Key Takeaways

- Integration with SB Software and expansion in U.K./EMEA and LAC are forecasted to enhance revenue through cross-selling and international growth.

- Innovation in product offerings and focus on operational efficiencies aims to boost customer satisfaction, transaction revenues, and net margins.

- Reduced equipment revenue and increased operating expenses, coupled with decreased cash reserves, pose risks to liquidity and long-term profitability amid international expansion challenges.

Catalysts

About Cantaloupe- A digital payments and software services company, provides technology solutions for self-service commerce market.

- The integration of SB Software's Vendmanager with Cantaloupe's payment devices is expected to enhance cross-selling opportunities and drive revenue growth through new customer acquisitions, impacting overall company revenue.

- Expansion into the U.K./EMEA and LAC regions, including notable wins like Carbon Neutral Vending and scaling deployments with key customers, is likely to boost international revenue, enhancing overall revenue growth.

- The increasing adoption of micro markets and smart stores, especially in new verticals like residential complexes and fitness centers, should attract new customers and higher transaction volumes, positively affecting revenue and gross margins.

- Innovations like the premium suite management system Suite and enhancements to the Seed vending management software platform could lead to increased customer efficiency and satisfaction, potentially improving subscription and transaction revenues as ARPU rises.

- Focus on operational efficiencies and scaling the international footprint to drive both revenue growth and net margins, with fiscal year 2025 guidance suggesting improvements in earnings and operating cash flow.

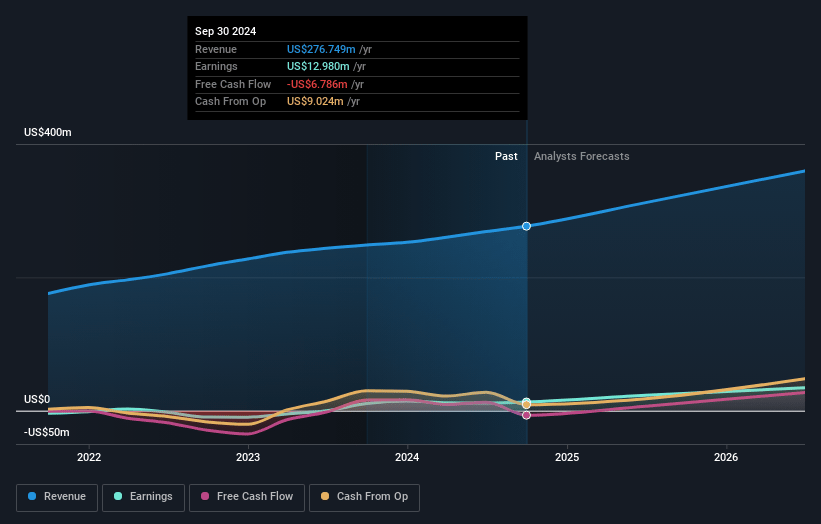

Cantaloupe Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cantaloupe's revenue will grow by 15.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.7% today to 14.0% in 3 years time.

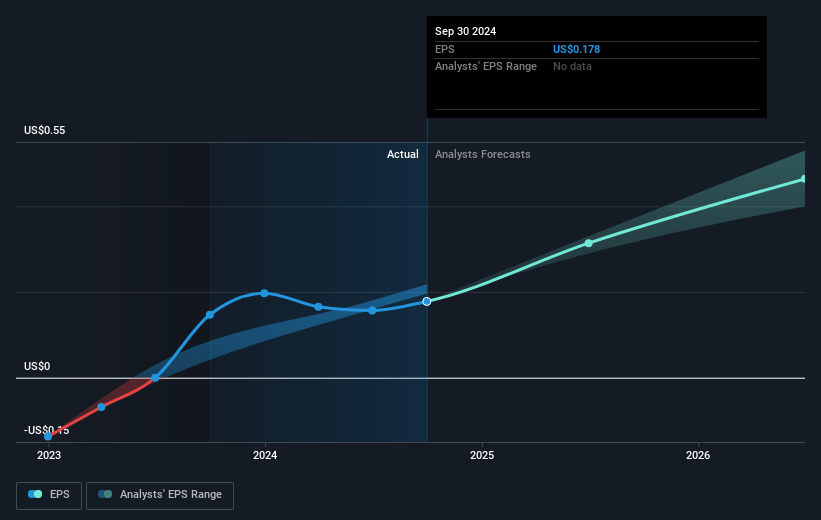

- Analysts expect earnings to reach $60.1 million (and earnings per share of $0.8) by about January 2028, up from $13.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.3x on those 2028 earnings, down from 46.8x today. This future PE is lower than the current PE for the US Diversified Financial industry at 18.5x.

- Analysts expect the number of shares outstanding to grow by 0.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.83%, as per the Simply Wall St company report.

Cantaloupe Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company experienced a decrease in equipment revenue of 6.7% compared to Q1 FY 2024, which could impact overall revenue growth if this trend continues.

- Operating expenses increased to $24.7 million from $21.6 million, partly due to international expansion and non-recurring expenses, which could affect net margins if not managed efficiently.

- The decrease in cash and cash equivalents from $59 million to $33 million, primarily due to the SB Software acquisition and operating activities, poses a risk to liquidity and potential earnings if cash flow does not improve as anticipated.

- The wide guidance range for EBITDA and net income suggests uncertainty in forecasts, which could affect investor confidence and perceived earnings stability.

- Exposure to evolving international markets, such as Latin America and EMEA, involves risks associated with market entry and scaling strategies that might not yield desired revenue growth or could incur unexpected costs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.5 for Cantaloupe based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $428.7 million, earnings will come to $60.1 million, and it would be trading on a PE ratio of 17.3x, assuming you use a discount rate of 6.8%.

- Given the current share price of $8.32, the analyst's price target of $11.5 is 27.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives