Key Takeaways

- Expansion in digital lotteries and innovative mobile experiences is driving revenue growth, higher margins, and stronger customer retention.

- Strategic moves into new markets and enhanced financial flexibility position the company for sustained long-term growth and shareholder returns.

- Heavy dependence on jackpots, regulatory and economic uncertainty, increased spending, and digital competition threaten revenue stability, margins, and long-term growth prospects.

Catalysts

About Brightstar Lottery- Provides lottery solutions in the United States, Italy, rest of Europe, and internationally.

- Significant ongoing growth in iLottery (+26% YoY) and successful new e-instant game launches, alongside increasing penetration in major digital markets (US, Italy), positions the company to benefit from the continued global shift toward digital channels and mobile-enabled lottery play, supporting future revenue expansion and higher margin digital sales.

- Investments in cloud-based iLottery platforms, mobile-first experiences, and self-service/cashless point-of-sale (POS) innovations are expected to streamline operations, boost player engagement, and facilitate frictionless, higher-frequency participation, all of which should drive higher customer retention, frequency, and ultimately net margin improvement.

- Ongoing regulatory liberalization in key international markets and the company's strategic expansion into underpenetrated regions such as Italy, France, and Portugal offer access to new customer pools and untapped revenue streams, underpinning long-term top-line growth.

- Major product and pricing innovations, such as the Mega Millions $5 price point with added features, are likely to increase average player spend and improve margins as the changes are rolled out and adopted, especially when multistate jackpot cycles normalize.

- The company's ability to convert a high proportion of EBITDA to cash (67% in Q1), combined with cost discipline and the planned use of sale proceeds (from the gaming/digital asset divestiture) to further strengthen the balance sheet, provides flexibility for reinvestment, M&A, and shareholder returns, all supporting long-term earnings growth.

Brightstar Lottery Future Earnings and Revenue Growth

Assumptions

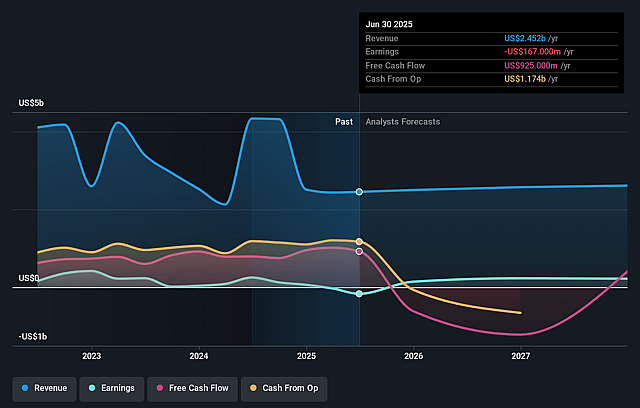

How have these above catalysts been quantified?- Analysts are assuming Brightstar Lottery's revenue will grow by 2.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.2% today to 15.1% in 3 years time.

- Analysts expect earnings to reach $400.1 million (and earnings per share of $1.18) by about July 2028, up from $-29.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.5x on those 2028 earnings, up from -101.0x today. This future PE is lower than the current PE for the US Hospitality industry at 24.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.04%, as per the Simply Wall St company report.

Brightstar Lottery Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The heavy reliance on large multistate jackpot activity to drive periodic improvements in both revenue and EBITDA introduces significant earnings volatility and exposes the company to the risk of lower-than-expected growth and margin compression during periods with unusually few jackpots, as highlighted by the first quarter's weak performance and downbeat guidance, directly impacting both top-line revenue and net margins.

- Continued macroeconomic and geopolitical uncertainty, including declining consumer confidence and the risk of recession, could dampen discretionary spending on lottery tickets, potentially weakening long-term revenue resilience and increasing sensitivity to economic shocks, contrary to the historical perception of lotteries as recession-resistant.

- Heightened regulatory scrutiny and political uncertainty in key markets-such as the ongoing review and legislative attention toward the Texas Lottery and the competitive and uncertain tender process for the Italy Lotto license-could restrict market access, raise compliance burdens, and potentially result in the loss of lucrative contracts, pressuring both revenue and long-term earnings visibility.

- The ongoing ramp-up in capital expenditures through 2025–2026, alongside increased investment in technology transition (to cloud), POS network enhancements, and rebranding, could weigh on free cash flow generation and net margins, with the company forecasting below-normal free cash flow for several years, increasing financial risk if revenue growth disappoints.

- Rapid growth of iGaming and digital betting in core jurisdictions like Italy creates a risk of cannibalization, as faster expansion in adjacent gambling verticals could cap lottery growth, exacerbated by the potential for shifting consumer interest and demographic trends away from traditional lottery products, ultimately pressuring long-term revenue sustainability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $18.437 for Brightstar Lottery based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $12.52.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $400.1 million, and it would be trading on a PE ratio of 12.5x, assuming you use a discount rate of 10.0%.

- Given the current share price of $14.43, the analyst price target of $18.44 is 21.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives