Key Takeaways

- Strategic expansion and new attractions are expected to boost attendance, enhance customer experience, and drive global revenue growth.

- Real estate and technology initiatives aim to diversify revenue, improve operational efficiencies, and increase customer retention and net margins.

- Weather-related disruptions and rising costs challenge revenue growth, with price resistance and decreased deferred revenue impacting future financial strategies.

Catalysts

About United Parks & Resorts- Operates as a theme park and entertainment company in the United States.

- United Parks & Resorts plans to launch a series of new rides and attractions in 2025, which are expected to drive attendance and boost revenue through increased visitor numbers and enhanced customer experience.

- The company's new and improved premium pass program is showing a strong sales increase of over 10% to date, which should lead to higher recurring revenue streams, improve customer retention, and potentially increase net margins with more premium offerings.

- Initiatives are underway to further monetize their strategic real estate holdings, including the potential development of hotels integrated into their properties, which could provide significant new revenue streams and enhance earnings through diversification.

- United Parks & Resorts is actively engaging in international expansion discussions with expected announcements for new projects, which are opportunities to drive revenue growth and expand their global market footprint.

- The company is advancing in technology and CRM initiatives, including substantial growth in app usage and increasing transaction values, aimed at significantly improving operational efficiencies, increasing in-park revenue, and potentially boosting net margins through enhanced customer engagement and experience.

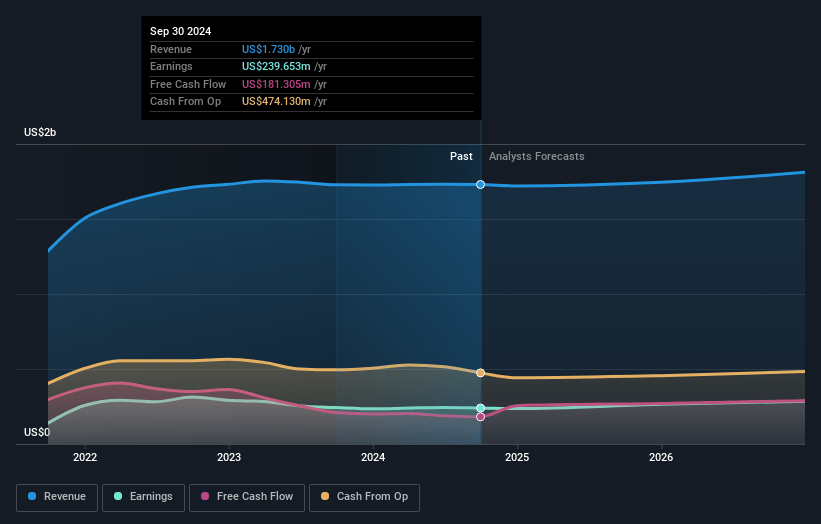

United Parks & Resorts Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming United Parks & Resorts's revenue will grow by 2.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.9% today to 16.1% in 3 years time.

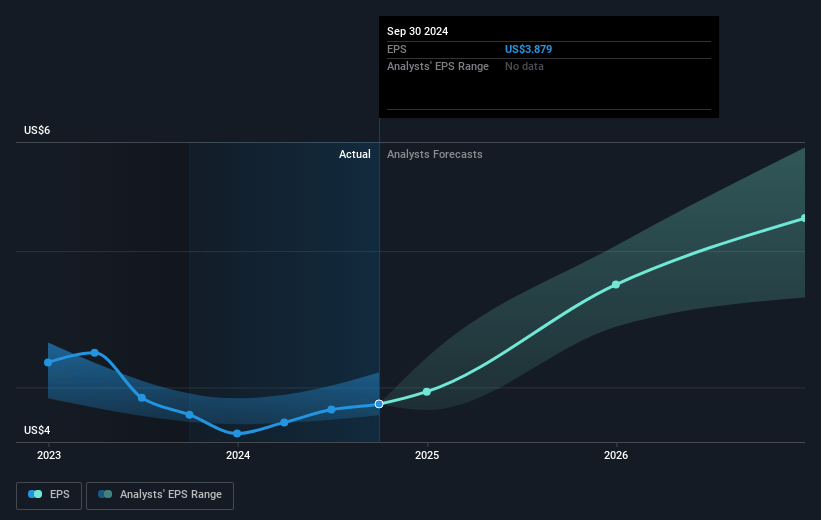

- Analysts expect earnings to reach $302.1 million (and earnings per share of $6.23) by about January 2028, up from $239.7 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $261.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.9x on those 2028 earnings, up from 11.9x today. This future PE is lower than the current PE for the US Hospitality industry at 24.3x.

- Analysts expect the number of shares outstanding to decline by 4.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.45%, as per the Simply Wall St company report.

United Parks & Resorts Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has faced significant weather-related disruptions with hurricanes impacting attendance, which could continue to affect future revenues and seasonal performance.

- Attendance was lower than expected, partially offsetting increases in per capita revenue, indicating that climatic or operational disruptions could lead to revenue losses not entirely recoverable through price increases.

- Despite strong per capita spending growth, there has been resistance from promotional pricing, impacting revenue and potentially affecting future admission revenue strategies.

- Operating expenses have increased due to labor-related costs and nonrecurring strategic expenses, which could reduce net margins if not continually offset by corresponding revenue increases.

- Although total deferred revenue has decreased slightly, which may indicate a potential reduction in future cash flow as it affects pre-paid bookings and season pass sales continuity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $61.82 for United Parks & Resorts based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $43.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $302.1 million, and it would be trading on a PE ratio of 12.9x, assuming you use a discount rate of 9.5%.

- Given the current share price of $51.93, the analyst's price target of $61.82 is 16.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives