Key Takeaways

- Rapid user and revenue growth is fueled by digital banking adoption, improved AI underwriting, and a more profitable pricing model that boosts retention and earnings stability.

- Strategic partnerships and ecosystem expansion increase product offerings, enhance compliance, and foster sustainable growth through higher customer value and deeper engagement.

- Heavy reliance on fee-driven credit products, rising customer acquisition costs, regulatory and legal risks, and weak product diversification threaten Dave's sustainable growth and margin stability.

Catalysts

About Dave- Provides various financial products and services through its financial services platform in the United States.

- Continued rapid member and revenue growth is supported by the ongoing migration of consumers away from traditional banks toward digital-first platforms, especially among the underbanked and gig economy workforce, which greatly expands Dave’s addressable market and increases both total revenue and average revenue per user (ARPU).

- Enhanced deployment of Dave’s proprietary AI-driven underwriting and risk platform (CashAI) is resulting in improved credit performance, lower loss ratios, and enabled larger advances to more users—a trend that strengthens variable margins and is expected to further increase net profit as scale and data advantages accrue.

- The rollout of a new, mandatory fee structure for the core ExtraCash product has driven materially higher monetization, stickier customer relationships, and reduced earnings volatility versus the old, optional tip-based model, providing visibility into higher ARPU and supporting both top line and EBITDA margin expansion going forward.

- Strategic partnerships—such as the new collaboration with Coastal Community Bank—are expected to unlock new product categories (e.g., longer-duration credit products) and enhance compliance infrastructure, enabling Dave to both increase customer lifetime value (CLV) and accelerate cross-sell opportunities, which should drive sustainable multi-year revenue and margin growth.

- Intensified member engagement through a broader and more integrated ecosystem (e.g., ExtraCash, Dave Card, deeper banking relationships) leverages long-term trends in financial literacy and mobile adoption, leading to higher user retention, increased transaction frequency, and an ongoing lift in both revenue and net margins.

Dave Future Earnings and Revenue Growth

Assumptions

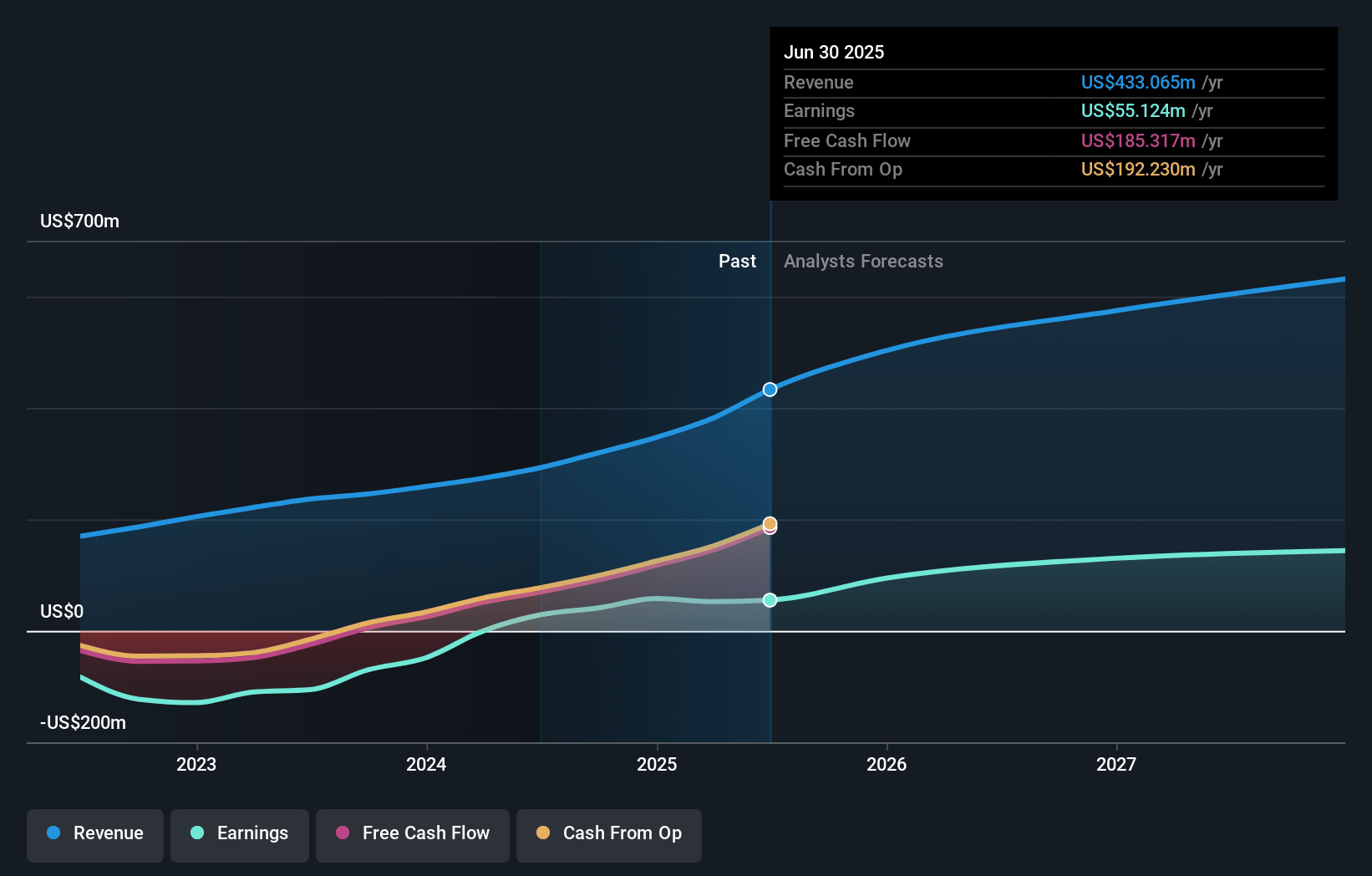

How have these above catalysts been quantified?- Analysts are assuming Dave's revenue will grow by 16.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.7% today to 29.8% in 3 years time.

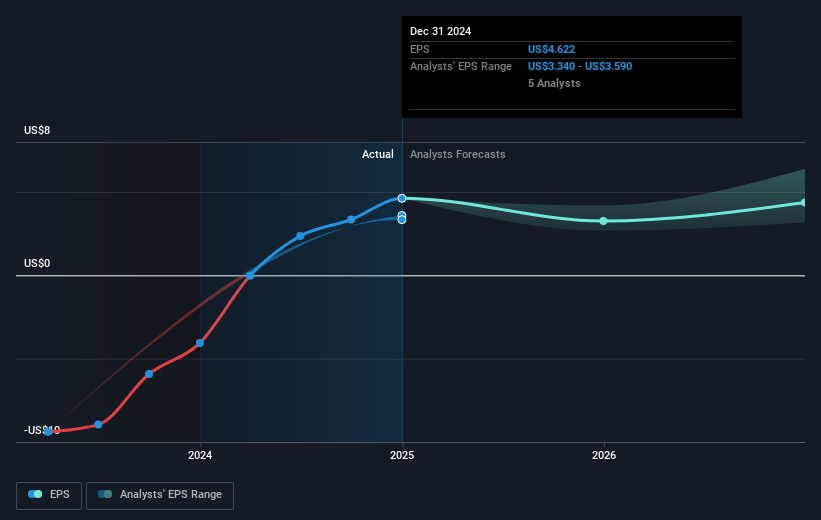

- Analysts expect earnings to reach $177.8 million (and earnings per share of $10.87) by about May 2028, up from $52.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.1x on those 2028 earnings, down from 46.5x today. This future PE is greater than the current PE for the US Consumer Finance industry at 10.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.99%, as per the Simply Wall St company report.

Dave Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued high dependency on ExtraCash’s mandatory fee structure, which is newly implemented and drove much of the recent ARPU/monetization gains, exposes Dave to regulatory risk or consumer backlash; potential fee caps or restrictions could directly impact core revenues and net margin durability over the long term.

- Normalization of credit performance post-tax refund season, combined with guidance that provision for credit losses as a percentage of originations will trend upward through the remainder of the year, highlights ongoing exposure to credit cycle pressures, which could negatively impact future earnings and variable margins if delinquencies or charge-offs materially rise in a weaker macro or higher-rate environment.

- Rising customer acquisition costs (CAC up 13% year-over-year) amid management’s pivot toward higher-value but costlier acquisition channels increases long-term risk that accelerating digital finance competition from neobanks, traditional banks, and alternative fintechs will further inflate CAC and compress operating margins if monetization cannot keep pace.

- Limited product diversification and still-low direct deposit penetration—at sub-10% of the base considering Dave their “primary account”—makes Dave vulnerable to churn, slows cross-sell rates, and increases dependency on short-duration, small-dollar credit cycles for revenue, constraining sustainable top-line growth and overall earnings stability compared to more diversified fintech peers.

- Material litigation with the DOJ introduces uncertainty and potential for increased compliance costs, adverse outcomes, or reputational damage, which could impact both near-term profitability and long-term investor confidence, ultimately weighing on share price performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $182.0 for Dave based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $206.0, and the most bearish reporting a price target of just $130.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $595.8 million, earnings will come to $177.8 million, and it would be trading on a PE ratio of 20.1x, assuming you use a discount rate of 7.0%.

- Given the current share price of $183.32, the analyst price target of $182.0 is 0.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.