Narratives are currently in beta

Key Takeaways

- Weak midweek occupancy and spend per guest at the STRAT, alongside macroeconomic challenges, may suppress short-term revenue and margins.

- Operating challenges in new taverns and caution in M&A activities could constrain current margins and future growth.

- Golden Entertainment's share repurchase and strong financials demonstrate management confidence and could stabilize earnings, while leveraging market gains and demographic trends for growth.

Catalysts

About Golden Entertainment- Owns and operates a diversified entertainment platform in the United States.

- Weakness in the core midweek occupancy and spend per guest at the STRAT due to lack of meeting space and competition trends in Las Vegas, which may suppress revenue and net margins in the near term.

- Challenges stemming from macroeconomic factors like consumer discretionary spending cuts and extreme weather conditions impacting casino visitation rates are expected to continue, possibly affecting future revenue growth.

- Expected stabilization and recovery in midweek occupancy and customer spending in 2025 at the STRAT, suggesting a lag in earnings recovery as this performance reversal materializes, impacting short-term earnings expectations.

- Operating challenges and increased initial costs in newly opened taverns, compounded by recent wage hikes, suggest current margin pressures that might not improve until these venues stabilize over the next 9 to 18 months, affecting net margins in the short term.

- The M&A environment's cautious outlook and strategic hesitation to engage in sale-leaseback transactions due to uncertain valuation environments suggest potential constraints on immediate growth and strategic expansion, impacting future earnings potential.

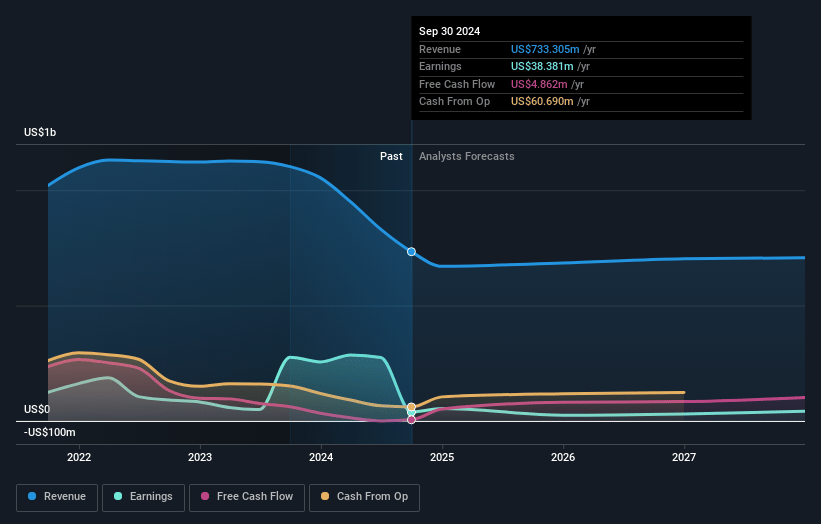

Golden Entertainment Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Golden Entertainment's revenue will decrease by -1.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 5.2% today to 3.1% in 3 years time.

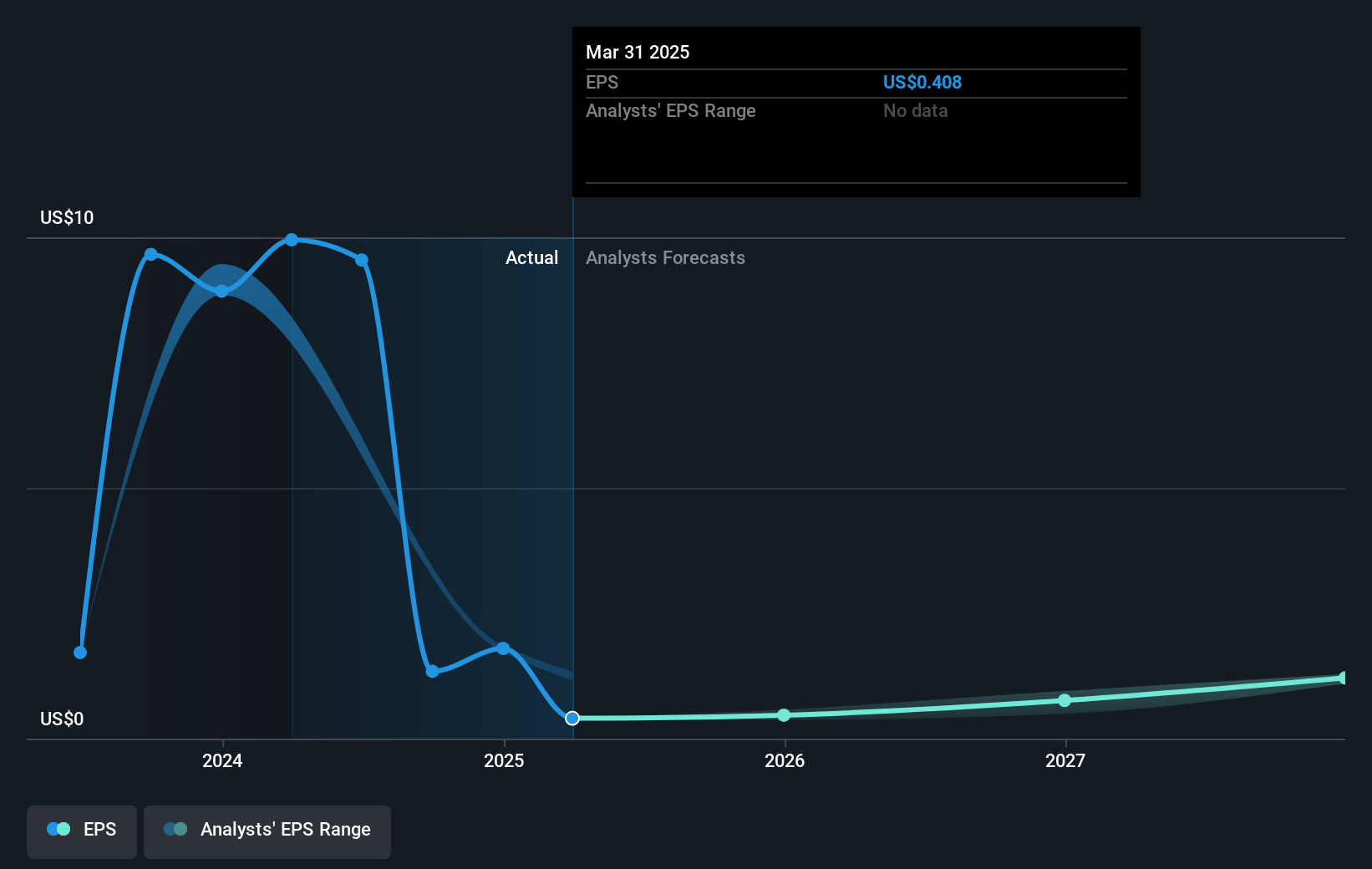

- Analysts expect earnings to reach $21.2 million (and earnings per share of $0.82) by about December 2027, down from $38.4 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $44.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 54.6x on those 2027 earnings, up from 24.0x today. This future PE is greater than the current PE for the US Hospitality industry at 24.3x.

- Analysts expect the number of shares outstanding to decline by 1.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.65%, as per the Simply Wall St company report.

Golden Entertainment Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Golden Entertainment has repurchased nearly 2 million shares over the last 6 months. This share repurchase activity can indicate management's confidence in the company's future performance and provide support to earnings per share even if revenue growth slows.

- The company maintains one of the best balance sheets in the gaming industry with a net leverage of approximately 2x EBITDA and $240 million of availability under its revolving credit facility. This financial strength can support operational stability and potential future growth or investment opportunities.

- Despite lower overall visitation, Golden Entertainment's properties in Laughlin increased their market share in the quarter and reduced operating expenses, which can positively impact net margins and show resilience in competitive markets.

- Golden Entertainment expects a stronger Q4 for the STRAT compared to Q3 and sees opportunities for growth in 2025 from returning midweek occupancy and increased spend from core customers. These improvements could enhance revenue and margins if realized.

- The company believes it can benefit from favorable long-term demographic and economic trends in Southern Nevada, potentially driving stable or increased revenue as these trends continue to develop.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $36.14 for Golden Entertainment based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $31.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $694.4 million, earnings will come to $21.2 million, and it would be trading on a PE ratio of 54.6x, assuming you use a discount rate of 8.6%.

- Given the current share price of $33.62, the analyst's price target of $36.14 is 7.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives