Key Takeaways

- Ongoing investment in digital technology and automation supports growth but pressures margins due to rising costs and competitive digital engagement demands.

- Expansion and menu innovation drive global and same-store sales growth, but limited international scale and shifting consumer preferences could restrain long-term revenue.

- Mounting sales, margin, and income pressures driven by declining traffic, cost inflation, U.S. demand concentration, limited global scale, and costly tech investments threaten growth.

Catalysts

About Wendy's- Operates as a quick-service restaurant company in the United States and internationally.

- While Wendy’s is leveraging growing digital adoption and mobile ordering with enhancements to its app and loyalty programs—evidenced by digital sales exceeding 20% of total mix and strong early results from the rollout of FreshAI voice ordering—increased competition for digital engagement may require continual investment in technology and marketing, which risks compressing operating margins over the long term.

- Although expansion into emerging international markets and a ramped international pipeline are delivering strong growth, with over 60% of new units in the first quarter coming from outside the U.S. and high double-digit growth in regions like Asia-Pacific and Latin America, the company’s limited scale abroad compared to global peers restricts its ability to fully benefit from urbanization and demographic shifts, potentially capping systemwide revenue and earnings growth.

- While Wendy’s menu innovation and high-profile collaborations (such as with Takis and popular snack brands) are driving customer engagement and supporting same-store sales through incremental offerings, changing consumer preferences toward health-conscious and premium products could threaten the long-term relevance of traditional fast food, putting pressure on revenue and same-store sales even as core traffic temporarily lifts.

- Despite investments in automation, kitchen technology, labor productivity, and customer-facing efficiency tools to help offset persistent labor market tightening and wage inflation, structural increases in minimum wage and the need for ongoing technology investments may continue to erode restaurant-level margins, particularly in U.S. markets where wage growth is outpacing topline sales improvements.

- While the global refranchising strategy and build-to-suit initiatives are creating a more capital-light, higher-margin structure and diversifying revenue streams, heightened regulatory scrutiny on environmental practices and rising sustainability compliance costs could increase G&A and capex needs, limiting free cash flow and tempering the positive effects on long-term net margins and earnings.

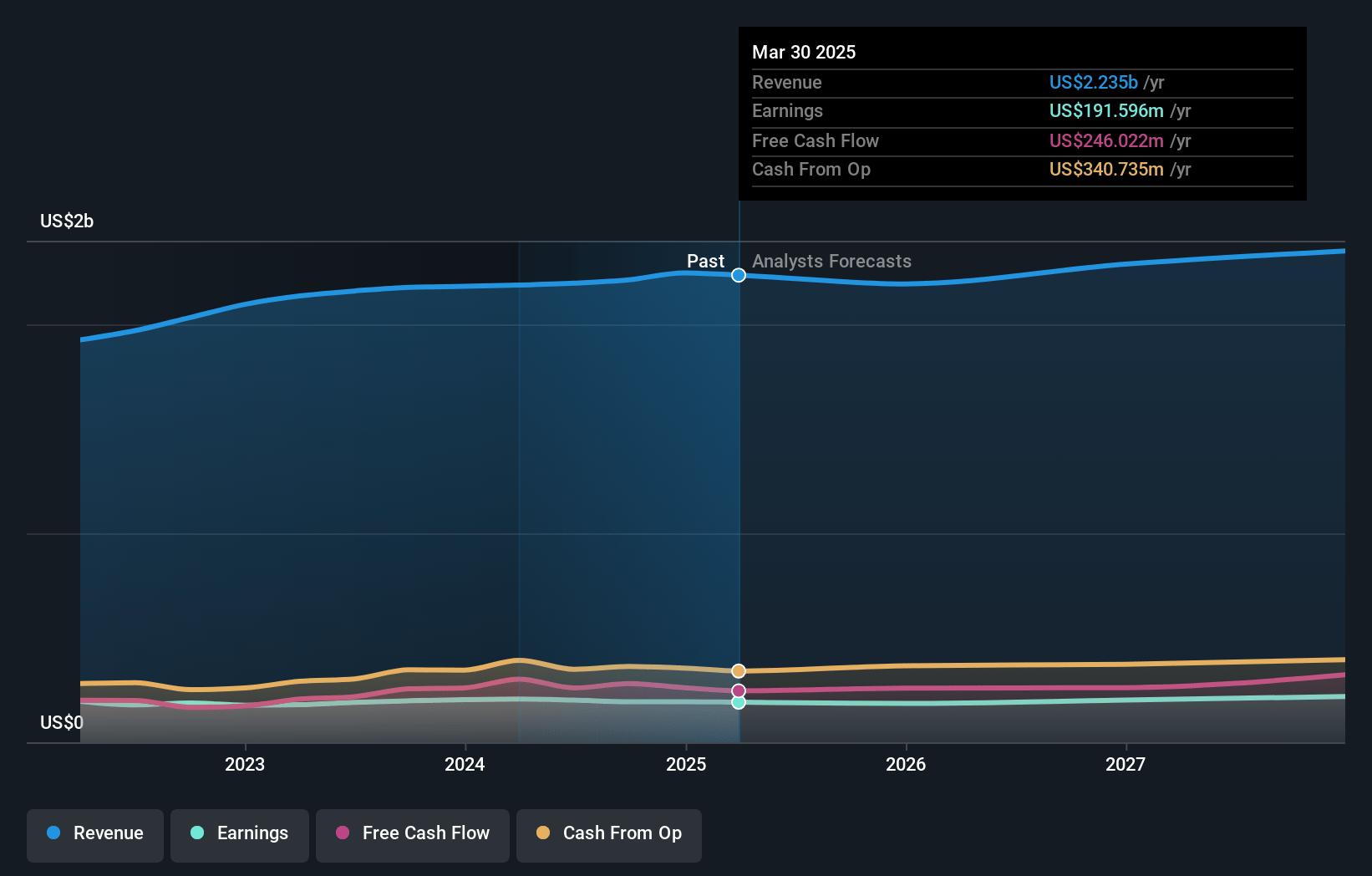

Wendy's Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Wendy's compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Wendy's's revenue will grow by 1.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 8.6% today to 8.9% in 3 years time.

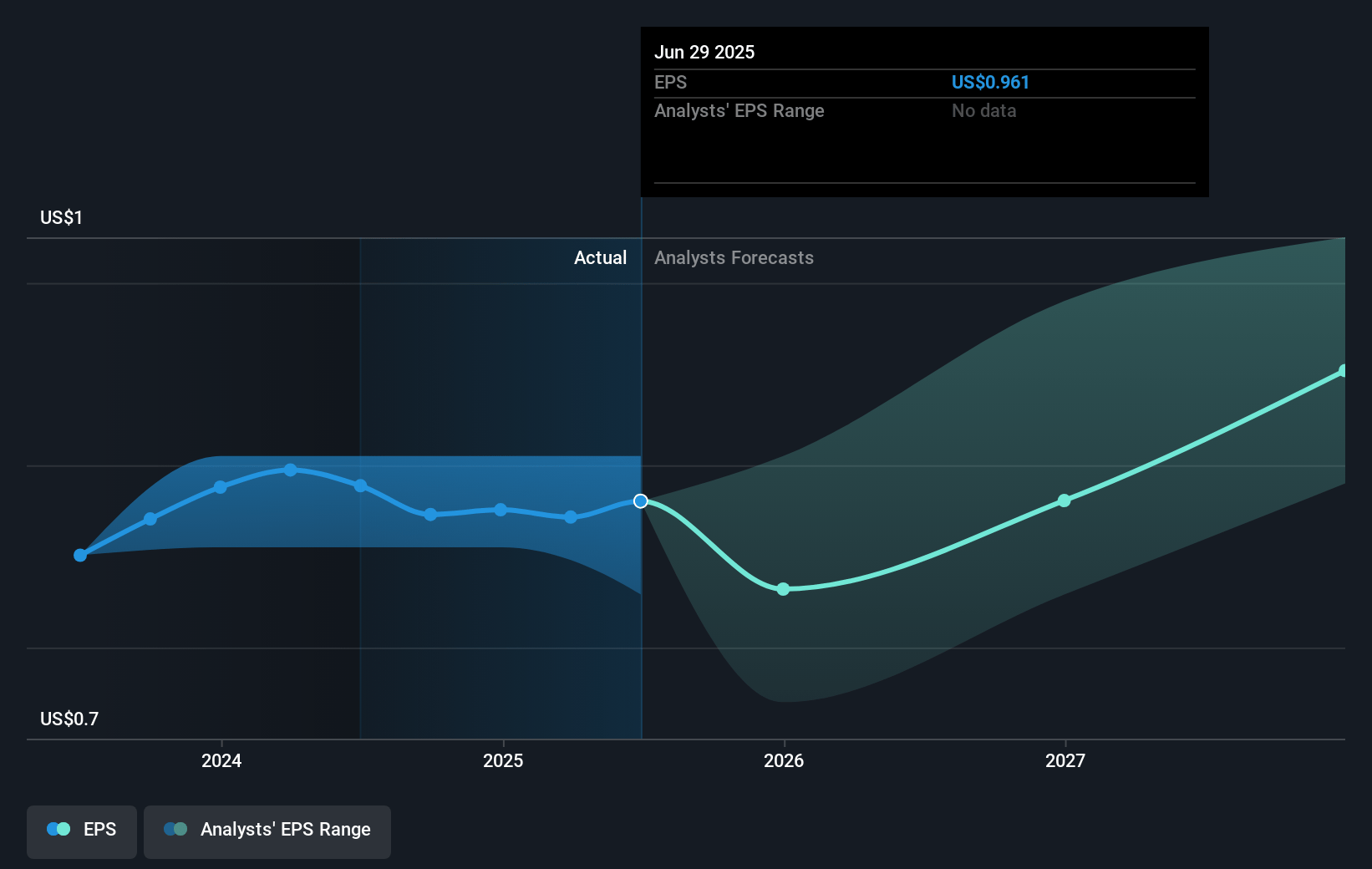

- The bearish analysts expect earnings to reach $206.4 million (and earnings per share of $1.11) by about July 2028, up from $191.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, up from 11.4x today. This future PE is lower than the current PE for the US Hospitality industry at 24.5x.

- Analysts expect the number of shares outstanding to decline by 5.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Wendy's Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent industry-wide decline in QSR (Quick Service Restaurant) burger traffic, with the company reporting mid-single digit declines in the first quarter of 2025 and guiding that this pressure is likely to persist for the rest of the year, poses a substantial risk to same-restaurant sales and overall revenue growth.

- Wendy’s core U.S. business is increasingly exposed to economic pressures faced by lower-income consumers, as evidenced by management commentary that households with less than $75,000 in annual income pulled back industry-wide by high single digits to low double digits—this concentration could heighten earnings volatility during economic downturns.

- Margin pressures are mounting due to higher commodity costs and ongoing wage rate inflation, resulting in U.S. company-operated restaurant margin contraction of 50 basis points year-over-year; if these cost increases continue without sufficient sales leverage or price hikes, long-term operating margins and net income could continue to erode.

- Although the company is expanding internationally, its footprint remains significantly smaller compared to global competitors, meaning it is less able to offset stagnation or declines in North America, which could constrain top-line revenue growth and impede long-term earnings diversification.

- Ongoing heavy investments in technology and digital infrastructure—including FreshAI, digital menu boards, and app enhancements—are driving up general and administrative expenses, and if these investments fail to produce the anticipated uplift in customer engagement and average check size, returns on capital may be insufficient to offset increased operating expenses, negatively impacting cash flow and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Wendy's is $11.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Wendy's's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.5, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.3 billion, earnings will come to $206.4 million, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 11.6%.

- Given the current share price of $11.33, the bearish analyst price target of $11.0 is 3.0% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives