Narratives are currently in beta

Key Takeaways

- Strategic focus on cannabis REIT operations positions AFC for favorable supply-demand dynamics, enhancing net margins and earnings potential.

- Advantageous portfolio structure in a falling interest rate environment supports stable net margins and long-term shareholder value growth.

- The company's focus on the cannabis sector and slow legislative progress could limit capital access and adversely impact revenue and earnings.

Catalysts

About Advanced Flower Capital- Advanced Flower Capital Inc. originates, structures, underwrites, and invests in senior secured loans, and other various commercial real estate loans and debt securities for established companies operating in the cannabis industry.

- Advanced Flower Capital has exceeded their loan origination target, indicating strong growth potential and a renewed commitment to supporting the cannabis sector, which can drive revenue growth.

- The company maintains a robust pipeline of $400 million in potential deals, suggesting continued opportunity for investment and expansion, likely leading to increased earnings.

- With a strategic shift to operating as a pure-play cannabis mortgage REIT, AFC is poised to capitalize on favorable supply-demand dynamics and risk-adjusted returns, enhancing net margins.

- The fixed-rate and high SOFR floor structure of their portfolio positions AFC advantageously for a falling interest rate environment, potentially supporting stable or improved net margins.

- AFC's accretive capital raises and disciplined loan paydowns allow for capital redeployment into new, high-yield opportunities, which can improve earnings and long-term shareholder value.

Advanced Flower Capital Future Earnings and Revenue Growth

Assumptions

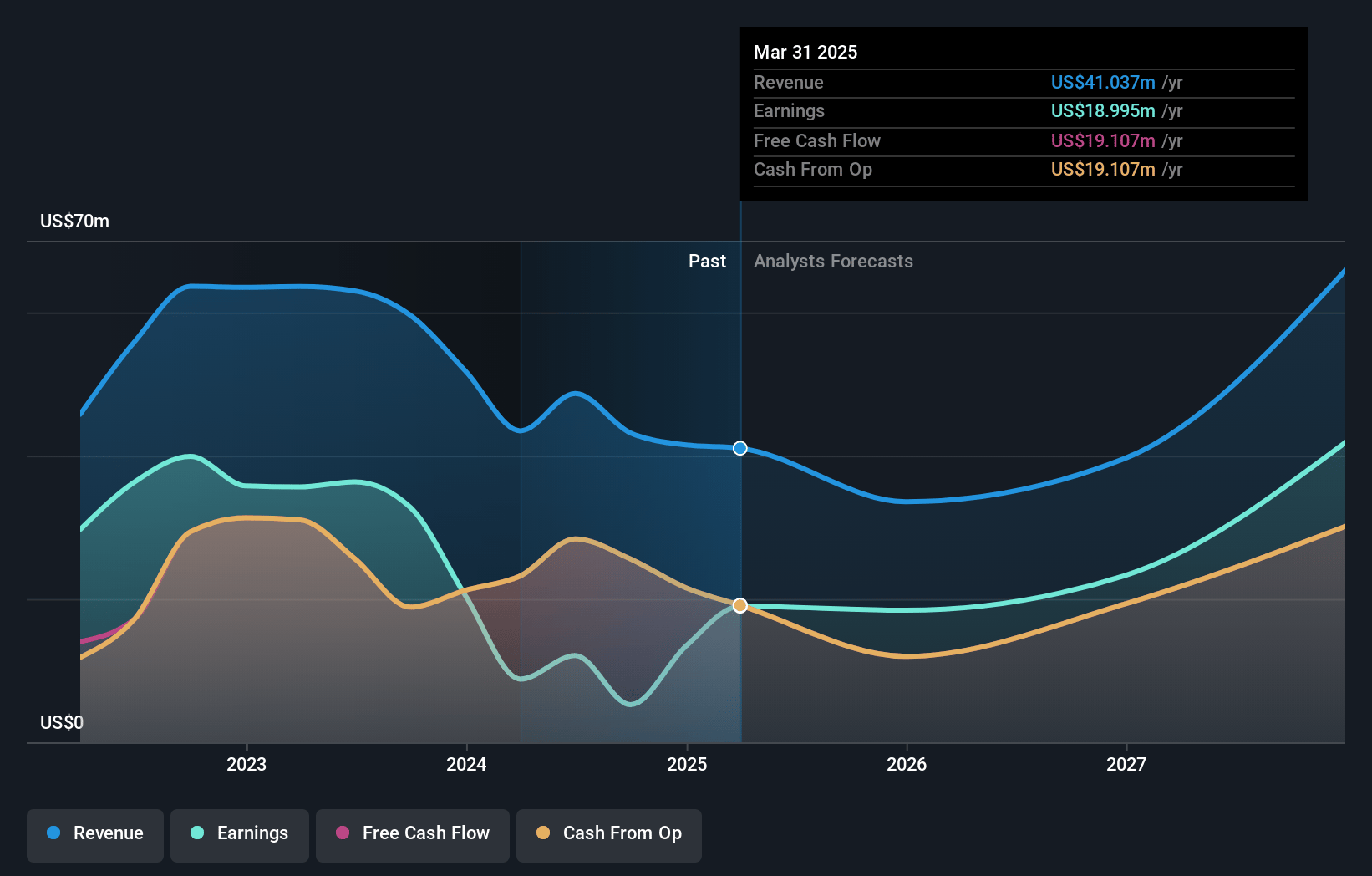

How have these above catalysts been quantified?- Analysts are assuming Advanced Flower Capital's revenue will grow by 24.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.2% today to 64.8% in 3 years time.

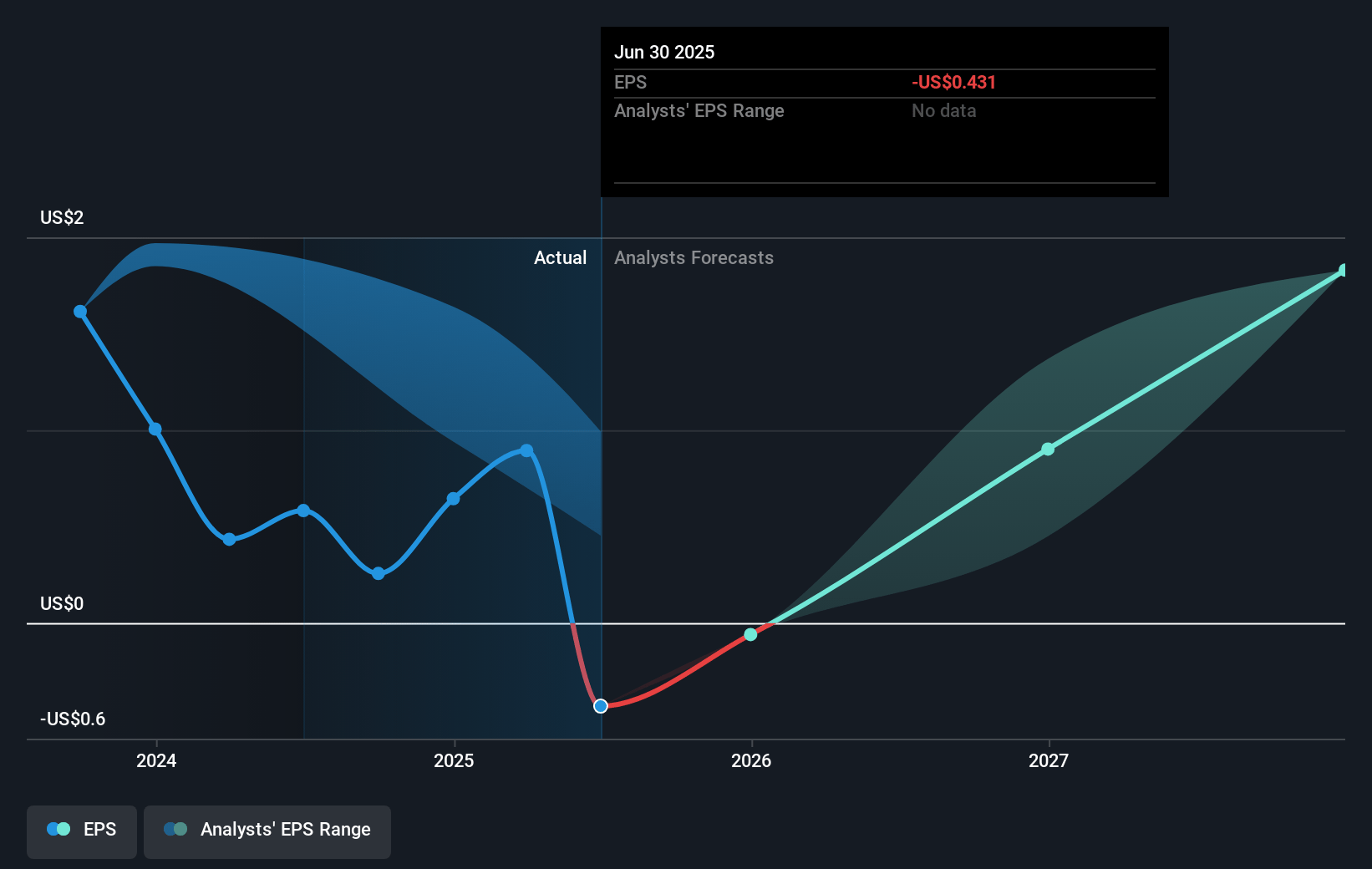

- Analysts expect earnings to reach $53.8 million (and earnings per share of $2.47) by about January 2028, up from $5.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.6x on those 2028 earnings, down from 34.3x today. This future PE is lower than the current PE for the US Mortgage REITs industry at 11.4x.

- Analysts expect the number of shares outstanding to decline by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Advanced Flower Capital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The slow progress in federal cannabis legislation, particularly the challenges surrounding the Safe Banking Act, could limit access to capital for the cannabis sector, potentially impacting AFC's pipeline and deal flow, adversely affecting revenue growth.

- The inherent uncertainties and potential for actual results to differ from projections can pose risks to AFC's financial performance, especially in terms of earnings and net margins.

- The high weighted average yield to maturity of the loan portfolio, primarily due to high interest rates and SOFR floors, might pose a risk if interest rates decline significantly, impacting net interest income.

- An increasing provision for credit losses and the growth in unrealized losses on loans indicate potential risks in loan performance, which could negatively impact net margins and earnings.

- The company's focus on a concentrated sector like cannabis, which is capital-intensive and faces regulatory and market maturity challenges, could expose it to sector-specific risks that might affect revenue and distributable earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.0 for Advanced Flower Capital based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $83.1 million, earnings will come to $53.8 million, and it would be trading on a PE ratio of 5.6x, assuming you use a discount rate of 5.9%.

- Given the current share price of $8.2, the analyst's price target of $12.0 is 31.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives