Last Update01 May 25Fair value Decreased 3.86%

Key Takeaways

- Expansion of virtual brands and strategic closures aim to optimize resources and improve net margins, boosting revenue and franchisee cash flow.

- Investments in digital initiatives and Diner 2.0 remodels are expected to enhance customer engagement, drive traffic growth, and increase profitability.

- Rising inflation and declining sales, along with closures and operational challenges, could affect Denny's revenue, margins, and future earnings projections.

Catalysts

About Denny's- Through its subsidiaries, owns and operates franchised full-service restaurant chains under the Denny's and Keke’s Breakfast Cafe brands in the United States and internationally.

- Denny's plans to continue expanding its virtual brands, such as The Burger Den, The Meltdown, and Banda Burrito, which have already contributed significantly to same-restaurant sales growth. This focuses on optimizing underutilized labor and offering these during off-peak hours, which is likely to enhance revenue and improve net margins.

- The Diner 2.0 remodel program, which has shown a 6.5% uplift in traffic during tests, is expected to increase same-restaurant sales and profitability as it is further rolled out, enhancing both revenues and net margins.

- Investments in digital enhancements, including improved digital guest experience, search engine optimization, and a new loyalty CRM program launching in the latter half of the year, are projected to drive increased engagement and conversion, positively impacting revenue.

- The focus on growing the Keke’s Breakfast Cafe brand, with a record-breaking year for expansion and strong momentum in new markets, is expected to contribute positively to revenues and margins. The new design concept is targeting a 6% to 8% increase in sales.

- The intentional acceleration of closing lower-volume Denny’s locations is expected to drive higher average unit volumes (AUVs) across the remaining locations, improving franchisee cash flow and potentially enhancing overall earnings and margins.

Denny's Future Earnings and Revenue Growth

Assumptions

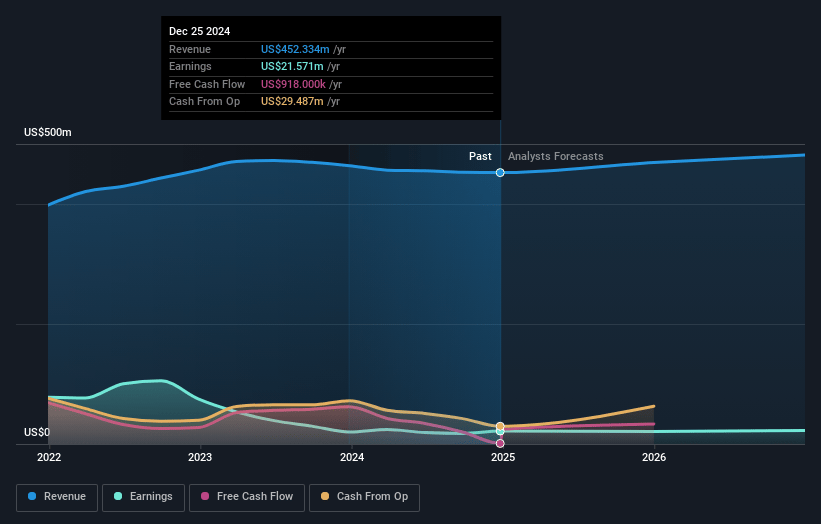

How have these above catalysts been quantified?- Analysts are assuming Denny's's revenue will grow by 4.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 4.8% today to 4.7% in 3 years time.

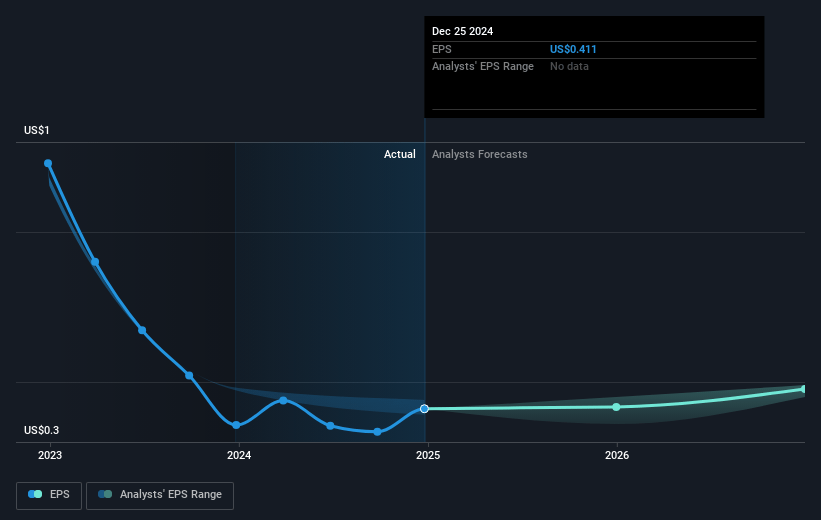

- Analysts expect earnings to reach $24.0 million (and earnings per share of $0.51) by about May 2028, up from $21.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.7x on those 2028 earnings, up from 8.8x today. This future PE is lower than the current PE for the US Hospitality industry at 22.6x.

- Analysts expect the number of shares outstanding to decline by 0.78% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Denny's Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The shift in consumer sentiment and macroeconomic factors like rising inflation are causing uncertainty, resulting in recent declines in same-restaurant sales. This could adversely impact future revenues.

- Denny's plan to close 70-90 lower-volume restaurants could lead to decreased total revenue, despite intentions to improve cash flow for franchisees and reinvest in the brand.

- The sensitivity of new markets and the slower margin growth in newly opened Keke's locations indicate potential inefficiencies that could affect net margins.

- The company's cautious guidance for 2025 and observed sales declines early in the year suggest potential risks to meeting earnings projections.

- Keke's recent termination of franchise agreements and temporary closures indicate possible operational challenges, which could impact revenue and brand reputation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $7.208 for Denny's based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $509.9 million, earnings will come to $24.0 million, and it would be trading on a PE ratio of 20.7x, assuming you use a discount rate of 11.4%.

- Given the current share price of $3.7, the analyst price target of $7.21 is 48.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.