Key Takeaways

- Sezzle's expanding product suite and integration capabilities drive stickiness with younger users, powering sustained revenue growth and resilient margins even in challenging credit environments.

- Its rapid adoption among non-traditional merchants and everyday categories supports outperformance in the ongoing cash-to-digital transition, ensuring structural growth beyond industry averages.

- Intensifying competition, rising compliance costs, and a vulnerable user base threaten Sezzle's margins, scalability, and ability to sustain profitable growth.

Catalysts

About Sezzle- Operates as a technology-enabled payments company primarily in the United States and Canada.

- While analyst consensus highlights strong user and merchant growth, the consistently accelerating revenue-up 123 percent year-over-year with monthly user growth of 77 percent-suggests that analysts are underestimating the compounding effects of Sezzle becoming a default payment method, especially as average purchase frequency per user is rapidly rising, which points to an even steeper long-term revenue and gross margin trajectory.

- Analysts broadly agree that integration with WebBank enables higher take rates and margin expansion, but the full national rollout is already showing substantial improvements in unit economics and enables Sezzle to rapidly launch new products and enter underpenetrated US states, driving structural, multi-year improvements in both revenue yield and net margins.

- Unlike consensus, which focuses mainly on current product features, Sezzle's rapid buildout of a financial "super-app" with embedded tools like credit building, loyalty rewards, and auto couponing positions it as the stickiest BNPL platform among younger consumers who will dominate spending growth, driving durable increases in high-margin, recurring revenue streams.

- The company's near real-time portfolio turnover-payments collected within roughly 42 days and immediate visibility on origination quality-uniquely enables agile credit risk management at scale, insulating future net income margins against credit cycle shocks and supporting rapid, profitable expansion even during broader credit tightening.

- Sezzle's pipeline and traction with enterprise-level and non-traditional merchants in everyday spend categories like grocery and bills, paired with a seamless omnichannel experience, positions Sezzle to capture a disproportionate share of the cash-to-digital shift, fueling structural transaction volume and top-line revenue growth well above industry rates for years to come.

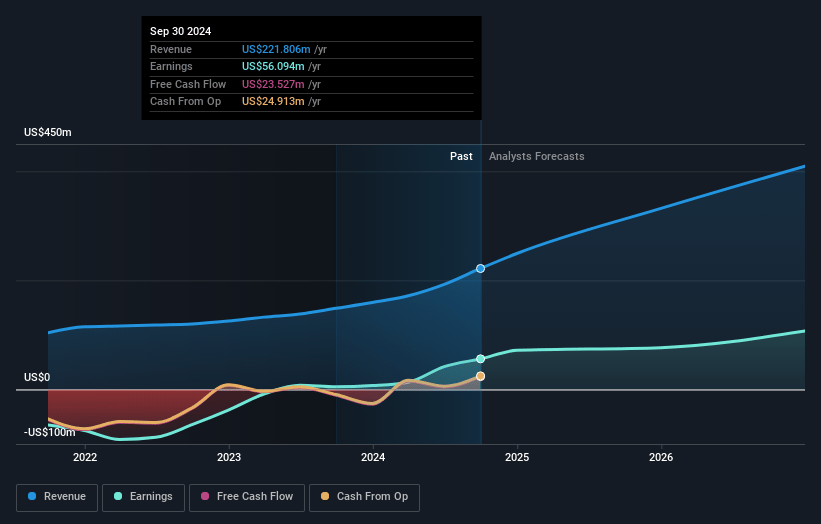

Sezzle Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Sezzle compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Sezzle's revenue will grow by 38.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 32.4% today to 26.8% in 3 years time.

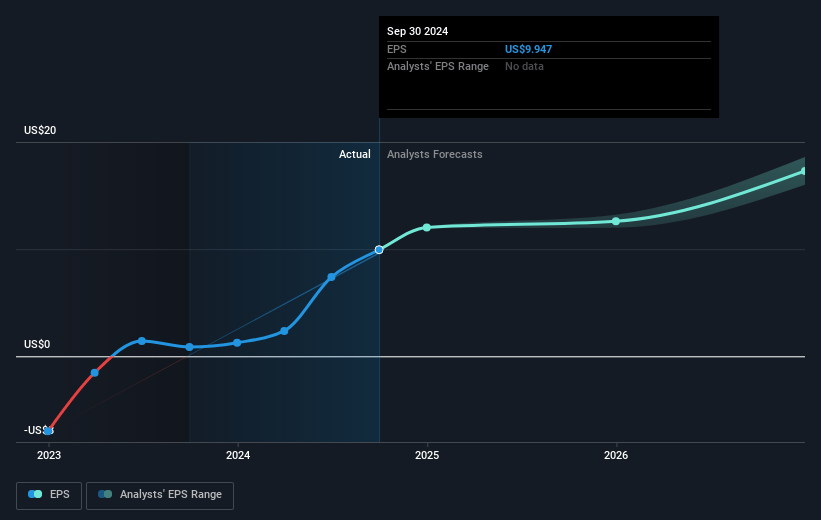

- The bullish analysts expect earnings to reach $236.0 million (and earnings per share of $6.07) by about July 2028, up from $106.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 33.6x on those 2028 earnings, down from 42.0x today. This future PE is greater than the current PE for the US Diversified Financial industry at 17.5x.

- Analysts expect the number of shares outstanding to decline by 0.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.08%, as per the Simply Wall St company report.

Sezzle Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising interest rates and tighter consumer credit conditions could increase Sezzle's funding costs and consumer defaults, thereby reducing net margins and overall earnings.

- The lack of significant brand differentiation in the BNPL sector, as discussed in the call where Sezzle acknowledged overlapping merchant relationships and consumer need for multiple BNPL accounts, could lead to price competition and compress Sezzle's net margins and future revenue growth.

- High customer acquisition costs and ongoing reliance on merchant partnerships, especially as competition intensifies and as merchants add more BNPL options, could pressure Sezzle's operating margins and limit scalability of revenues.

- Regulatory risk is evident given management's highlighting of tighter compliance (especially around state-by-state lending rules and the value of their WebBank partnership), which suggests future regulatory crackdowns or increased compliance costs could erode Sezzle's revenue streams and impact profitability.

- Sezzle's user base is weighted towards mid-to-low income, younger consumers-segments that are more vulnerable to macroeconomic downturns, which combined with likely increased saturation and potential for elevated delinquencies as they expand credit, may lead to higher loan loss provisions and reduced net earnings in future periods.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Sezzle is $202.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Sezzle's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $202.0, and the most bearish reporting a price target of just $101.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $881.3 million, earnings will come to $236.0 million, and it would be trading on a PE ratio of 33.6x, assuming you use a discount rate of 7.1%.

- Given the current share price of $134.55, the bullish analyst price target of $202.0 is 33.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.