affect future net margins and earnings.

- Increased provisions for credit losses, reaching $271 million in the third quarter compared to $198 million the prior year, could pose a risk to net margins and profitability if elevated provisions persist.

- The 30-day-plus delinquency rate increased to 3.6% of loans in repayment this quarter, indicating potential future challenges in credit performance, which could harm revenue through increased charge-offs or provisions.

- The potential for federal loan resumption to alter borrower payment behaviors, though not yet observed, remains a risk that could impact loan performance and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $26.67 for SLM based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $32.0, and the most bearish reporting a price target of just $23.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.7 billion, earnings will come to $610.1 million, and it would be trading on a PE ratio of 10.2x, assuming you use a discount rate of 9.2%.

- Given the current share price of $24.05, the analyst's price target of $26.67 is 9.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives