Key Takeaways

- Expansion into health and wellness services on more ships is projected to boost revenue through enhanced offerings and guest engagement.

- High-value services like cryotherapy, combined with improved capital management, are expected to enhance net margins and financial flexibility.

- Heavy reliance on cruise demand and partner infrastructure exposes OneSpaWorld to revenue volatility and margin pressures from external market shifts and financial instrument risks.

Catalysts

About OneSpaWorld Holdings- Operates health and wellness centers onboard cruise ships and at destination resorts worldwide.

- OneSpaWorld's expansion of health and wellness centers on more ships, including new ship builds, is expected to drive future revenue growth through increased service offerings and guest interactions.

- Introduction and scaling of high-value services like cryotherapy and LED light facial treatments indicate potential for increased revenue and improved net margins as these new, higher-priced services gain traction across the fleet.

- Enhanced productivity efforts, including increased spa usage by cruise guests and more experienced staff recommending upsells, are likely to improve operational efficiency and net margins.

- Investments in Med-Spa services on more ships are anticipated to generate higher revenue per ship given the increasing consumer interest in medical spa services.

- Strengthened capital structure through refinancing and active capital management, such as share repurchases, positions OneSpaWorld for improved financial flexibility, supporting continued earnings growth and providing room for margin improvement.

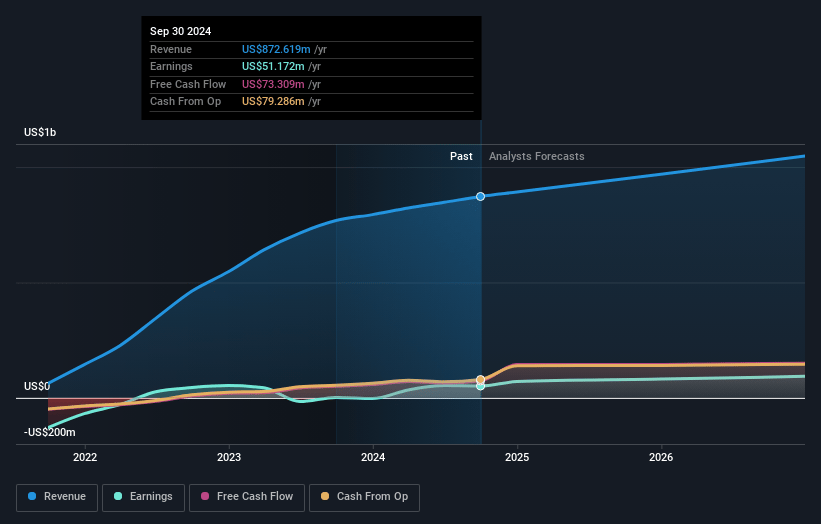

OneSpaWorld Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming OneSpaWorld Holdings's revenue will grow by 8.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.9% today to 9.3% in 3 years time.

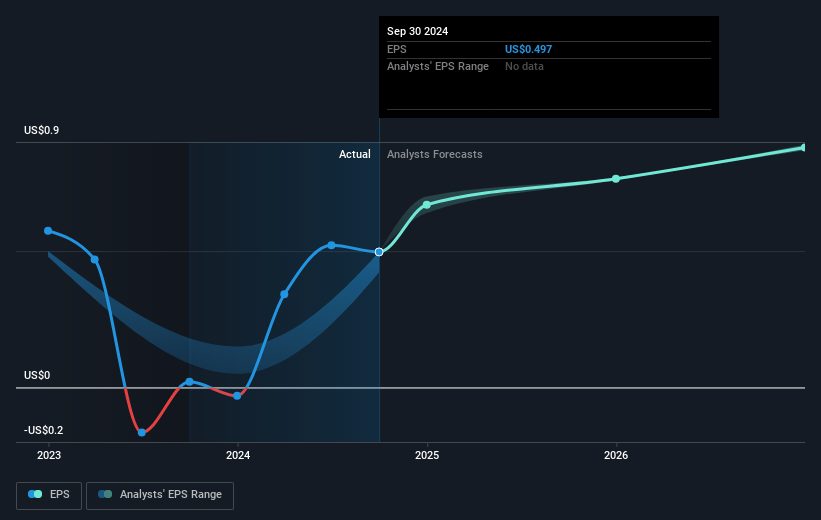

- Analysts expect earnings to reach $104.2 million (and earnings per share of $0.93) by about January 2028, up from $51.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.8x on those 2028 earnings, down from 44.0x today. This future PE is greater than the current PE for the US Consumer Services industry at 20.7x.

- Analysts expect the number of shares outstanding to grow by 2.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

OneSpaWorld Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- High reliance on cruise industry performance means changes in cruise demand or unforeseen setbacks in the cruise market could materially impact OneSpaWorld’s revenue and earnings.

- Income was negatively impacted by a $7.4 million decline in fair value of warrant liabilities last year; such revaluation risks in financial instruments could create future volatility in net margins.

- Renovation disruptions at key land-based resorts such as hotels undergoing upgrades have negatively affected land-based revenue, indicating dependency risks on partner infrastructure investments.

- Increased costs attributed to service and product revenue growth may constrain net margins if not managed effectively against potential pricing pressures or market softening.

- Tariff changes and geopolitical events could impact the supply chain or pricing for OneSpaWorld’s product offerings, potentially affecting future revenue and cost structures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $22.25 for OneSpaWorld Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $104.2 million, and it would be trading on a PE ratio of 28.8x, assuming you use a discount rate of 6.4%.

- Given the current share price of $21.64, the analyst's price target of $22.25 is 2.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives