Key Takeaways

- Heavy reliance on Chinese exporters and exposure to shifting trade policies create revenue and earnings volatility amid rising regulatory and geopolitical risks.

- Growing regulatory scrutiny, compliance costs, and fierce competition could limit margin expansion and challenge sustainable, long-term earnings growth.

- Reliance on Chinese revenue streams, rising costs, and global trade and regulatory uncertainties threaten Payoneer's profitability and hamper its capacity for stable, scalable international growth.

Catalysts

About Payoneer Global- Operates as a financial technology company.

- While Payoneer is benefiting from the long-term acceleration of cross-border e-commerce and the global shift to remote work with B2B revenue up 37% and strong growth in regions like APAC and Latin America the company faces heightened regulatory and geopolitical risk. The recent global tariff regime and ongoing trade policy uncertainties threaten to disrupt transaction volumes and curb revenue growth, as reflected in the suspended guidance and projected $50 million annual revenue headwind.

- Although the digitization of financial services continues to expand Payoneer's total addressable market and supports higher adoption of value-added products (such as workforce management and cards, driving ARPU growth of 22% year-over-year), the company is increasingly exposed to intensifying regulatory scrutiny and compliance costs due to its expansion into multiple new jurisdictions. This could pressure net margins and limit operational leverage, especially as compliance and G&A expenses increase.

- Despite Payoneer's diverse geographic revenue base and deepening relationships in key growth markets like China and India (where new licenses and market entries suggest strong secular growth opportunity), the heavy dependence on Chinese exporters with one-third of revenue sourced from China, and 20% directly exposed to the U.S.-China trade corridor leaves the company vulnerable to sudden shifts in trade flows, policy, or sanctions, amplifying volatility in both revenue and earnings.

- While long-term industry trends favor embedded finance and the integration of payment solutions for global platforms providing Payoneer with avenues to grow recurring transaction-based revenues and improve customer stickiness the rapid commoditization of cross-border payment services and fierce competition from both fintechs and entrenched incumbents could apply downward pressure to take rates, compressing gross margin gains achieved through product diversification.

- Even with Payoneer's demonstrated operating discipline and the ability to scale its financial stack for higher profitability (evidenced by a 27% adjusted EBITDA margin and ongoing cost optimization), dependence on the more vulnerable SME and freelancer segments exposes the company to higher revenue cyclicality and greater risk during global economic downturns. This underscores ongoing risks to sustainable earnings growth if macroeconomic headwinds persist.

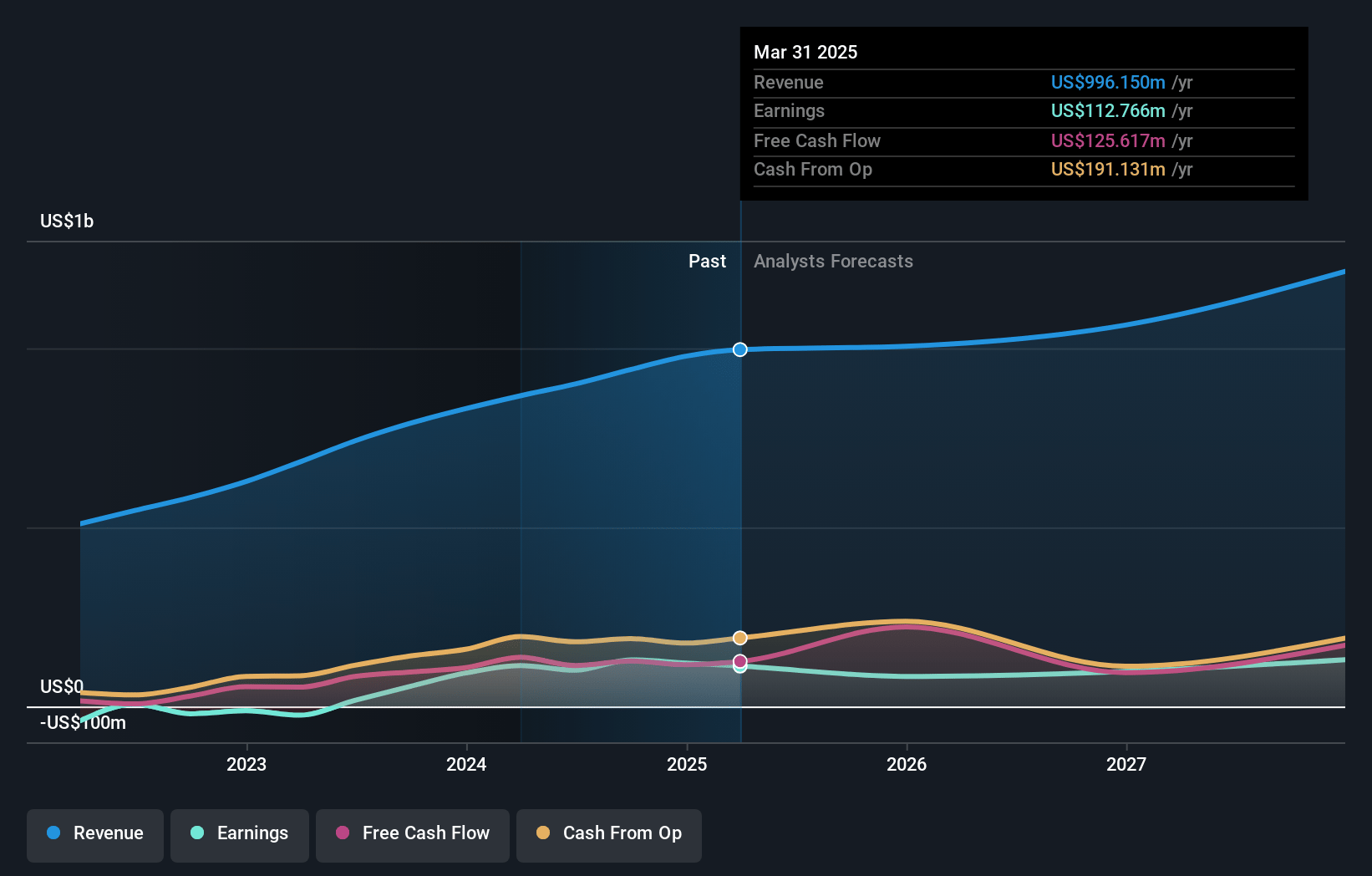

Payoneer Global Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Payoneer Global compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Payoneer Global's revenue will grow by 7.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 11.3% today to 11.1% in 3 years time.

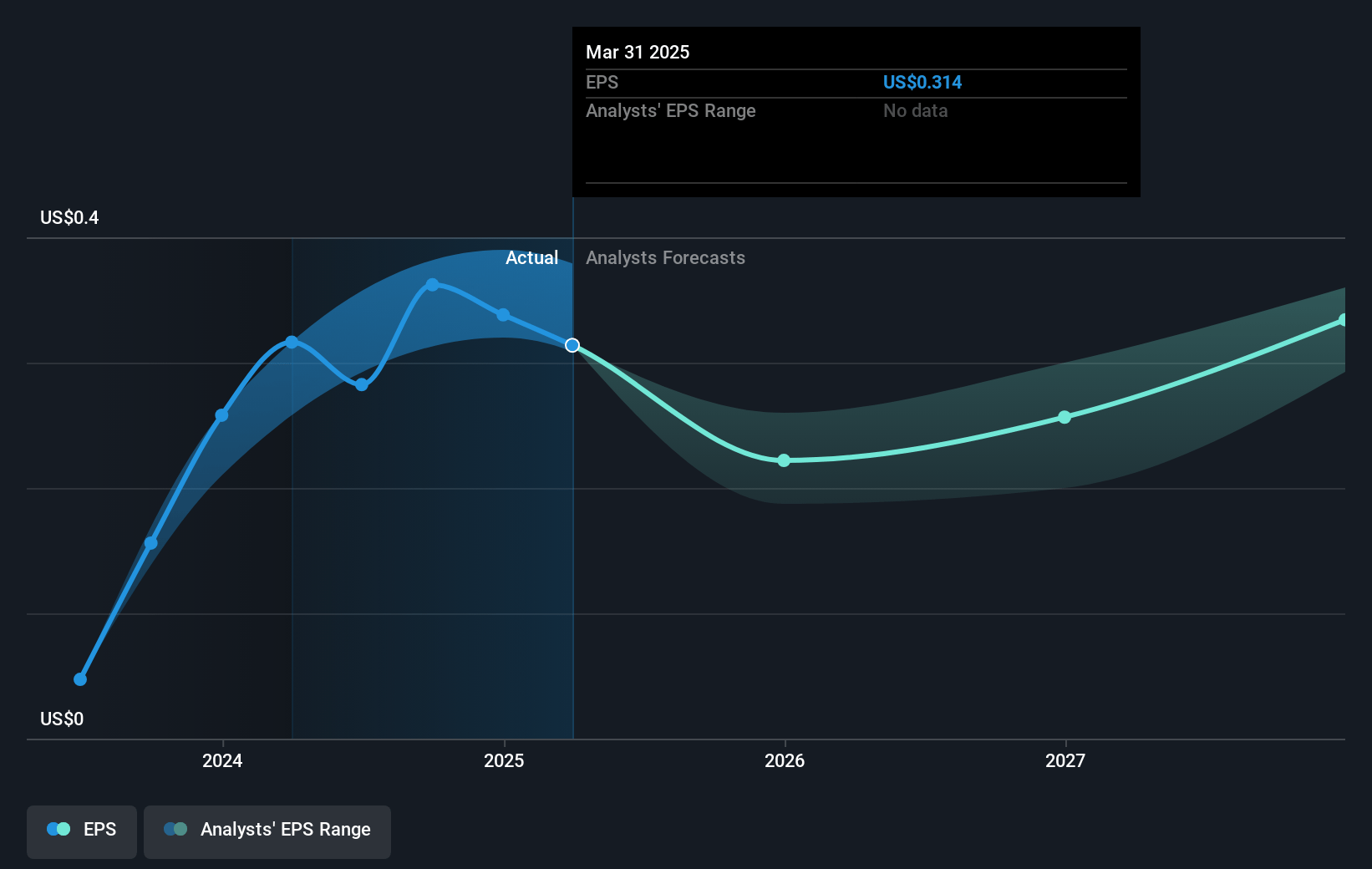

- The bearish analysts expect earnings to reach $138.0 million (and earnings per share of $0.35) by about July 2028, up from $112.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 27.7x on those 2028 earnings, up from 21.4x today. This future PE is greater than the current PE for the US Diversified Financial industry at 15.9x.

- Analysts expect the number of shares outstanding to grow by 2.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.05%, as per the Simply Wall St company report.

Payoneer Global Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Management has suspended full-year 2025 guidance due to high uncertainty in the global macroeconomic and trade policy environment, including volatility from tariffs, which could result in a potentially significant negative impact to future revenue and earnings.

- A substantial portion of Payoneer's revenue (about one third) is linked to Chinese customers, and roughly 20 percent of total revenue directly depends on the China–U.S. corridor; evolving or escalating tariffs and trade barriers in these routes pose downside risk to transaction volume and top-line growth.

- Increased transaction costs, higher labor and consulting expenses, and investment in card incentive programs are putting upward pressure on operating expenses, which, if not offset by revenue growth, could compress net margins and reduce profitability.

- The company's customer base is heavily weighted toward SMBs and marketplace sellers, which are more exposed to economic downturns and competitive pricing pressure, resulting in risk to revenue stability and overall net margin performance.

- Intensifying regulatory requirements, geopolitical risks, and complex international compliance obligations (such as new licenses, anti-money laundering, and tax initiatives) will drive up ongoing operational costs and may inhibit Payoneer's ability to scale profitably across geographies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Payoneer Global is $8.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Payoneer Global's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $8.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $138.0 million, and it would be trading on a PE ratio of 27.7x, assuming you use a discount rate of 7.1%.

- Given the current share price of $6.66, the bearish analyst price target of $8.0 is 16.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.