Key Takeaways

- Strategic market expansion and partnerships in Money Transfer and Merchant Services will enhance revenue growth and customer base.

- The Ren payments platform drives technological advancement and financial performance improvement through internal and external usage.

- Euronet's diversification and reliance shifts face challenges, potentially impacting margins, profitability, and growth amid stagnation, competition, and regulatory pressures.

Catalysts

About Euronet Worldwide- Provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers worldwide.

- Euronet Worldwide plans to expand its ATM network by adding domestic and international access fees in existing and new markets, aiming to boost operating income and profit margins.

- The company is leveraging its Ren payments platform not only for internal transaction processing but also as a product offered to other businesses, which enhances technological capabilities and is expected to positively impact earnings and revenue growth.

- With a strategic focus on digital transformation, Euronet anticipates significant growth from digital and direct-to-consumer transactions in the Money Transfer segment, which shows the potential for continuous revenue and customer base expansion.

- Strategic partnerships and new market expansions, especially in the Money Transfer segment and Merchant Services, are expected to drive revenue growth with the acquisition of significant new partnerships like PLS Financial Services.

- The anticipated release of highly popular gaming content, like Grand Theft Auto VI, through direct partnerships is expected to significantly boost revenue in the epay segment, capitalizing on increased demand in digital media.

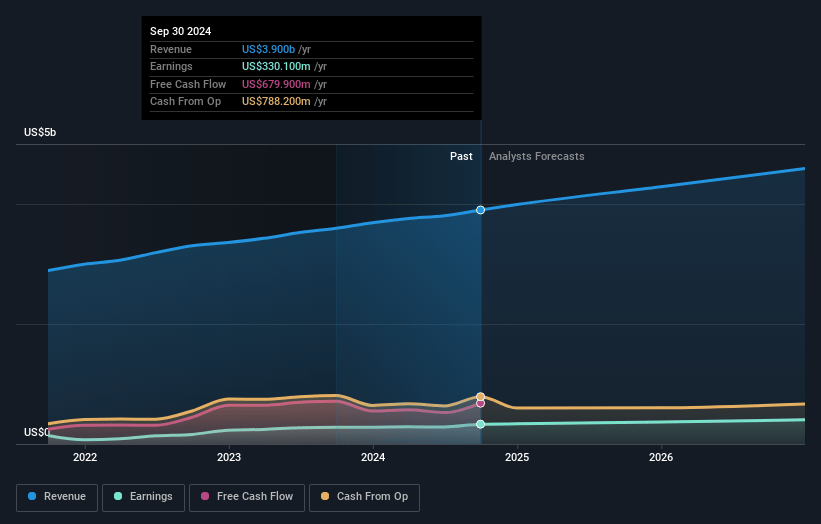

Euronet Worldwide Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Euronet Worldwide's revenue will grow by 7.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.5% today to 8.7% in 3 years time.

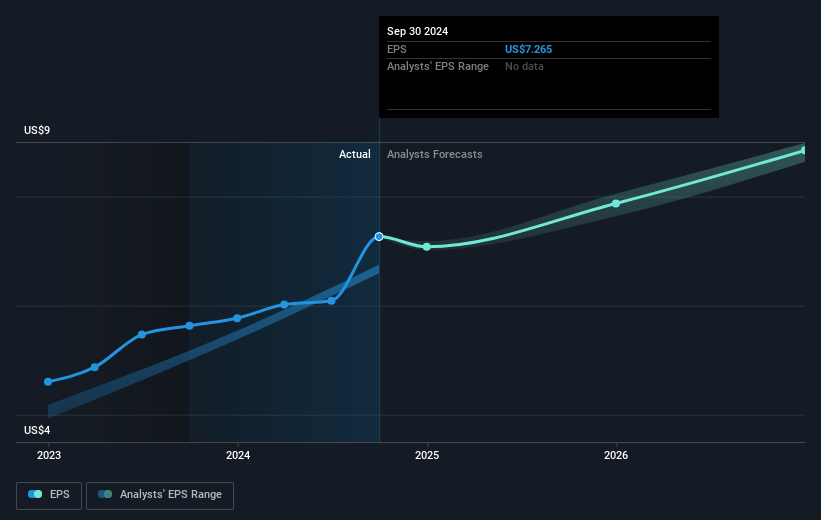

- Analysts expect earnings to reach $418.4 million (and earnings per share of $9.2) by about January 2028, up from $330.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.1x on those 2028 earnings, up from 13.0x today. This future PE is lower than the current PE for the US Diversified Financial industry at 18.5x.

- Analysts expect the number of shares outstanding to grow by 1.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.85%, as per the Simply Wall St company report.

Euronet Worldwide Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A primary risk is the international transactions which are still slightly down, reflecting a potentially stagnating market that could affect future revenues and profitability growth.

- Euronet is attempting to diversify its epay business away from reliance on major third-party content like Google Play and iTunes. This transition could result in fluctuating net margins due to increased competition and the uncertainties in the proprietary product offerings.

- The company's EFT margins are facing pressures, with costs increasing compared to pre-COVID levels, potentially impacting overall profitability and net earnings growth.

- The reliance on digital marketing for customer acquisition in the Money Transfer segment poses risks; if acquisition costs increase or if new customer growth slows, this could impact net margins and earnings.

- The expansion of domestic access fees in Europe might face regulatory and competitive challenges which can affect the anticipated profitability improvement in the EFT segment revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $126.75 for Euronet Worldwide based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $150.0, and the most bearish reporting a price target of just $108.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.8 billion, earnings will come to $418.4 million, and it would be trading on a PE ratio of 17.1x, assuming you use a discount rate of 7.8%.

- Given the current share price of $98.0, the analyst's price target of $126.75 is 22.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives