Key Takeaways

- Execution risks in expanding investment solutions and new markets could impact revenue if market demand and strategic offerings don't align.

- Significant tech investments, including AI and modernization, may pressure margins if expected efficiency gains aren't realized.

- Northern Trust's strategic growth, driven by strong asset management inflows, technology initiatives, and wealth management expansion, enhances efficiency, profitability, and future revenue prospects.

Catalysts

About Northern Trust- A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

- Northern Trust's focus on expanding alternative investment solutions and entering new markets presents execution risks. Challenges in fully leveraging firm capabilities could impact revenue growth if market demand doesn’t align with strategic offerings.

- The company plans significant investments in technology and modernization, including accelerating cloud adoption and deploying AI. These investments may strain net margins if they do not lead to expected efficiency gains.

- Northern Trust's increase in operational expenses related to modernization and the focus on organic growth could pressure earnings if revenue growth does not outpace these expenses.

- The strategic shift to prioritize scalable growth within Asset Servicing and Capital Markets may result in fewer business opportunities if the market dynamics don't favor existing capabilities, potentially affecting margins if cost adjustments don't follow.

- Northern Trust's initiative to deepen investment in high-cost areas like international expansion and the establishment of ultrahigh net worth practices in Wealth Management suggests high reliance on these new ventures achieving anticipated success, directly impacting margins and earnings growth.

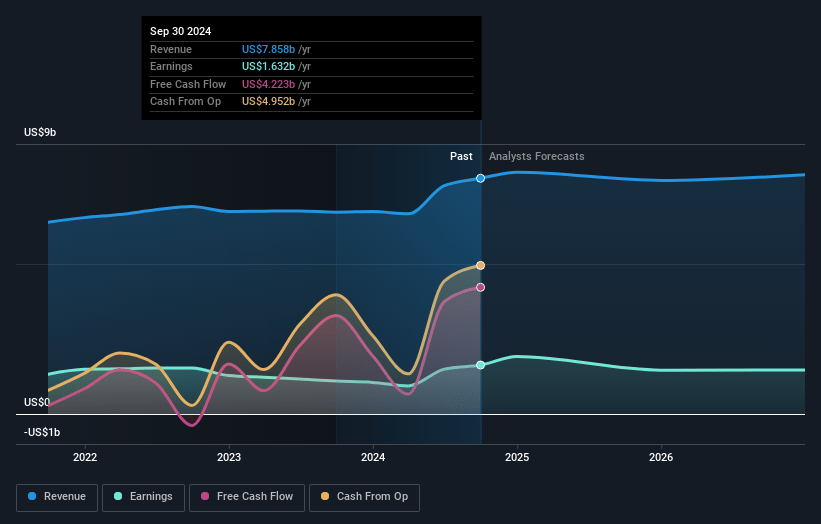

Northern Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Northern Trust's revenue will grow by 1.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 23.8% today to 20.2% in 3 years time.

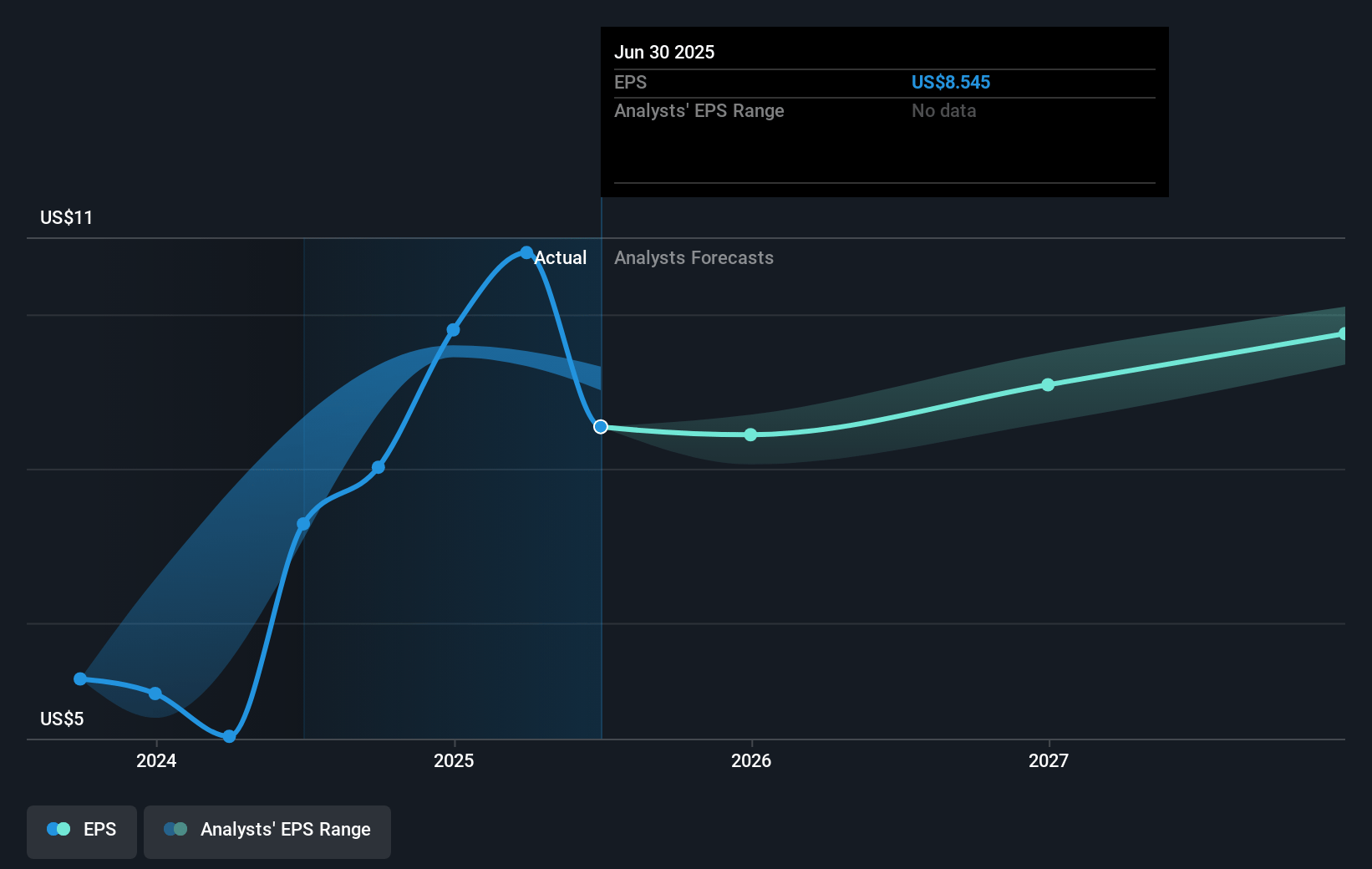

- Analysts expect earnings to reach $1.8 billion (and earnings per share of $9.46) by about January 2028, down from $2.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, up from 11.2x today. This future PE is lower than the current PE for the US Capital Markets industry at 23.1x.

- Analysts expect the number of shares outstanding to decline by 1.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.41%, as per the Simply Wall St company report.

Northern Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Northern Trust has demonstrated a strong revenue and earnings growth trajectory, with revenue up 8% for the full year, trust fees up 12% in the fourth quarter, and EPS growing by more than 50%. This growth is partially credited to their One Northern Trust strategy, which emphasizes optimizing growth and leveraging capabilities across businesses. Such strong financial performance can positively impact revenue and earnings.

- The company experienced positive inflows in asset management, with a 13% growth in liquidity, surpassing $300 billion in AUM, and positive long-term flows indicating strong demand for its services. This suggests a potential for sustained revenue growth in the asset management segment.

- Northern Trust has made significant progress in its technology and productivity initiatives, including automation and AI, leading to substantial cost savings. A headcount reduction over several quarters while enhancing productivity indicates improved efficiency and potentially better profit margins in the future.

- Wealth Management experienced 12% growth in trust fees and significant expansion in wealth deposits, reflecting strong market demand in what is considered a high-margin business segment. This contributes positively to the company’s net margins.

- The strategic focus on expanding alternative investment solutions, collaborating across sectors, and having a disciplined business generation approach in Wealth Management and Asset Servicing positions Northern Trust to capitalize on emerging industry trends, potentially improving future revenue streams and enhancing profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $115.97 for Northern Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $136.0, and the most bearish reporting a price target of just $101.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $8.7 billion, earnings will come to $1.8 billion, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 8.4%.

- Given the current share price of $112.41, the analyst's price target of $115.97 is 3.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.