Key Takeaways

- Exclusive partnerships and advanced technology products strengthen Genius Sports’ competitive moat, recurring revenue base, and support higher margins and rapid earnings growth.

- Expansion in global sports betting and digital fan engagement positions Genius Sports for sustained top-line growth, improved operating leverage, and increasing share of high-margin revenue streams.

- Heavy dependence on exclusive sports league contracts, media unpredictability, slow product monetization, risky M&A, and rapid tech shifts threaten margin and revenue stability.

Catalysts

About Genius Sports- Engages in the development and sale of technology-led products and services to the sports, sports betting, and sports media industries.

- Expansion and extension of exclusive long-term data rights partnerships like the NCAA (now running through 2032) and the company’s proven ability to leverage technology agreements into exclusive rights deals at no out-of-pocket cost strengthens Genius Sports’ recurring, high-margin revenue base and solidifies its competitive moat, likely driving sustained revenue growth and gross margin expansion.

- Rapid adoption and scaling of new high-value technology products (e.g., GeniusIQ, BetVision, SAOT, Performance Studio) across major leagues creates multiple new monetization vectors in in-play betting, coaching, broadcast augmentation, and fan engagement, which should meaningfully boost average contract value, blended net revenue margins, and accelerate overall earnings growth.

- Global expansion of sports betting, particularly the surge in in-play and micro-betting across both North America and emerging markets, positions Genius Sports as a critical infrastructure enabler with transaction-based, scalable revenue models, thereby supporting both top-line growth and improved operating leverage.

- Growth in digital and mobile-first sports content consumption drives demand for Genius Sports’ integrated media, marketing, and fan engagement platforms (e.g., FANHub, augmented advertising), with initial traction signaling strong pipeline momentum and setting up accelerated media revenue growth and higher-margin revenue streams, particularly beyond 2025.

- Increasing operational scale, visible cost control, and continued mix shift toward recurring, technology-driven revenues allow for further operating margin expansion—reflected in meaningful year-over-year gains and a long-term path to 30%+ adjusted EBITDA margins, which are likely to lift future free cash flow and earnings.

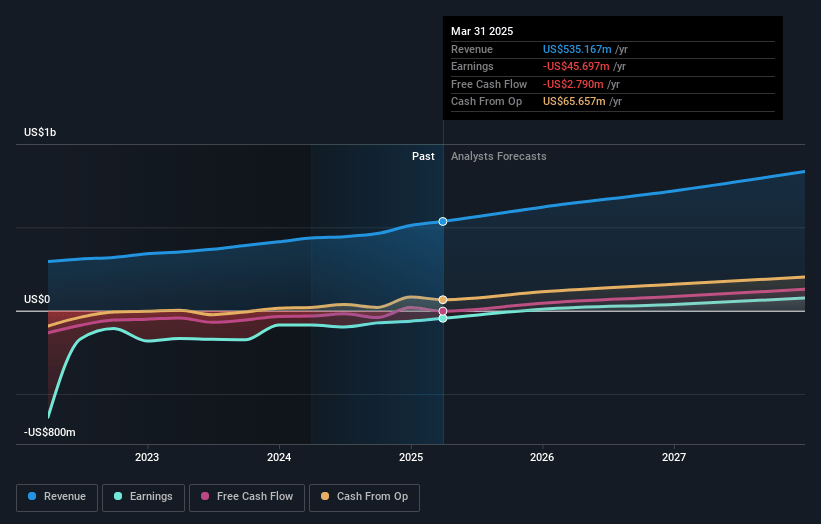

Genius Sports Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Genius Sports's revenue will grow by 17.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -8.5% today to 10.6% in 3 years time.

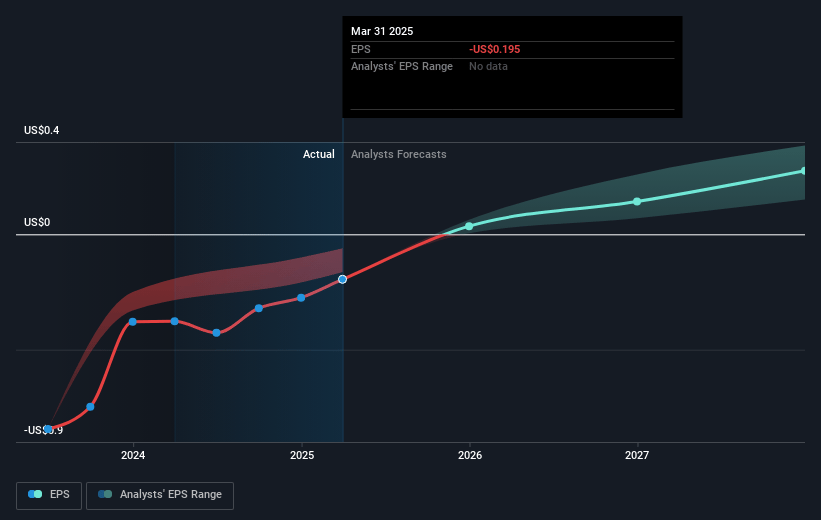

- Analysts expect earnings to reach $92.7 million (and earnings per share of $0.33) by about May 2028, up from $-45.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $106.3 million in earnings, and the most bearish expecting $41.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 48.9x on those 2028 earnings, up from -51.7x today. This future PE is greater than the current PE for the US Hospitality industry at 22.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.31%, as per the Simply Wall St company report.

Genius Sports Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company’s ongoing reliance on exclusive data and technology agreements with major sports leagues (such as the NCAA and NFL) presents significant renewal risk; any renegotiation or loss of these contracts could directly undermine revenue predictability and margin stability.

- The Q1 earnings reveal that media revenue declined year-on-year ($26 million vs. $35 million), and the company acknowledges media is less predictable and more sensitive to timing/client spend; if fragmented media consumption trends intensify or digital ad spend doesn’t rebound, this could pressure future top-line growth.

- Despite aggressive investment in product innovation and technology (e.g., GeniusIQ, BetVision, SAOT), the company is just beginning to see financial impact from initiatives like FANHub and expects the bulk of new NCAA monetization and advertising gains only in 2026—if product adoption lags or client sales cycles elongate, earnings and margin expansion may be delayed.

- The business is pursuing M&A as a capital allocation priority; integration and execution risks, combined with the possibility of overpaying for growth and increased operating costs, could negatively affect net margins and delay reaching sustainable, profitable scale.

- The rapid pace of technological innovation in the sports data space—such as leagues or operators developing their own in-house analytics using AI—or the entry of new tech-based competitors could erode Genius Sports’ market share, force pricing concessions, and ultimately compress revenue and margin growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.4 for Genius Sports based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $871.7 million, earnings will come to $92.7 million, and it would be trading on a PE ratio of 48.9x, assuming you use a discount rate of 8.3%.

- Given the current share price of $10.03, the analyst price target of $12.4 is 19.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.