Key Takeaways

- Strong market expertise and expansion in Africa and Canada drive revenue growth, with potential regulation benefiting market share.

- Cost reduction from U.S. sportsbook shutdown and robust cash position support shareholder returns and strategic investments.

- Challenges in the U.S. and Canadian markets, reliance on Africa, and foreign exchange risks threaten Super Group's earnings and profitability goals.

Catalysts

About Super Group (SGHC)- Operates as an online sports betting and gaming operator.

- Super Group's strategic focus on Africa, where it holds strong market positions in several regulated markets, is expected to drive significant revenue growth as the continent's population is projected to grow to 2.5 billion by 2050.

- The rollout of the Spin brands and the anticipated expansion into new African markets within the next 12 months is likely to boost revenue and operating margins due to Super Group's established local expertise and competitive advantage in this region.

- Strong growth in Canada, particularly with the Jackpot City brand, is contributing to increased revenues and could see further growth with potential regulation in provinces like Alberta, enhancing Super Group's market share.

- The completion of the U.S. sportsbook shutdown will reduce costs, thereby improving net margins, while ongoing efforts in New Jersey and Pennsylvania's iGaming could potentially lead to profitability if revenue targets are met.

- Super Group's robust financial position, with cash reserves and no debt, facilitates potential shareholder returns through dividends and allows for strategic investments or M&A to enhance earnings growth.

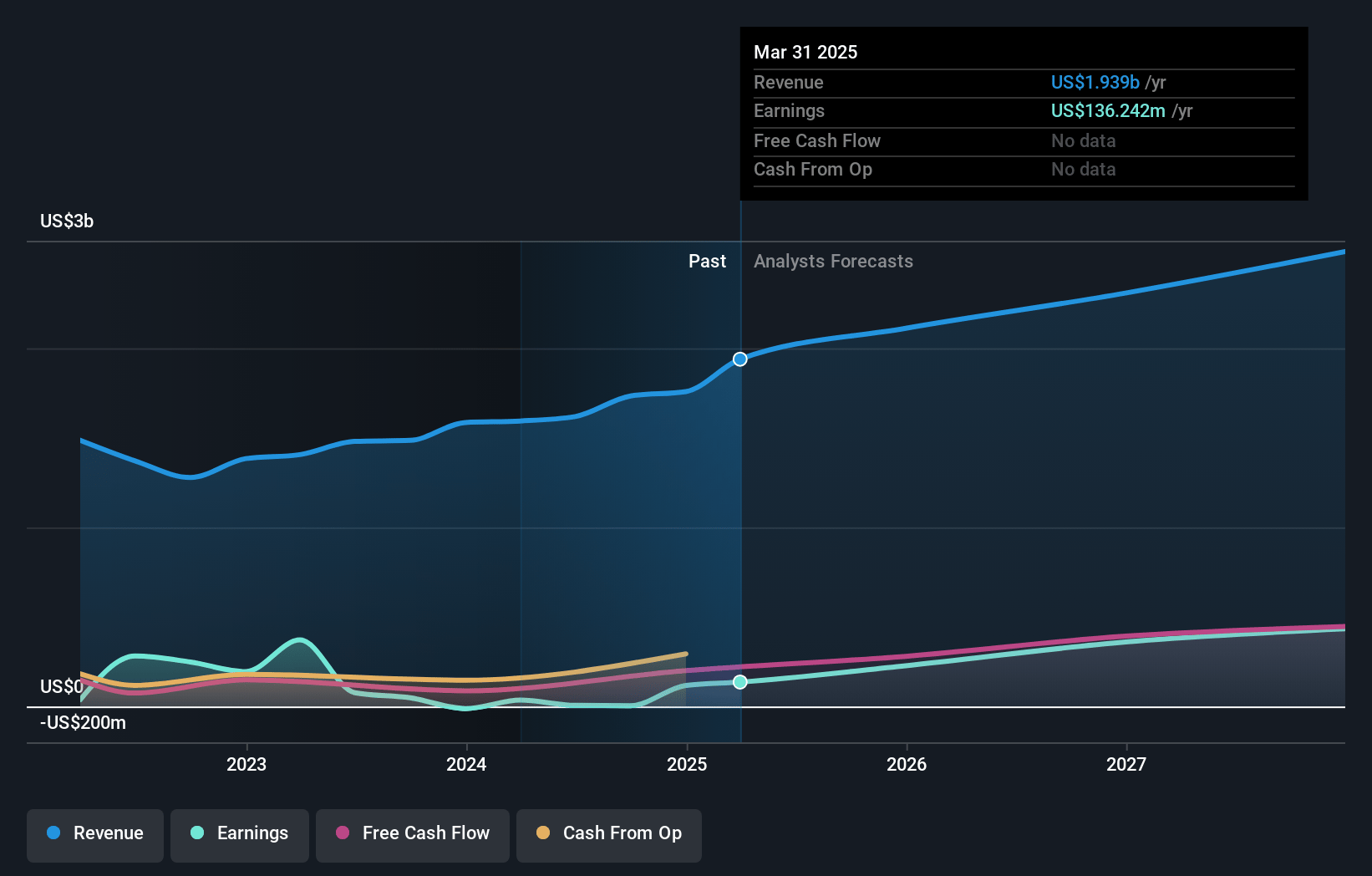

Super Group (SGHC) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Super Group (SGHC)'s revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.3% today to 15.6% in 3 years time.

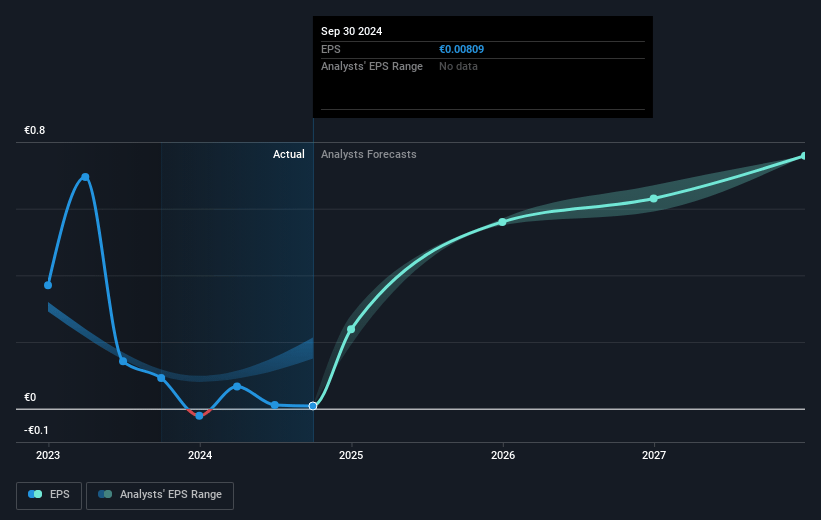

- Analysts expect earnings to reach €320.3 million (and earnings per share of €0.63) by about January 2028, up from €4.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.9x on those 2028 earnings, down from 959.2x today. This future PE is lower than the current PE for the US Hospitality industry at 24.3x.

- Analysts expect the number of shares outstanding to grow by 0.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.34%, as per the Simply Wall St company report.

Super Group (SGHC) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The challenge in the U.S. market, with the shutdown of the U.S. sportsbook operation and uncertainty around achieving profitability in iGaming, could negatively impact overall earnings and profitability targets.

- Dependence on the African market, while currently advantageous, may pose future risk due to potential regulatory changes or increased competition, which could affect revenue and market share.

- Exposure to foreign exchange headwinds, as indicated in previous discussions about growth, could affect reported revenue and net earnings.

- The uncertainty surrounding future regulation of iGaming in the U.S., and the potential for regulatory shifts, may add to the risk factors affecting strategic planning and profitability in this market.

- The competitive landscape and market dynamics in Canada pose challenges; they have experienced issues like cybersquatting impacting traffic and potential regulatory changes that could influence revenue generation and market positioning.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.5 for Super Group (SGHC) based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €2.0 billion, earnings will come to €320.3 million, and it would be trading on a PE ratio of 17.9x, assuming you use a discount rate of 7.3%.

- Given the current share price of $8.08, the analyst's price target of $9.5 is 14.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives