Last Update 10 Dec 25

Fair value Increased 2.50%PAX: Future Profit Margins And Earnings Multiples Will Shape Balanced Outlook

Analysts have modestly raised their price target on Patria Investments to approximately $16.57 from $16.17, citing higher projected revenue growth, a sharply improved profit margin profile, a slightly lower discount rate, and a normalization of future valuation multiples.

Valuation Changes

- Fair Value Estimate has risen slightly from $16.17 to $16.57 per share, reflecting a modest upward revision in intrinsic valuation.

- Discount Rate has edged down marginally from 8.34% to 8.28%, indicating a slightly lower perceived risk profile or cost of capital.

- Revenue Growth has increased from about 9.51% to 11.55%, suggesting higher expectations for top line expansion.

- Net Profit Margin has risen significantly from roughly 9.89% to 36.70%, pointing to a much stronger anticipated profitability profile.

- Future P/E Multiple has fallen sharply from approximately 71.3x to 14.2x, implying a more conservative valuation framework for forward earnings.

Key Takeaways

- Shifting investor appetite for alternative assets and inflation-resistant strategies is fueling strong fundraising, improved asset mix, and higher margins for Patria.

- Strategic expansion in Latin America and global diversification efforts position Patria to capture increasing institutional flows and sustain long-term revenue growth.

- Exposure to fee compression, regional instability, rapid acquisitions, and expansion risks could constrain margins, slow growth, and challenge Patria's profitability and operational resilience.

Catalysts

About Patria Investments- Operates as a private market investment firm.

- The accelerating global shift of institutional capital towards alternative assets, particularly private equity, infrastructure, and credit, is directly driving robust organic fundraising growth, reflected in Patria's repeated upward revision to annual fundraising guidance and rate of net new fee-earning AUM inflows; this underpins long-term revenue and earnings expansion.

- Increasing investor demand for inflation-resistant, high-yield strategies (such as infrastructure and credit) amid global macro uncertainty and high interest rates has led to outsized fundraising traction in these segments. This trend is poised to continue, improving both asset mix and margins as Patria allocates new capital into higher-fee, resilient strategies.

- Sustained economic development and a growing middle class in Latin America, alongside swelling pension fund pools (e.g., in Mexico), are expanding the firm's addressable market for alternatives. Patria's established regional presence positions it to capture a disproportionate share of local product launches and institutional allocations, supporting consistent AUM and fee revenue growth.

- Global investors are rotating capital into regions perceived as less exposed to U.S. trade and geopolitical risks, with Latin America and Europe benefiting. Patria is gaining incremental flows from Asian, Middle Eastern, and European LPs seeking portfolio diversification and new markets, which should accelerate fundraising and revenue diversification.

- The company's ongoing expansion into new strategies, products, and geographies (including recent acquisitive moves in Brazilian and Mexican real estate and GPMS European platforms) further diversifies fee revenues and enhances operating leverage, thus supporting higher sustainable margins and earnings compounding as scale advantages take hold.

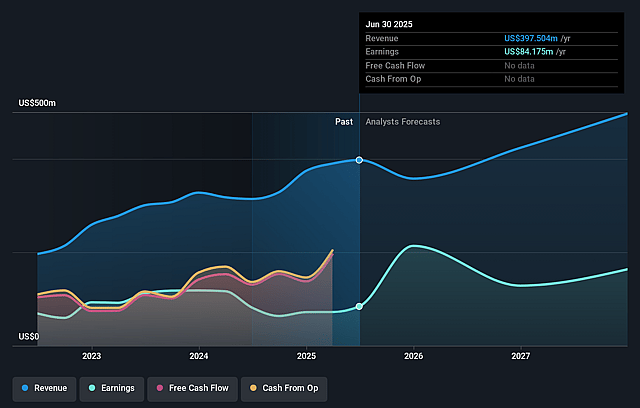

Patria Investments Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Patria Investments's revenue will grow by 9.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 21.2% today to 9.9% in 3 years time.

- Analysts expect earnings to reach $51.6 million (and earnings per share of $0.38) by about September 2028, down from $84.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 71.2x on those 2028 earnings, up from 26.6x today. This future PE is greater than the current PE for the US Capital Markets industry at 26.7x.

- Analysts expect the number of shares outstanding to grow by 3.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.31%, as per the Simply Wall St company report.

Patria Investments Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces potential fee compression as new fund strategies diversify its asset mix-management explicitly guides the average fee rate to decline from 95 basis points to 92–94 basis points in coming quarters; this long-term industry trend and evolving product mix could reduce net margins and slow overall earnings growth.

- A significant portion of Patria's fundraising and AUM is still anchored in Latin America (~30% of invested assets in Brazil, with further exposure in Chile, Colombia, and Peru), exposing the firm to cyclical regional political and macroeconomic instability (including tariff battles and elections); volatility or adverse outcomes here could lead to fundraising slowdowns, AUM outflows, or deterioration in asset performance, affecting revenues and profitability.

- Rapid expansion through acquisitions (e.g., multiple Brazilian REITs and entry into Mexico) may lead to operational complexity and integration challenges, especially as the firm increases its reliance on inorganic growth; if not managed effectively, this can result in rising expenses, lower operating leverage, and ultimately constrain future earnings growth.

- The company's business model, with 80% of fee-earning AUM locked in non-permanent vehicles (and a pending AUM pipeline tied to capital deployment), introduces some risk if investment opportunities slow or if any underlying asset classes (such as LatAm infrastructure or credit) see a cyclical downturn; delayed deployment or weaker performance could result in a lull in fee generation, directly impacting revenues and distributable earnings.

- Entrance into markets like Mexico, while gradual, involves material regulatory and competitive risks; attempts at further internationalization and product innovation may increase exposure to oversight, compliance costs, and competition with global players in both established and emerging markets-which could erode market share, pressure fees, and weigh on margins and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.167 for Patria Investments based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $522.0 million, earnings will come to $51.6 million, and it would be trading on a PE ratio of 71.2x, assuming you use a discount rate of 8.3%.

- Given the current share price of $14.05, the analyst price target of $16.17 is 13.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Patria Investments?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.