Key Takeaways

- Expedia Group's dependency on international markets poses risks if international demand weakens or unfavorable foreign exchange rates persist.

- Slowdown in B2B growth and partnership expansions, coupled with potential advertising revenue declines, challenges revenue and margin growth.

- Expedia Group faces challenges with travel demand softening, tech disruptions, foreign exchange headwinds, and rising marketing costs, risking revenue and margin pressures.

Catalysts

About Expedia Group- Operates as an online travel company in the United States and internationally.

- A potential headwind for Expedia Group in 2025 is its dependency on international markets for growth, as these have shown better performance compared to the U.S. market. If international demand weakens or foreign exchange rates are unfavorable, this could impact revenue growth.

- The slowdown in the B2B segment, despite its recent success, and any complications in expanding new partnerships, particularly in regions like APAC, could constrain growth expectations, affecting overall bookings and revenue.

- Despite strong growth in advertising revenue, there could be concerns about its sustainability. A slowdown here would impact high-margin revenue contributions, thus affecting net margins and overall earnings.

- The reliance on increased efficiencies and further cost management to drive margin expansion may face challenges if operational costs rise unexpectedly, putting pressure on net margins and prompting more conservative earnings forecasts.

- External market factors, such as FX headwinds and softening travel demand in certain regions, could lead to revenue pressures, making future growth projections less certain. These factors may contribute to decelerating growth in gross bookings and overall revenue.

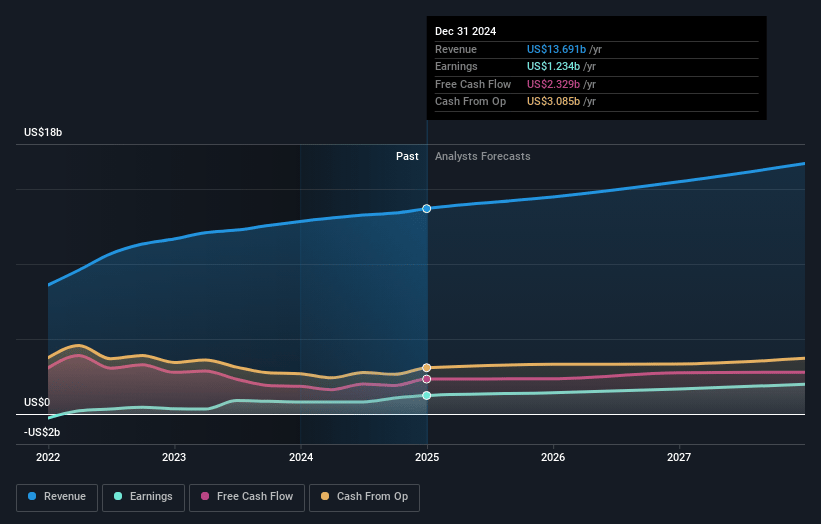

Expedia Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Expedia Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Expedia Group's revenue will grow by 4.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 8.5% today to 10.6% in 3 years time.

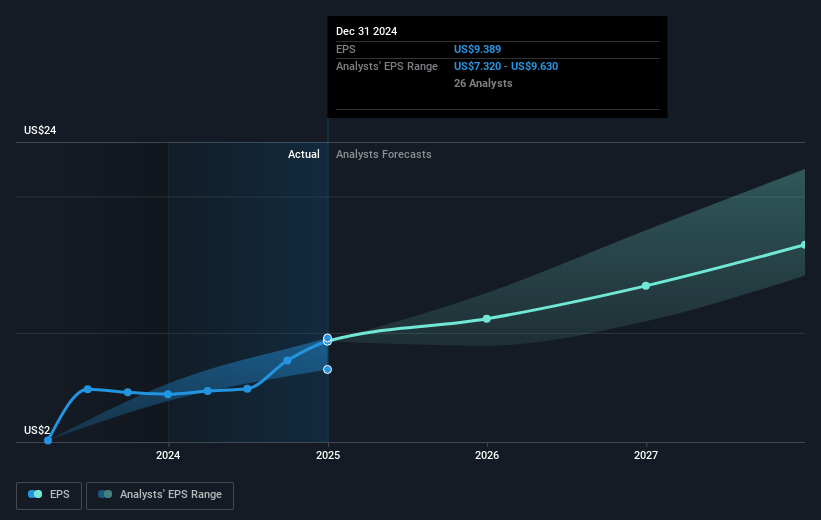

- The bearish analysts expect earnings to reach $1.7 billion (and earnings per share of $14.96) by about July 2028, up from $1.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, down from 20.9x today. This future PE is lower than the current PE for the US Hospitality industry at 24.5x.

- Analysts expect the number of shares outstanding to decline by 2.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.59%, as per the Simply Wall St company report.

Expedia Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company acknowledged some softening in the travel demand environment early in Q1 2025, which could indicate potential challenges in maintaining consistent revenue growth in the near term.

- Expedia Group faced disruptions to Vrbo and Hotels.com during their tech migrations, and while there has been a recovery, the risk remains that these brands may not sustain or accelerate growth as needed, impacting overall bookings and revenue.

- The impact of foreign exchange headwinds is already evident in their financial results and guidance, suggesting that further fluctuations could affect net margins and earnings.

- Increased marketing expenses and the necessity to invest significantly to regain lost ground in brands like Vrbo may pressure net margins if not offset by proportional revenue increases.

- The company cited exposure to risks associated with their forward-looking statements, market conditions, and reliance on current assumptions, which could lead to unexpected deviations in actual financial performance, impacting earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Expedia Group is $135.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Expedia Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $290.0, and the most bearish reporting a price target of just $135.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $15.9 billion, earnings will come to $1.7 billion, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 8.6%.

- Given the current share price of $192.19, the bearish analyst price target of $135.0 is 42.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.