Key Takeaways

- Strong client acquisition in Asia boosts future revenue growth through increased trading activities and brokerage fees.

- Expanding product offerings and crypto trading in Hong Kong diversify revenue streams and enhance future earnings potential.

- Futu's reliance on stock performance and foreign exchange, along with rising costs and a lack of market expansion, threatens revenue and margin stability.

Catalysts

About Futu Holdings- Provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally.

- Futu Holdings has experienced strong client acquisition growth, particularly in Hong Kong, Singapore, and Malaysia, due to effective marketing campaigns and elevated market sentiment. This is likely to impact their future revenue growth through increased trading activities and brokerage fees.

- The company is expanding its product offerings, including U.S. stock dividend reinvestment plans, NISA accounts in Japan, and U.S. margin trading. These innovations cater to diverse customer needs, potentially boosting future earnings through a broader revenue base.

- Futu reported a significant increase in total trading volume, especially in U.S. stocks, driven by heightened interest in technology stocks and leveraged ETFs, which improves the prospects for higher future revenues.

- The growth in total client assets by 48% year-over-year, partly due to market appreciation and robust net asset inflows, suggests a strengthening asset base, which can enhance future interest income and overall earnings.

- The company's expansion into crypto trading in Hong Kong, along with the anticipated VATP license, positions it well in a burgeoning market sector, which could drive additional future revenue streams and improve earnings.

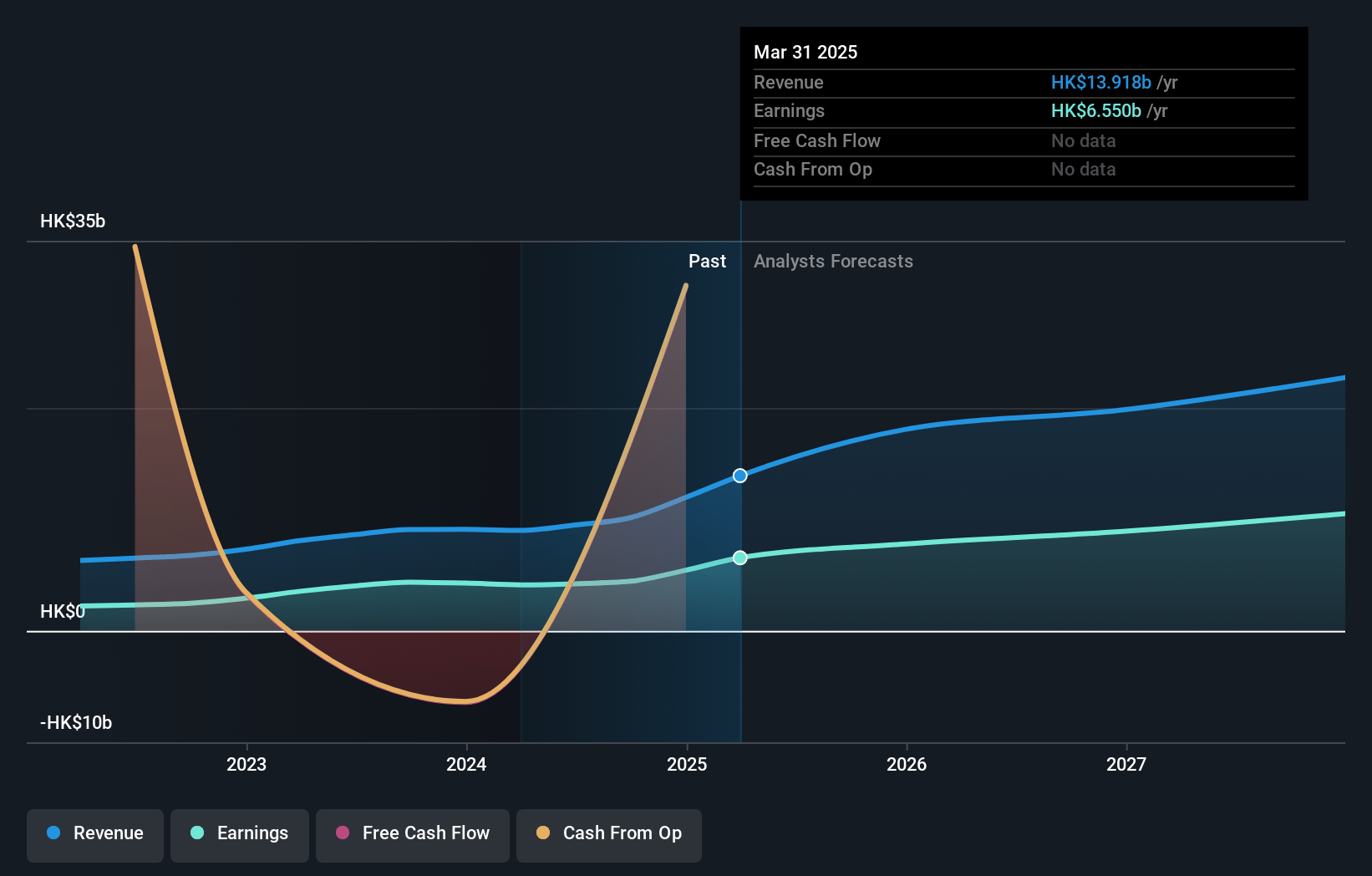

Futu Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Futu Holdings's revenue will grow by 23.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 43.8% today to 48.0% in 3 years time.

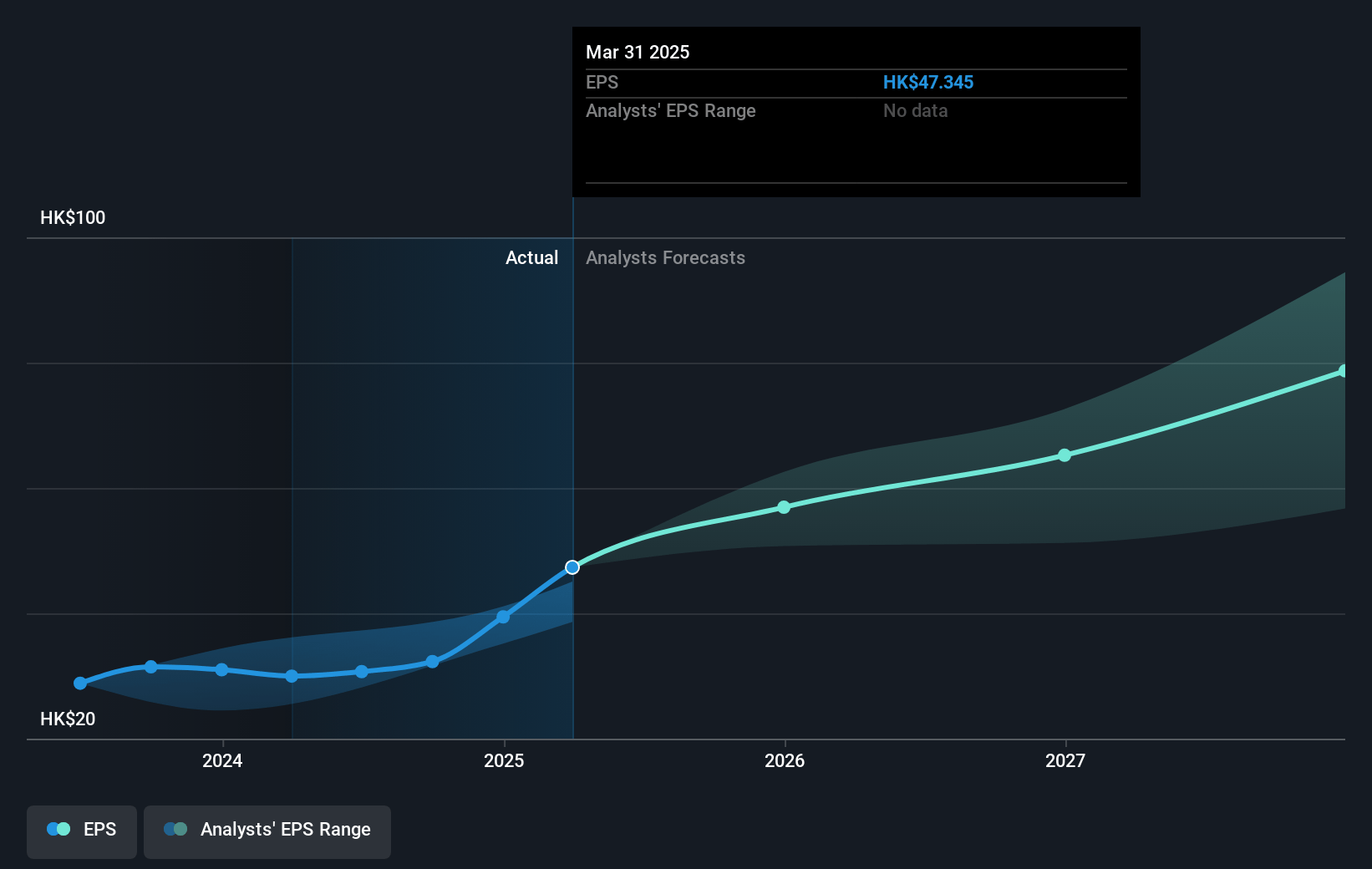

- Analysts expect earnings to reach HK$9.1 billion (and earnings per share of HK$69.61) by about January 2028, up from HK$4.4 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as HK$6.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.8x on those 2028 earnings, down from 24.1x today. This future PE is lower than the current PE for the US Capital Markets industry at 23.1x.

- Analysts expect the number of shares outstanding to decline by 1.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.64%, as per the Simply Wall St company report.

Futu Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in blended commission rate, due to clients gravitating towards higher-priced stocks, could impact brokerage income and margin profitability.

- The significant expenses in interest and servicing are rising, driven by security borrowing and lending business, which could squeeze net margins if not controlled.

- Unrealized foreign exchange losses driven by currency fluctuations, such as the RMB appreciation, are impacting net income margins and future earnings stability.

- The lack of imminent plans to enter new markets, coupled with the variable nature of marketing expenditure, could limit accelerated client acquisition or revenue growth opportunities.

- Dependence on equity market performance for asset growth and trading volumes makes Futu vulnerable to market downturns, which could significantly impact revenue and profit stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $120.88 for Futu Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $160.3, and the most bearish reporting a price target of just $95.18.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be HK$19.0 billion, earnings will come to HK$9.1 billion, and it would be trading on a PE ratio of 16.8x, assuming you use a discount rate of 7.6%.

- Given the current share price of $99.69, the analyst's price target of $120.88 is 17.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives