Narratives are currently in beta

Key Takeaways

- Global expansion and revenue-intense brand growth suggest potential for higher future revenue streams and net margins.

- Enhanced digital presence and extended-stay segment growth offer stable revenue and earnings expansion opportunities.

- Elevated competition, regional underperformance, and infrastructure reliance may harm revenue stability, margins, and growth prospects amidst shifting economic conditions.

Catalysts

About Choice Hotels International- Operates as a hotel franchisor in the United States and internationally.

- The acceleration of global unit growth, with 75% more hotels opened globally compared to the previous year, and a net room increase in more revenue intense brands, signals potential for higher future revenue streams due to increased property scale and room availability.

- The integration and expansion of the Radisson Americas brands have led to a significant increase in digital traffic, booking conversion rates, and new hotel developments, providing potential for enhanced revenue and earnings growth.

- The expanded pipeline of over 110,000 rooms, with a RevPAR premium of over 30% compared to existing properties, suggests future higher revenue and enhanced net margins due to more revenue intense brands.

- The strategy to grow the fastest in the cycle-resilient extended-stay segment, with over 10% yearly unit growth and a pipeline of over 350 extended-stay hotels, offers a potential for stable revenue and earnings expansion.

- The commitment to higher royalty rates, now above 5%, and contracts in the pipeline with higher effective rates than the current portfolio, indicates potential for increasing revenue and margins in the long term.

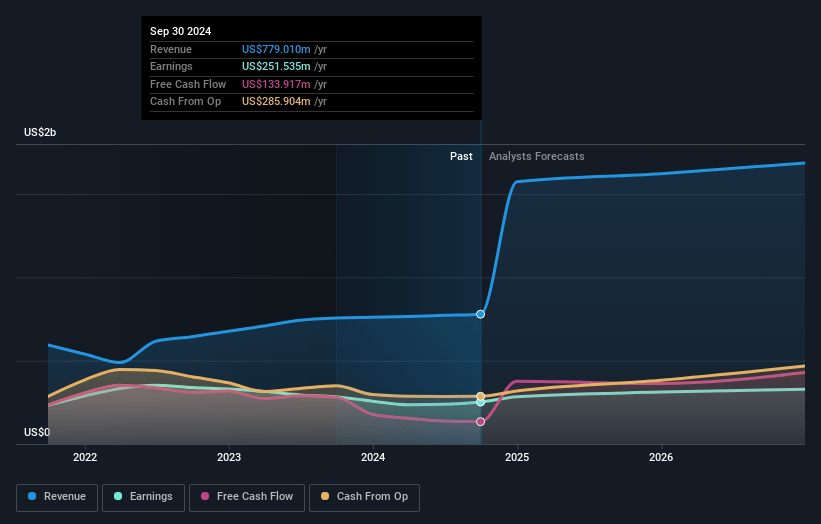

Choice Hotels International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Choice Hotels International's revenue will grow by 30.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 32.3% today to 19.6% in 3 years time.

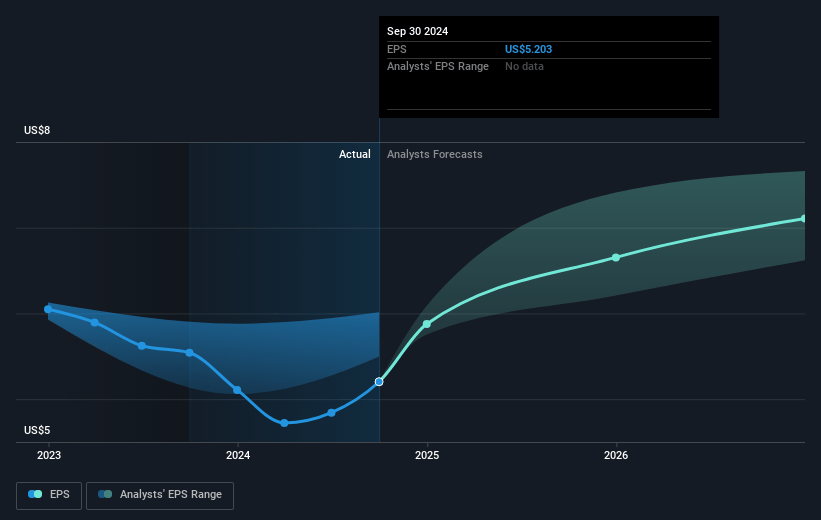

- Analysts expect earnings to reach $342.1 million (and earnings per share of $7.5) by about January 2028, up from $251.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.2x on those 2028 earnings, down from 26.9x today. This future PE is lower than the current PE for the US Hospitality industry at 23.0x.

- Analysts expect the number of shares outstanding to decline by 0.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.05%, as per the Simply Wall St company report.

Choice Hotels International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Elevated competition and reliance on key money for new development projects may squeeze margins or increase costs, impacting net margins.

- Potential variability in SG&A and increased capital expenditures for hotel development might impact free cash flow conversions negatively.

- Regional underperformance in key segments compared to industry benchmarks could weaken RevPAR growth prospects and affect overall revenue.

- Continued reliance on short-term infrastructure project-driven demand presents risk if this demand tapers off, possibly affecting revenue stability.

- Economic outlook and consumer confidence shifts could result in lower-than-expected domestic RevPAR growth impacting overall revenue and projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $133.57 for Choice Hotels International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $160.0, and the most bearish reporting a price target of just $110.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $342.1 million, and it would be trading on a PE ratio of 22.2x, assuming you use a discount rate of 8.1%.

- Given the current share price of $145.31, the analyst's price target of $133.57 is 8.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives