Last Update 09 Dec 25

SDA: AI Partnership Will Drive Service Conversion And Acquisition Efficiency

Analysts have modestly revised their price target for SunCar Technology Group upward to approximately $7.17 per share from about $7.17 per share. This reflects slightly lower discount rate assumptions and a marginally reduced future price to earnings multiple, while keeping long term growth and profitability expectations broadly unchanged.

What's in the News

- Withdrew prior 2025 full year revenue guidance of $521 million to $539 million, signaling reduced visibility on near term growth (Company guidance update).

- Signed an AI technology cooperation agreement with Volcano Engine, ByteDance's enterprise technology platform, to integrate the Doubao large language model into SunCar's core services (Company announcement).

- Plans to use Doubao's multimodal AI to enhance auto insurance offerings, with a stated target of a 40% improvement in policy matching accuracy and up to 70% lower customer acquisition costs (Company announcement).

- Deploying AI driven upgrades to auto services, including a redesigned smart dispatch system that is expected to cut average response times from 30 minutes to under 5 minutes and improve predictive maintenance and customer conversion rates (Company announcement).

- Leveraging AI for partner marketing to reduce content production time from 7 days to 4 hours and cut promotion costs by more than 70%, while aiming to lift renewal rates by 25% (Company announcement).

Valuation Changes

- Fair Value Estimate: Unchanged at approximately $7.17 per share, indicating no material shift in the long term intrinsic value assessment.

- Discount Rate: Fallen slightly from about 8.46% to approximately 8.42%, reflecting a modest reduction in perceived risk or required return.

- Revenue Growth: Essentially unchanged at roughly 14.01% per year, signaling stable expectations for top line expansion.

- Net Profit Margin: Stable at around 8.08%, suggesting no meaningful revision to long term profitability assumptions.

- Future P/E: Edged down slightly from about 18.72x to roughly 18.70x, implying a marginally lower valuation multiple applied to future earnings.

Key Takeaways

- Robust digital platform and strategic partnerships position SunCar to capitalize on accelerating online adoption and digitalization in the auto insurance and gas vehicle markets.

- Growth in high-margin, technology-driven service offerings and deepening industry collaborations support revenue diversification and sustained improvement in profitability.

- Heavy exposure to China, competitive threats, disintermediation risks, high tech investment demands, and partner dependency all challenge SunCar's revenue stability and earnings growth.

Catalysts

About SunCar Technology Group- Through its subsidiaries, operates as a cloud-based provider of digitalized enterprise auto services and auto e-Insurance service in the People’s Republic of China.

- The ongoing digital transformation of China's auto insurance and services market remains in its early stages, with over 330 million drivers still primarily purchasing insurance and services offline; SunCar's strong digital platform, proven partnerships, and rapid innovation position it to capture increasing online adoption, supporting sustained revenue and earnings growth.

- Strategic expansion into the large, underpenetrated gas vehicle market-where digitalization by dealers is accelerating out of necessity-creates a significant new addressable market, multiplying the company's reach beyond EV-focused channels and potentially driving a step-change in insurance-related revenues.

- Increased adoption of AI-powered, customizable software solutions by auto partners and insurers enables SunCar to deliver higher-value, differentiated products (such as real-time insurance apps and fleet management), expanding recurring technology service revenues and driving operating leverage, which should improve net margins.

- Strengthening high-margin service offerings (concierge, luxury, and cross-industry partnerships) and the successful cross-sell of these services to existing/future insurance clients diversifies the revenue base, boosts total addressable market, and supports long-term margin expansion.

- Deepening collaborations with major automakers and insurers-including exclusive and multi-year deals with companies like Tesla, Xiaomi, Zeekr, and SAIC-provide visibility into future contract-driven revenue streams and support further scaling of SunCar's platform, with positive implications for both top-line growth and margin improvement.

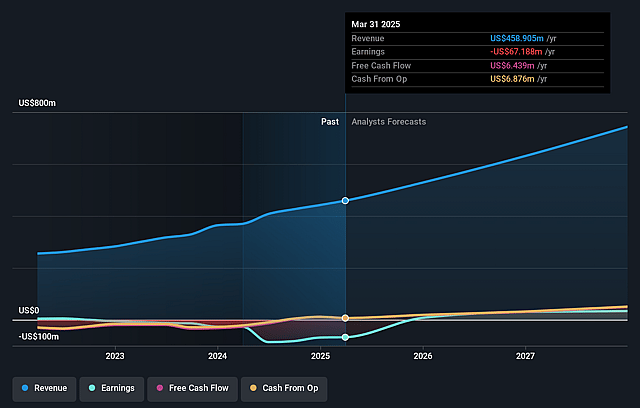

SunCar Technology Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SunCar Technology Group's revenue will grow by 19.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -14.6% today to 8.5% in 3 years time.

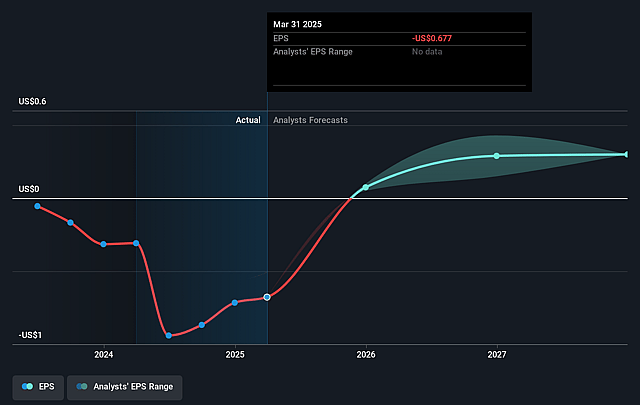

- Analysts expect earnings to reach $65.6 million (and earnings per share of $0.3) by about September 2028, up from $-67.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.6x on those 2028 earnings, up from -4.3x today. This future PE is greater than the current PE for the US Consumer Services industry at 20.4x.

- Analysts expect the number of shares outstanding to grow by 4.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.22%, as per the Simply Wall St company report.

SunCar Technology Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- SunCar's heavy concentration in the Chinese domestic auto market exposes it to macroeconomic volatility, regulatory shifts, and potential long-term slowing in auto sales or insurance growth within China, which could result in unstable or declining revenues and threaten earnings stability.

- Intensifying competition from both established insurtechs and emerging fintech entrants (including those backed by global tech firms) could commoditize insurance and auto services, driving margin pressure and reducing SunCar's ability to sustain its revenue growth trajectory and operating profitability.

- Increased adoption of direct-to-consumer digital insurance platforms and the evolving trend toward disintermediation in the insurance market may diminish the value of SunCar's broker/aggregator business model, directly impacting core commissions-based revenues and long-term earnings potential.

- Expanding technology investments in AI, software, and proprietary platforms-necessary to maintain differentiation and innovation-could compress net margins if operational scale or unique value-add cannot be sustained as product development costs and R&D expenditures increase.

- SunCar's reliance on strategic partnerships with major automakers, insurance carriers, banks, and retail giants creates dependency risk: any adverse changes in partner strategies, non-renewal of agreements, or the loss of key accounts could result in material revenue loss and long-term earnings declines.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.167 for SunCar Technology Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $3.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $773.2 million, earnings will come to $65.6 million, and it would be trading on a PE ratio of 20.6x, assuming you use a discount rate of 8.2%.

- Given the current share price of $2.81, the analyst price target of $9.17 is 69.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on SunCar Technology Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.