Key Takeaways

- Regulatory normalization and limited competition enable premium loan pricing, supporting strong earnings growth and higher net margins in the cannabis lending market.

- A diversified portfolio with loan focus on established operators reduces risk, ensuring stable revenue, resilient margins, and consistent shareholder returns.

- Advanced Flower Capital faces heightened credit risk, competitive threats, regulatory uncertainty, and profitability pressures that jeopardize dividend sustainability and long-term growth prospects.

Catalysts

About Advanced Flower Capital- Advanced Flower Capital Inc. originates, structures, underwrites, invests in, and manages senior secured loans and other types of mortgage loans and debt securities for established companies operating in the cannabis industry.

- The gradual progress toward cannabis regulatory normalization in the United States, including expected federal reform and improved access to traditional banking, stands to unlock substantial new lending and refinancing opportunities for Advanced Flower Capital, ultimately increasing origination volume and net interest income.

- Ongoing demographic shifts driven by an aging population and broader adoption of health and wellness solutions are expected to fuel robust, long-term cannabis demand, ensuring a steady pipeline of creditworthy borrowers and reducing default risks, which should support consistent revenue growth and drive higher net margins.

- Limited competition from other capital providers due to persistent underbanking in the cannabis sector allows Advanced Flower Capital to maintain premium loan pricing and strong yields, supporting high net interest income and superior long-term earnings growth.

- The company’s continued diversification of its loan portfolio across multiple states, combined with an active focus on lending to established, multistate operators, reduces credit concentration risk and supports earnings stability, allowing for more predictable and resilient net margins even in volatile markets.

- Strengthened balance sheet flexibility, as demonstrated by the recent renewal and potential expansion of the senior secured credit facility with an FDIC-insured bank, enhances Advanced Flower Capital’s ability to fund growth and drive future dividend increases, directly benefiting shareholder returns and supporting upward pressure on the stock price.

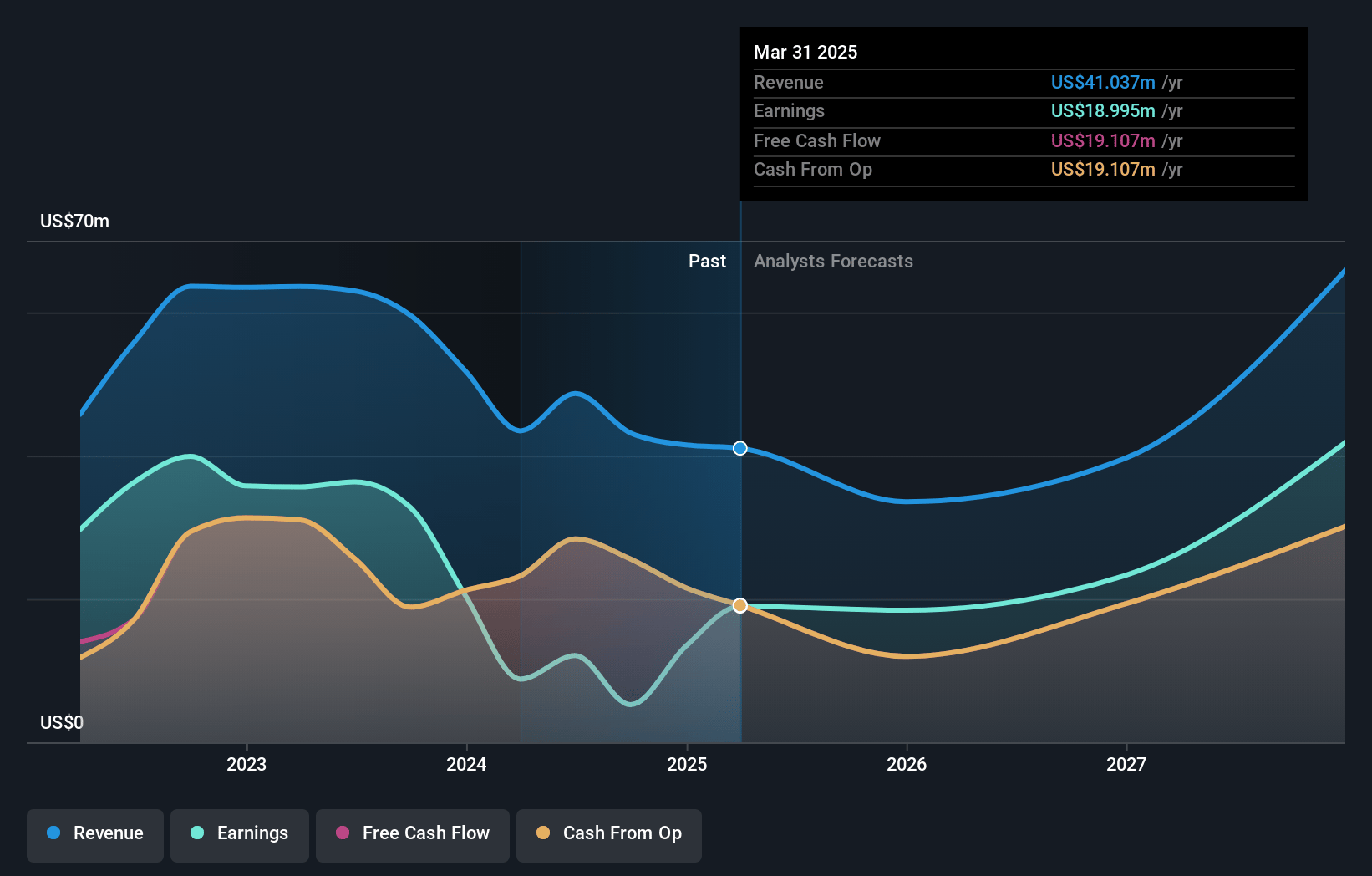

Advanced Flower Capital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Advanced Flower Capital compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Advanced Flower Capital's revenue will grow by 20.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 46.3% today to 65.1% in 3 years time.

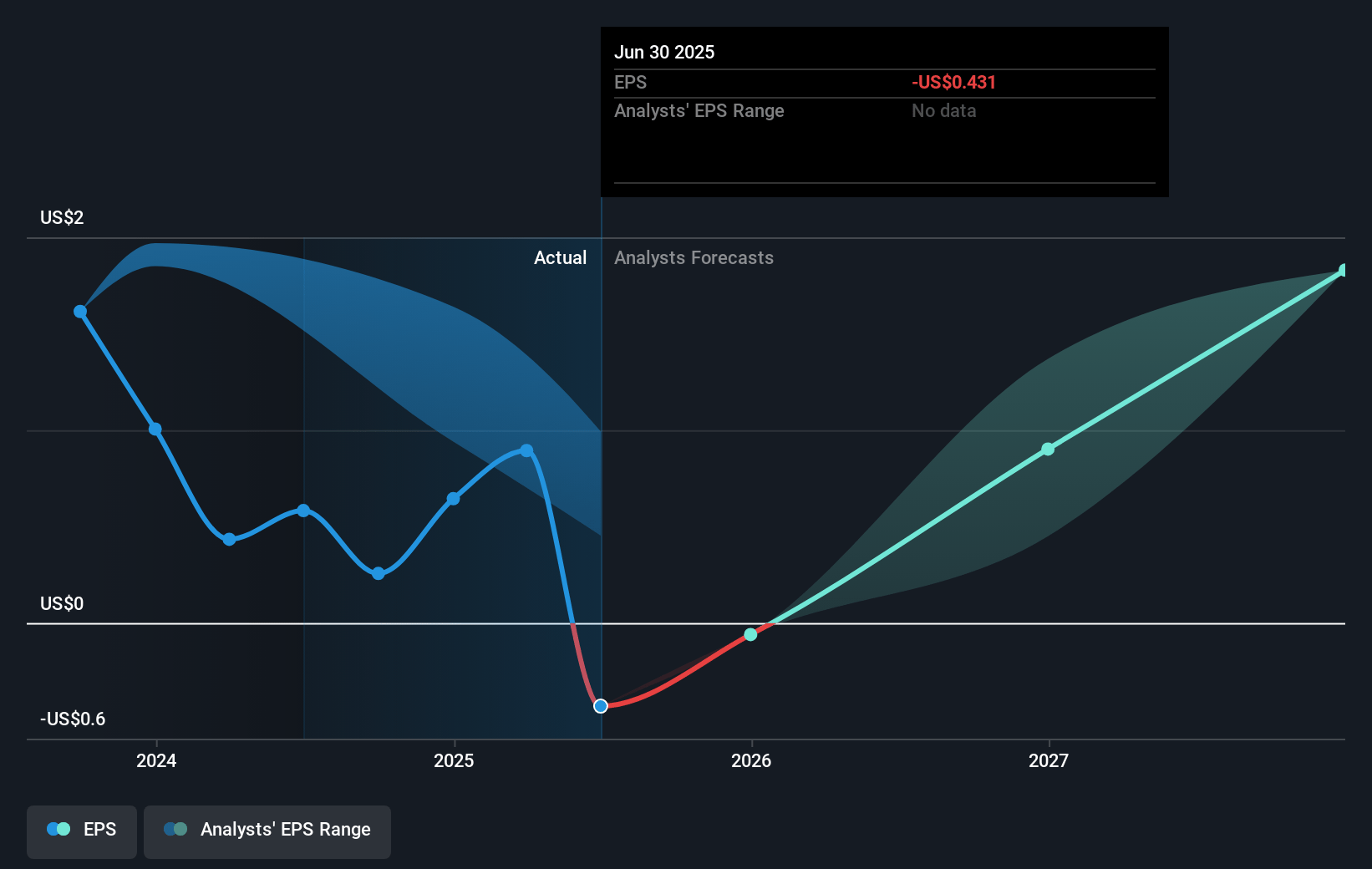

- The bullish analysts expect earnings to reach $46.6 million (and earnings per share of $2.03) by about July 2028, up from $19.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.1x on those 2028 earnings, up from 5.4x today. This future PE is lower than the current PE for the US Mortgage REITs industry at 11.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Advanced Flower Capital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The potential for federal cannabis legalization could attract large banks and traditional lenders into the space, significantly increasing competition and compressing loan yields, which would directly reduce Advanced Flower Capital’s future revenues and net interest margins.

- The company continues to manage a portfolio with significant exposure to a small number of borrowers, and ongoing underperformance of several legacy loans—combined with high CECL reserves and litigation—poses substantial credit risk that could lead to further loan losses and erode net asset value and core earnings over time.

- Muted origination activity, driven by management’s stated selectivity amidst ongoing cannabis market volatility, signals a risk of declining loan origination volumes even as other lenders enter the market, which may result in stagnant or shrinking revenues and put downward pressure on profitability.

- Distributable earnings per share are below the current dividend payout and the policy remains to return 85% to 100% of distributable earnings as dividends, implying limited retained earnings and reduced flexibility to reinvest in growth or weather adverse market cycles, threatening the sustainability of both dividends and longer-term profitability.

- Persistent regulatory uncertainty and compliance challenges, evidenced by ongoing legal proceedings with key borrowers and fluctuating state-level regulations, increase operational costs and the risk of adverse actions that could restrict the company’s lending activities, thereby negatively impacting future earnings and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Advanced Flower Capital is $13.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Advanced Flower Capital's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $13.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $71.6 million, earnings will come to $46.6 million, and it would be trading on a PE ratio of 9.1x, assuming you use a discount rate of 6.4%.

- Given the current share price of $4.53, the bullish analyst price target of $13.0 is 65.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.