Key Takeaways

- Leadership changes and compensation restructuring aim to improve operational efficiency and net margins.

- Share repurchases and investment in Global Investment Solutions might drive earnings growth and enhance shareholder value.

- Heavy reliance on credit and investment solutions for future growth could lead to revenue vulnerability if growth expectations are unmet.

Catalysts

About Carlyle Group- An investment firm specializing in direct and fund of fund investments.

- The Carlyle Group anticipates having robust investment opportunities in Global Credit and Insurance, Global Investment Solutions, Global Wealth, and Capital Markets, which could also lead to a 40% increase in revenue growth over the next few years, potentially supporting a more optimistic revenue outlook.

- The repositioning within Carlyle’s leadership team and the overhaul of the compensation strategy are expected to align incentives more effectively and drive further operational efficiency, which may result in an improvement in net margins.

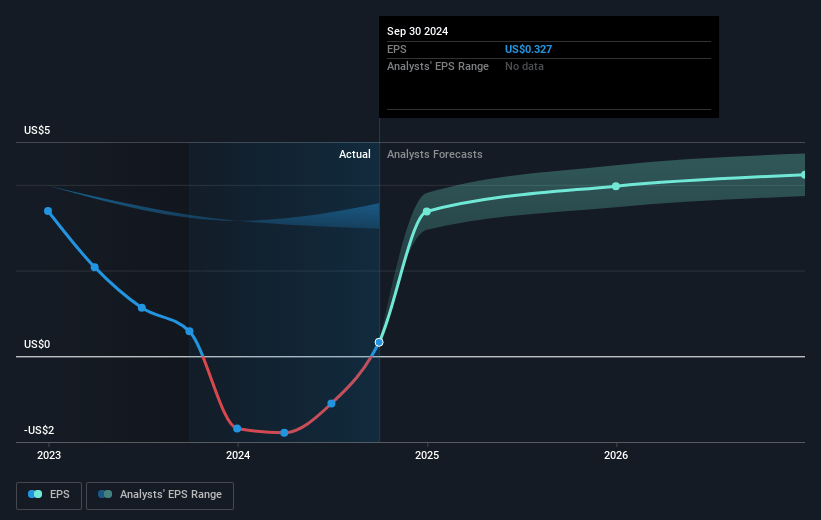

- Carlyle's new capital allocation strategy, especially the $1.4 billion share repurchase authorization, suggests a strong internal belief in the undervaluation of their shares, which could lead to a significant rise in earnings per share as buybacks reduce the outstanding share count.

- With particular growth momentum in Global Investment Solutions and the successful closing of new collateralized fund obligations, the expansion of this business segment might lead to continued increases in fee-related earnings and operating income.

- Carlyle's presence in asset-backed finance, infrastructure, and renewable energy sectors within its capital markets business is likely to enhance transaction revenue significantly, potentially improving earnings consistency despite broader market fluctuations.

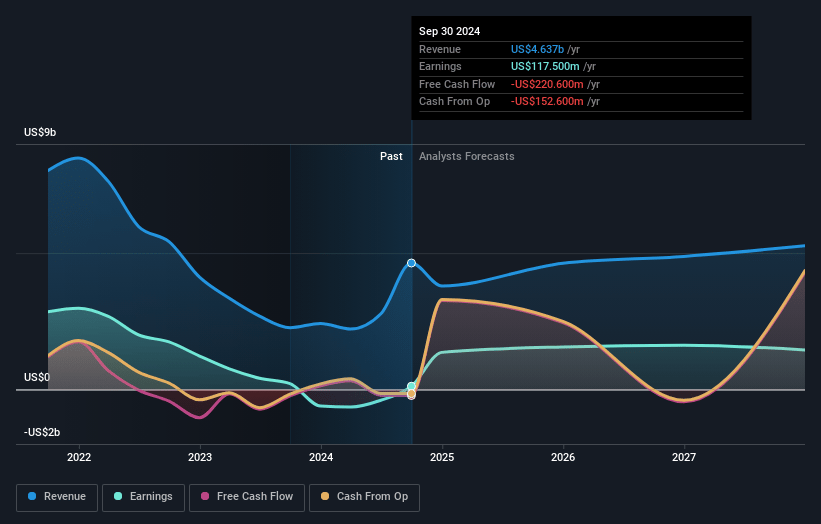

Carlyle Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Carlyle Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Carlyle Group's revenue will grow by 2.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 21.5% today to 28.7% in 3 years time.

- The bearish analysts expect earnings to reach $1.5 billion (and earnings per share of $4.16) by about April 2028, up from $1.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.9x on those 2028 earnings, which is the same as it is today today. This future PE is lower than the current PE for the US Capital Markets industry at 23.1x.

- Analysts expect the number of shares outstanding to grow by 0.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.73%, as per the Simply Wall St company report.

Carlyle Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The anticipated modest decline in Global Private Equity management fees due to timing in fundraising efforts could adversely affect revenue.

- There are expected headwinds in the CLO business within Global Credit, which could impact the profitability and revenue growth of this segment.

- The dependence on significant 2025 growth from credit and investment solutions, with lower expectations for private equity, suggests potential vulnerability in revenue if projected growth does not materialize.

- The high levels of investment required to drive long-term growth in areas such as asset-backed finance and Global Wealth distribution may pressure net margins in the short term.

- The planned continuation of share buybacks, while positive for shareholders, could limit capital available for other investments that might enhance long-term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Carlyle Group is $39.79, which represents one standard deviation below the consensus price target of $45.81. This valuation is based on what can be assumed as the expectations of Carlyle Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $58.0, and the most bearish reporting a price target of just $37.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $5.0 billion, earnings will come to $1.5 billion, and it would be trading on a PE ratio of 12.9x, assuming you use a discount rate of 8.7%.

- Given the current share price of $36.57, the bearish analyst price target of $39.79 is 8.1% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NasdaqGS:CG. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.