Narratives are currently in beta

Key Takeaways

- Strong booking trends and strategic investments in unique destinations suggest ongoing revenue growth and enhanced guest experiences.

- Operational improvements, reduced debt costs, and achieving key targets ahead of schedule indicate increased net margins and earnings.

- Increased costs from taxes, emissions, and dry dock days, along with high leverage and capital expenditure, may impact Carnival Corp's margins and profitability.

Catalysts

About Carnival Corporation &- Engages in the provision of leisure travel services in North America, Australia, Europe, Asia, and internationally.

- Record booking trends and advanced bookings indicate robust future demand, suggesting potential revenue growth as occupancy and prices are already elevated compared to prior years.

- Operational improvements and demand growth well above the company's modest new supply pipeline could lead to higher net margins by optimizing existing assets and maximizing revenue management efficiency.

- Investments in unique destination strategies such as Celebration Key and RelaxAway, Half Moon Cay could create differentiated demand, potentially boosting revenues through enhanced guest experiences and higher onboard spending.

- Achieving SEA Change targets ahead of schedule, with expectations of hitting EBITDA per ALBD and ROIC goals earlier, signals strong operational execution that is likely to increase earnings.

- Ongoing deleveraging efforts and refinancing of high-interest debt, while achieving investment-grade leverage metrics by 2026, are expected to reduce interest expenses and improve net income.

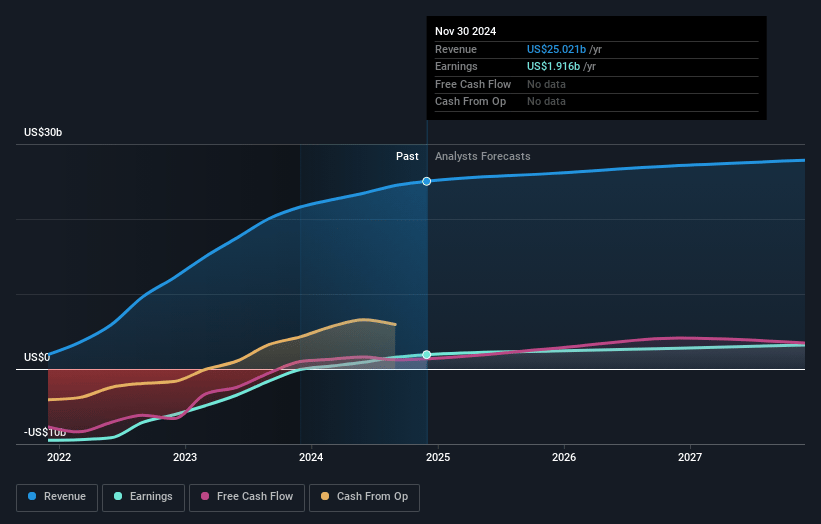

Carnival Corporation & Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Carnival Corporation &'s revenue will grow by 3.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.7% today to 11.5% in 3 years time.

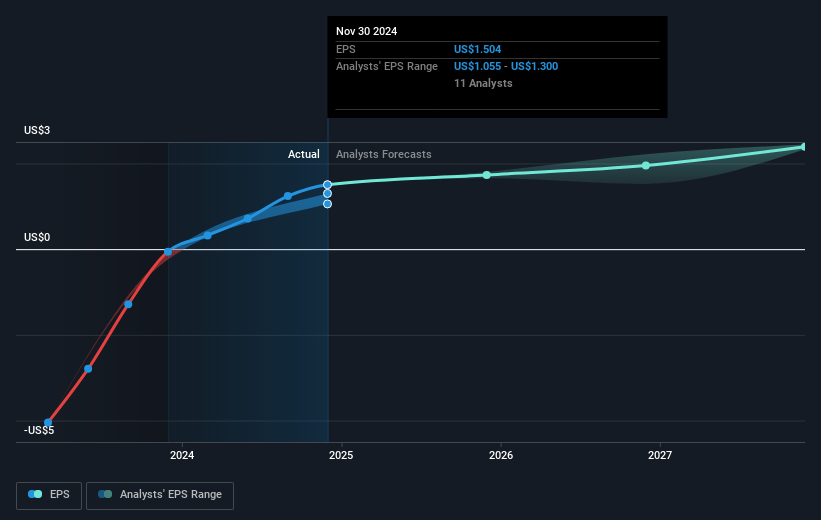

- Analysts expect earnings to reach $3.2 billion (and earnings per share of $2.37) by about January 2028, up from $1.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.5x on those 2028 earnings, down from 19.0x today. This future PE is lower than the current PE for the US Hospitality industry at 24.3x.

- Analysts expect the number of shares outstanding to grow by 1.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.56%, as per the Simply Wall St company report.

Carnival Corporation & Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The introduction of new passenger taxes in Mexico poses a potential risk for Carnival Corp’s itineraries involving Mexican ports. This could lead to higher costs that may not be easily passed on to consumers, possibly impacting revenue and margins.

- Increases in EU’s Carbon Emission Allowances (EUA) from 40% to 70%, resulting in higher fuel expenses, may put pressure on operating costs and margins.

- The company's ambition to enhance its destination strategy involves significant capital expenditure with uncertain returns, potentially affecting future cash flow and net income.

- Cannonball Corporation’s high leverage and focus on refinancing efforts, while necessary, may constrain its ability to invest in growth and return capital to shareholders, impacting its financial flexibility and bottom-line earnings.

- Rising dry dock days and associated costs could increase operating expenses, influencing net margins and affecting overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.75 for Carnival Corporation & based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $28.0 billion, earnings will come to $3.2 billion, and it would be trading on a PE ratio of 16.5x, assuming you use a discount rate of 9.6%.

- Given the current share price of $27.77, the analyst's price target of $29.75 is 6.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives