Key Takeaways

- Expansion into Asian markets and rapid digital growth position the company to capitalize on global demand and shift towards online gaming and betting.

- Strategic partnerships, cost efficiencies, and an asset-light model are driving stable earnings growth, reduced volatility, and improved shareholder returns.

- Digital gaming growth, shifting demographics, regulatory pressures, fixed costs, and Strip reliance threaten MGM’s long-term stability, margins, and earnings diversification.

Catalysts

About MGM Resorts International- Through its subsidiaries, operates as a gaming and entertainment company in the United States, China, and internationally.

- MGM’s aggressive international expansion, especially the Osaka integrated resort in Japan and continued growth in Macau, positions the company to benefit from surging demand for leisure and gaming among the expanding Asian middle class, supporting significant future revenue and earnings growth as these projects ramp up.

- The rapid growth and profitability of digital operations, particularly BetMGM and the new international launches such as Brazil, indicate the company is well-placed to capture a leading share of high-margin, digital-first gaming and sports betting, directly boosting long-term EBITDA and net margins as users shift spending online.

- Strategic partnerships such as the Marriott/BONVOY alliance and omnichannel integration are broadening MGM’s addressable market by attracting new customer segments and maximizing occupancy and RevPAR, which materially increases property-level EBITDA and reduces revenue volatility over time.

- Meticulous cost control, streamlined labor management, and the adoption of digital and AI-driven operational efficiencies throughout the business are structurally enhancing operating margins, enabling MGM to drive sustainable earnings growth and improved free cash flow, even through industry cycles.

- The asset-light strategy, including selective property sales and partnerships, has improved the balance sheet, reduced capital intensity, and set the stage for ongoing share repurchases and high-ROI investments, thereby supporting long-term growth in EPS and providing substantial upside as undervaluation is corrected.

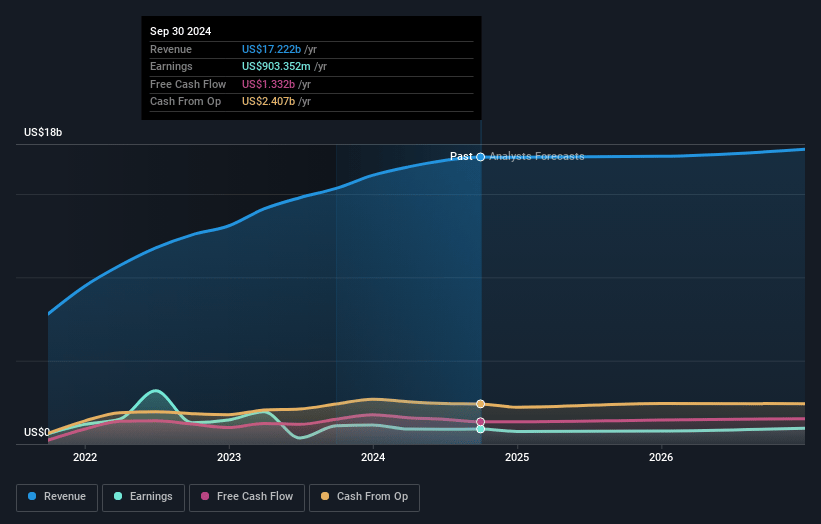

MGM Resorts International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on MGM Resorts International compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming MGM Resorts International's revenue will grow by 2.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.9% today to 5.3% in 3 years time.

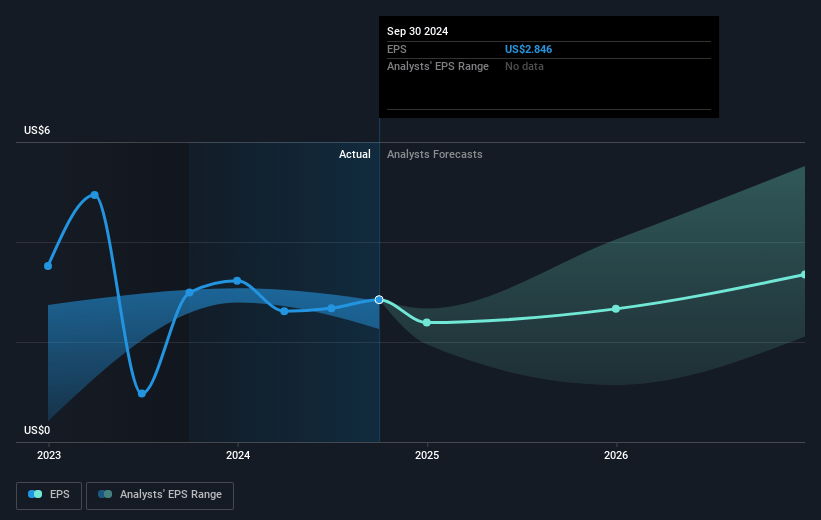

- The bullish analysts expect earnings to reach $980.2 million (and earnings per share of $4.04) by about May 2028, up from $674.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.7x on those 2028 earnings, up from 12.7x today. This future PE is lower than the current PE for the US Hospitality industry at 21.9x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

MGM Resorts International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The growing trend of online gambling and sports betting, combined with the company's own commentary on rising digital engagement and the success of BetMGM, suggests a potential decline in physical casino visitation, which could negatively impact MGM's core Las Vegas and regional property revenues over the long term.

- Demographic shifts, such as the aging of traditional casino-goers and the preference among younger generations for digital or alternative entertainment, threaten the long-term growth of MGM's brick-and-mortar resorts, which remain a significant contributor to overall company earnings.

- Persistent high leverage and significant fixed costs from MGM’s large-scale asset base, as acknowledged through large capital commitments to projects like Japan and ongoing substantial CapEx for property remodels, limit MGM’s financial flexibility and could lead to margin and net income pressure in the event of an economic downturn.

- Heavy reliance on the Las Vegas Strip for both revenues and profits leaves MGM particularly exposed to local disruptions, market saturation, or regional declines in travel—trends that are likely to become more volatile with the increasing impact of climate change on air travel and tourism patterns, thus creating long-term risk to occupancy, earnings, and revenue stability.

- Heightened regulatory scrutiny and changing international regulatory landscapes, as mentioned with adverse regulatory effects in markets like the Netherlands and labor pressures indicated by references to ongoing cost management and digital automation, suggest rising compliance and wage costs that are likely to compress operating margins and increase risks of fines or disruptions to overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for MGM Resorts International is $57.48, which represents two standard deviations above the consensus price target of $45.96. This valuation is based on what can be assumed as the expectations of MGM Resorts International's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $59.0, and the most bearish reporting a price target of just $35.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $18.5 billion, earnings will come to $980.2 million, and it would be trading on a PE ratio of 17.7x, assuming you use a discount rate of 11.4%.

- Given the current share price of $31.42, the bullish analyst price target of $57.48 is 45.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.