Last Update07 May 25

Key Takeaways

- Strategic investments in product innovation and market expansion are expected to drive revenue growth and strengthen Nasdaq's global position.

- Partnerships with AWS and expansion of Verafin solutions are set to enhance operational efficiency and customer engagement for financial growth.

- Regulatory and macroeconomic uncertainties, intense competition, and reliance on strategic partnerships pose risks to Nasdaq's growth, revenue, and margin stability.

Catalysts

About Nasdaq- Operates as a technology company that serves capital markets and other industries worldwide.

- Nasdaq's strategic investments in product innovation, international market expansion, and new product launches, especially in the index business, are expected to drive sustained revenue growth. These initiatives aim to strengthen their global position and diversify revenue streams from the Nasdaq 100, supporting long-term earnings performance.

- The enhanced partnership with AWS is expected to modernize Nasdaq's market infrastructure across its financial services clientele, driving operational efficiencies, improving scalability, and potentially increasing market share, positively impacting net margins and future revenue growth.

- The expansion of Verafin's AI-driven solutions is anticipated to enhance the platform's value, facilitating upselling opportunities, attracting new clients, and increasing engagement. This should support growth in ARR and revenue, contributing to profitability through increased customer retention and usage.

- As Nasdaq continues to expand its global footprint with initiatives like opening a new regional headquarters in Texas and engaging with international financial markets, this geographic expansion is expected to widen its client base and strengthen revenue streams, thereby improving overall earnings sustainability.

- Nasdaq's commitment to robust share repurchase programs and debt reduction initiatives is likely to enhance earnings per share (EPS) growth, providing a catalyst for stock valuation appreciation as the company returns capital to shareholders while maintaining financial flexibility.

Nasdaq Future Earnings and Revenue Growth

Assumptions

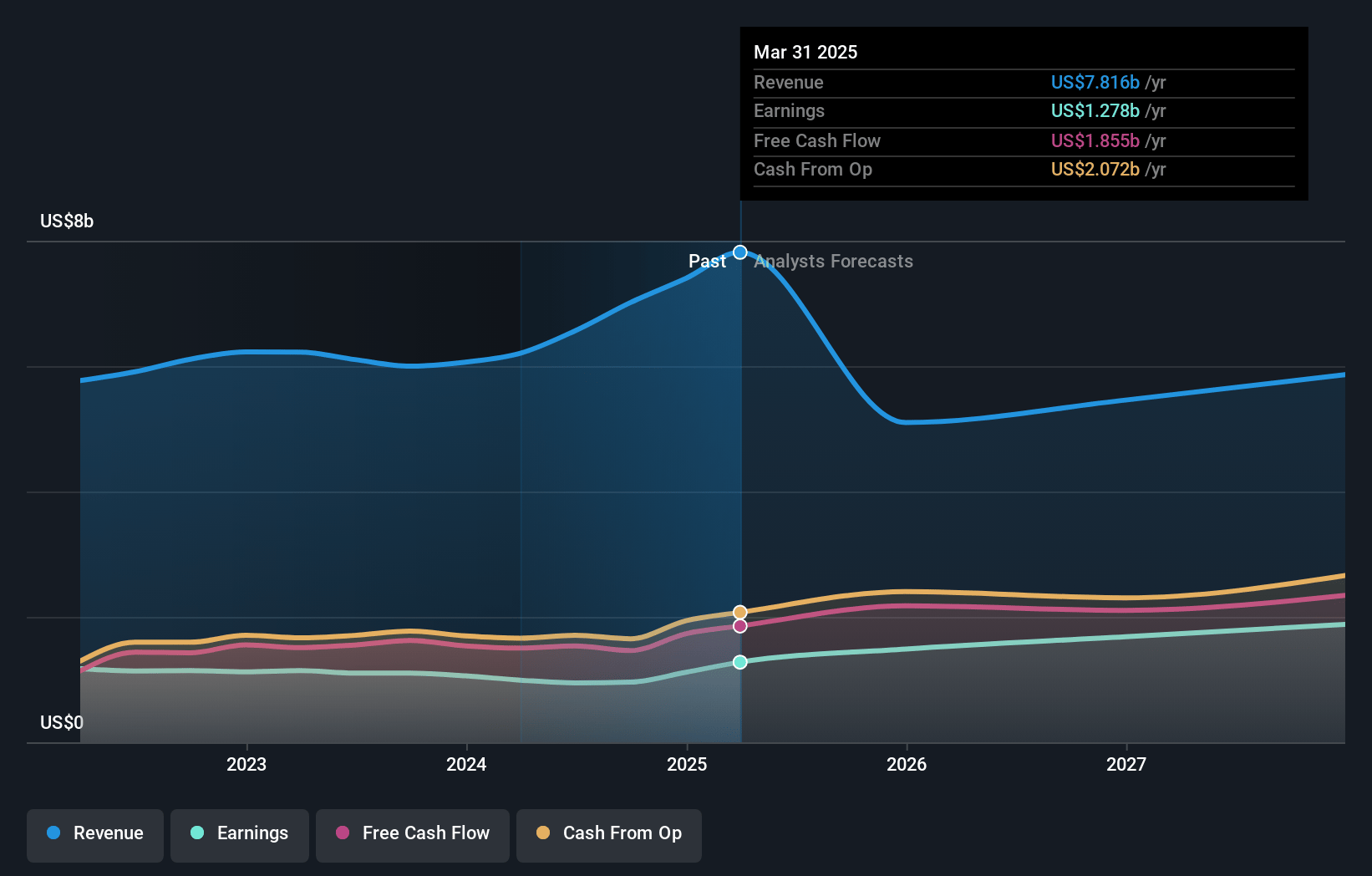

How have these above catalysts been quantified?- Analysts are assuming Nasdaq's revenue will decrease by 9.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.4% today to 31.2% in 3 years time.

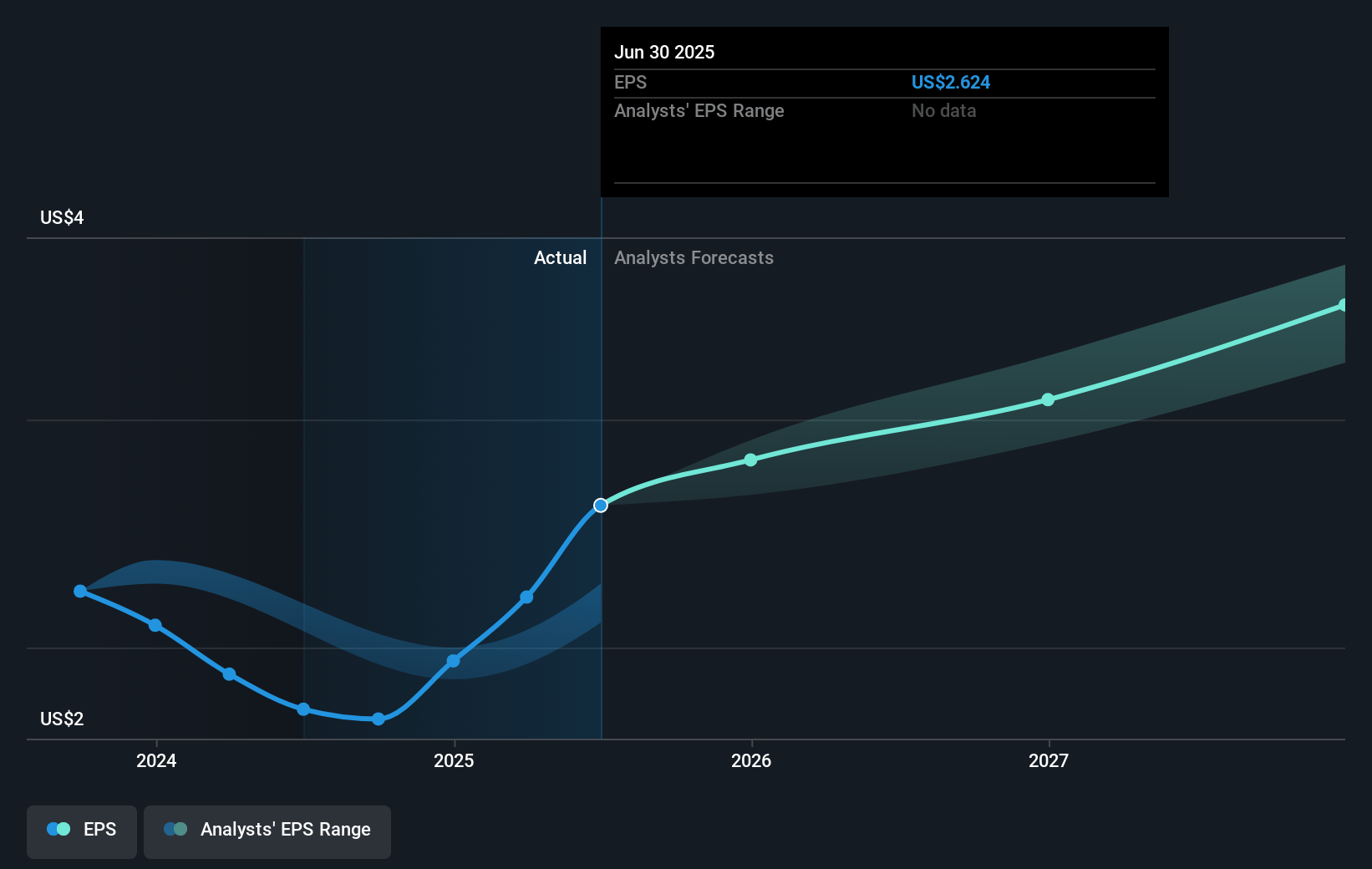

- Analysts expect earnings to reach $1.8 billion (and earnings per share of $3.29) by about May 2028, up from $1.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.5x on those 2028 earnings, down from 35.1x today. This future PE is greater than the current PE for the US Capital Markets industry at 25.0x.

- Analysts expect the number of shares outstanding to decline by 0.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.63%, as per the Simply Wall St company report.

Nasdaq Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The macro environment is marked by significant uncertainty, driven by changing trade policies and geopolitical tensions, which could weigh on global GDP growth expectations and corporate decision-making, potentially impacting Nasdaq's revenue and growth prospects.

- The delay in the decision-making process among clients, particularly for larger deals within the Financial Technology division, could lead to slower-than-expected revenue and ARR growth in subsequent quarters, affecting overall earnings.

- Nasdaq faces intense competition from other exchanges and financial technology firms, which could impact their market share and growth, particularly in the listings and financial technology segments, influencing future revenue and margin performance.

- Nasdaq's growth strategy involves a high dependence on strategic partnerships and acquisitions, such as the Adenza transaction, and their aim to achieve significant synergies; any failure to integrate or achieve expected efficiencies could affect net margins and long-term financial targets.

- Regulatory and macroeconomic uncertainties, especially concerning new regulations for financial markets and technology integration (such as cloud migration), could impact client acquisition and retention, influencing Nasdaq’s future revenue and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $83.722 for Nasdaq based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $101.0, and the most bearish reporting a price target of just $68.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.8 billion, earnings will come to $1.8 billion, and it would be trading on a PE ratio of 32.5x, assuming you use a discount rate of 7.6%.

- Given the current share price of $78.08, the analyst price target of $83.72 is 6.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.