Narratives are currently in beta

Key Takeaways

- Strategic shift to subscription and services revenue may enhance revenue stability and predictability through less volatile income streams.

- International expansion and regulatory clarity efforts signal sustained revenue growth and long-term capital inflows in the crypto space.

- Declining trading volumes, regulatory risks, and interest rate dependencies threaten Coinbase's traditional revenue streams and future growth prospects.

Catalysts

About Coinbase Global- Provides financial infrastructure and technology for the crypto economy in the United States and internationally.

- Coinbase's strategic shift from transaction fee revenue to subscription and services revenue, with a target of surpassing $2 billion in 2024, up from $1.4 billion in 2023, could enhance revenue stability and predictability, given the less volatile nature of subscription-based income.

- International expansion into four new markets, where revenues now exceed direct operating costs, indicates potential for sustained revenue growth and financial flexibility, supported by a stronger balance sheet of $8.2 billion.

- The growing adoption and integration of stablecoins, smart wallets, and Layer 2 solutions like Base can significantly enhance utility and revenue opportunities by enabling fast, cheap, and globally scalable payment solutions. The increased use of stablecoins such as USDC and EURC can contribute positively to revenue growth by fostering new financial transactions.

- Regulatory clarity efforts, with significant political support and pro-crypto legislation like the FIT 21 bill, could create a favorable environment for institutional adoption, thus unlocking significant inflows of capital and supporting long-term revenue growth in the crypto space.

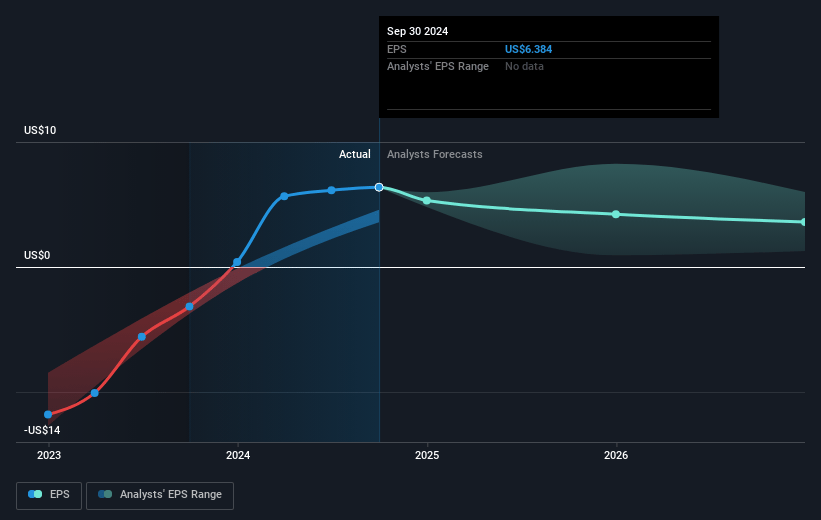

- The Board's authorization for up to a $1 billion stock buyback program, combined with a strategy of careful capital allocation to M&A and ventures, suggests potential for improved earnings per share (EPS), indicating confidence in the company's financial health and future prospects.

Coinbase Global Future Earnings and Revenue Growth

Assumptions

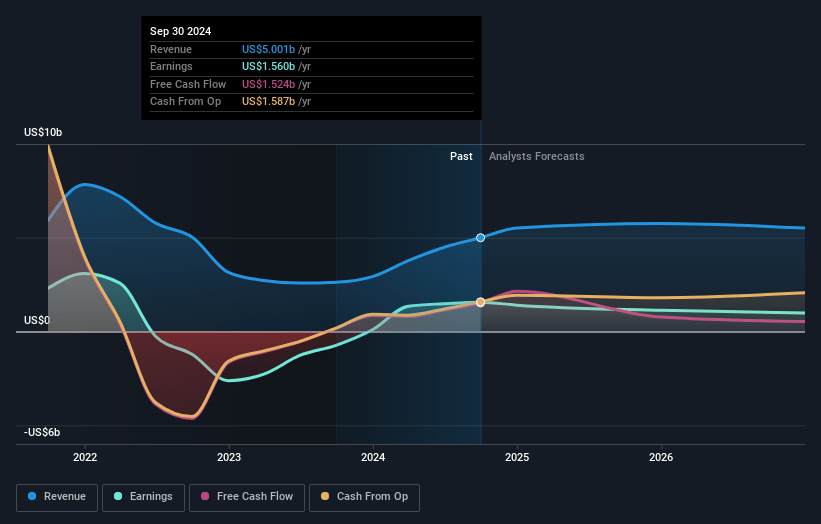

How have these above catalysts been quantified?- Analysts are assuming Coinbase Global's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 31.2% today to 14.0% in 3 years time.

- Analysts expect earnings to reach $799.3 million (and earnings per share of $3.09) by about January 2028, down from $1.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.7 billion in earnings, and the most bearish expecting $566.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 115.9x on those 2028 earnings, up from 42.4x today. This future PE is greater than the current PE for the US Capital Markets industry at 23.2x.

- Analysts expect the number of shares outstanding to grow by 1.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.92%, as per the Simply Wall St company report.

Coinbase Global Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faced a decline in trading volume and transaction revenue in Q3, influenced by lower crypto asset volatility and pricing, which may impact future revenues negatively if market conditions do not improve.

- The increase in stablecoin pair trading volume, which generates little-to-no fees, suggests a shift in customer behavior that could reduce the effectiveness of traditional revenue sources and impact net margins.

- Despite positive international expansion efforts, potential regulatory challenges remain a significant risk, especially if new laws are not favorable, impacting both revenue growth and operational costs.

- The company's heavy reliance on regulatory clarity to unlock new growth avenues highlights a major risk in achieving projected earnings if such clarity is delayed or creates obstacles.

- With a substantial portion of its revenues linked to interest rates via stablecoins, fluctuations in interest rates could adversely affect subscription and services revenue, influencing net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $293.88 for Coinbase Global based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $420.0, and the most bearish reporting a price target of just $150.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.7 billion, earnings will come to $799.3 million, and it would be trading on a PE ratio of 115.9x, assuming you use a discount rate of 6.9%.

- Given the current share price of $264.33, the analyst's price target of $293.88 is 10.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives