Last Update 26 Sep 25

Fair value Increased 2.78%Webull’s consensus price target has increased to $18.50, primarily driven by stronger revenue growth expectations and a modest compression in its future P/E ratio.

What's in the News

- Webull added to S&P Global BMI Index.

- Launched brokerage services in the Netherlands, initiating European expansion with AFM authorization; offers trading of European and U.S. equities, ETFs, U.S. options, and educational tools to Dutch residents.

- Reintroduced cryptocurrency trading for U.S. users, now fully integrated within the main Webull app, enabling 24/7 trading of over 50 digital assets.

- Entered a standby equity purchase agreement with Yorkville for up to $1 billion in ordinary shares over 36 months, with shares issued at 97.5% of market price and specific structuring and commitment fees.

Valuation Changes

Summary of Valuation Changes for Webull

- The Consensus Analyst Price Target has risen slightly from $18.00 to $18.50.

- The Consensus Revenue Growth forecasts for Webull has significantly risen from 26.1% per annum to 30.7% per annum.

- The Future P/E for Webull has fallen slightly from 57.57x to 54.75x.

Key Takeaways

- Diversification through global expansion and thriving subscription-based services is enhancing customer growth, revenue stability, and higher average user returns.

- Agile adoption of digital assets and favorable regulations strengthen product innovation, user engagement, and expansion of revenue sources worldwide.

- Webull's reliance on retail trading, exposure to regulatory and competitive pressures, and vulnerability to changing investor behavior threaten sustained revenue and margin growth.

Catalysts

About Webull- Operates as a digital investment platform.

- Ongoing expansion into new international markets, including recent launches in Canada, Latin America, and Europe, is rapidly diversifying Webull's customer base and driving robust growth in assets under management (AUM), which supports future revenue and top-line growth.

- The successful launch and acceleration of subscription-based offerings such as Webull Premium and paid analytics products are already exceeding targets, combining higher daily trading activity and increased average revenue per user (ARPU) to boost net margins and recurring revenue stability.

- Rapid adoption and reintroduction of crypto trading, alongside the platform's ability to quickly add new digital asset classes and prediction markets, positions Webull to capture growing demand for broad, mobile-accessible investment options, fueling revenue growth and market share.

- Strategic capital raises, including a $1 billion standby equity facility, are enabling accelerated new product development and global platform rollout, ensuring continued scale and innovation while supporting future margin expansion and operating leverage.

- Positive regulatory developments fostering transparency and enabling expanded access to digital assets allow Webull to introduce and monetize innovative products globally, driving higher user engagement, increased fee income, and broader revenue streams.

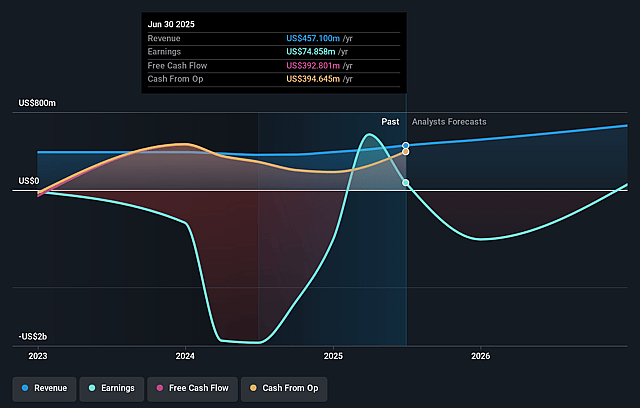

Webull Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Webull's revenue will grow by 26.1% annually over the next 3 years.

- Analysts are not forecasting that Webull will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Webull's profit margin will increase from 16.3% to the average US Capital Markets industry of 25.4% in 3 years.

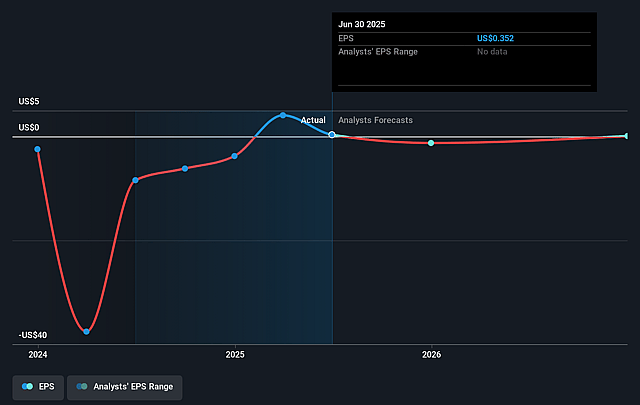

- If Webull's profit margin were to converge on the industry average, you could expect earnings to reach $233.4 million (and earnings per share of $0.39) by about September 2028, up from $74.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 57.6x on those 2028 earnings, down from 83.6x today. This future PE is greater than the current PE for the US Capital Markets industry at 26.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.04%, as per the Simply Wall St company report.

Webull Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Webull's significant growth in trading volumes, revenue, and customer assets is highly correlated with recent market volatility and favorable equity market conditions-if broader macroeconomic cycles change or retail trading activity structurally declines, transaction-based revenue could contract, impacting both revenue and long-term earnings.

- The platform's profitability and expansion are reliant on acquiring and monetizing active, self-directed retail traders; demographic shifts as younger investors age or widening consumer skepticism toward aggressive trading platforms could hinder customer acquisition, retention, and wallet share growth, thus slowing revenue expansion.

- Although rapid international and crypto rollout is highlighted as an opportunity, regulatory approval processes vary by region and asset class-with increasing regulatory scrutiny globally, delays, restrictions, or adverse regulations could constrain product offerings and require higher compliance costs, pressuring net margins and future revenue.

- Webull faces intensifying competition from larger, diversified brokers (e.g., Fidelity, Schwab, Robinhood) and specialized fintechs, which may escalate customer acquisition costs and impede the up-selling of higher-margin products (e.g., premium subscriptions, wealth management), thereby limiting margin and earnings growth.

- Ongoing industry-wide price competition (e.g., zero-commission trading, low-cost margin loans) and commoditization of core brokerage services places sustained pressure on fee structures, risking long-term margin compression and eroding profitability even as operating scale increases.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $18.0 for Webull based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $920.2 million, earnings will come to $233.4 million, and it would be trading on a PE ratio of 57.6x, assuming you use a discount rate of 8.0%.

- Given the current share price of $12.93, the analyst price target of $18.0 is 28.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.