Key Takeaways

- Strategic expansion in HRM facilities and racetrack projects enhances guest experience and revenue growth, driven by premium seating and significant market opportunities.

- Vertical integration and infrastructure investments strengthen financial performance, EBITDA growth, and shareholder value through disciplined capital management and technology adoption.

- Construction disruptions, economic factors, and reliance on new markets could impact Churchill Downs' revenue growth, with competition and investment risks affecting margins.

Catalysts

About Churchill Downs- Operates live and historical racing entertainment venues, online wagering businesses, and regional casino gaming properties in the United States.

- The expansion and renovation of the Churchill Downs Racetrack, including the Sky Terrace, Conservatory, and Infield General Admission projects, are expected to significantly enhance the guest experience and increase the number of premium seating options, which will likely drive revenue growth over the next several years.

- Strategic initiatives to develop and expand HRM (Historical Horse Racing Machines) facilities in Virginia and Kentucky, including the Rose Gaming Resort and upcoming venues, suggest a robust pipeline for EBITDA growth, as these ventures tap into significant markets with expanding customer bases.

- The Kentucky Derby's continuing appeal, buoyed by enhanced premium experiences such as the Starting Gate Courtyard and Pavilion project, is projected to increase ticket revenue and sponsorship opportunities, contributing to sustained revenue growth.

- The company's focus on integrating Exacta's HRM system technology could lead to increased EBITDA from expanded B2B offerings, as this vertical integration strategy enhances the competitiveness and financial performance of their Wagering Services and Solutions segment.

- Ongoing investments in infrastructure and strategic acquisitions indicate a solid capital management strategy poised to optimize free cash flow and bolster shareholder value through disciplined growth, share repurchases, and dividends.

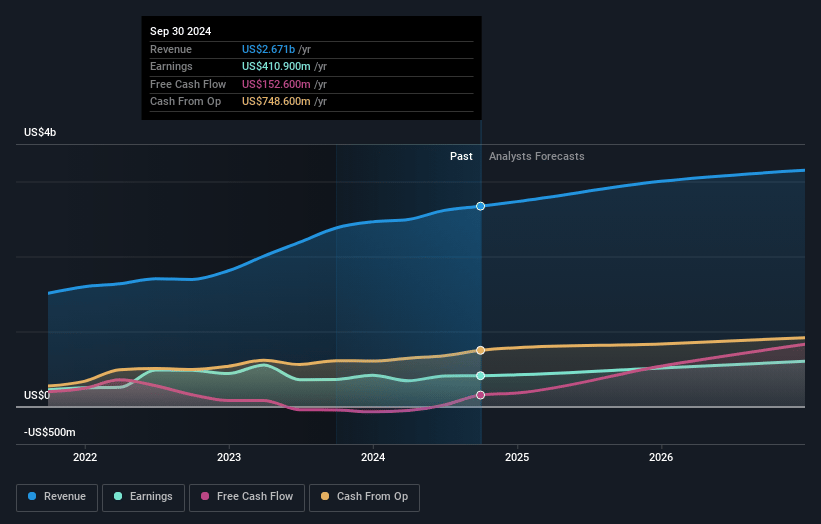

Churchill Downs Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Churchill Downs's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.6% today to 19.8% in 3 years time.

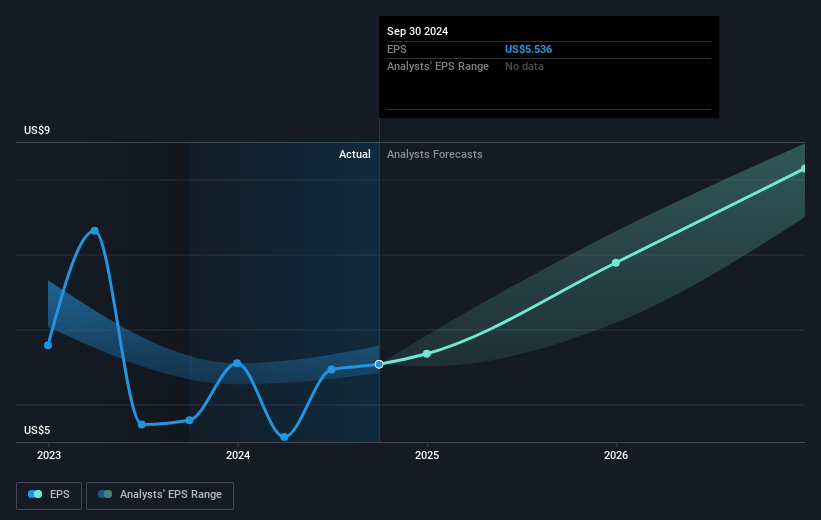

- Analysts expect earnings to reach $642.0 million (and earnings per share of $8.54) by about March 2028, up from $426.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.7x on those 2028 earnings, up from 19.0x today. This future PE is greater than the current PE for the US Hospitality industry at 23.3x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.25%, as per the Simply Wall St company report.

Churchill Downs Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The planned construction projects at Churchill Downs may lead to disruptions or delays, impacting the guest experience during the Derby and potentially affecting revenue if ticket sales are impacted by construction activities.

- The heavy investment in capital projects, such as the Skye Terrace and Conservatory renovations, creates a risk if there is not sufficient demand for the increased number of premium seats, which could affect net margins if expected revenue does not materialize.

- HRM facilities take time to ramp up in new markets, and reliance on building customer bases in areas unfamiliar with historical racing machines may delay anticipated earnings growth, particularly in Virginia.

- The company faces competition from gray market gaming operations, which could siphon off potential revenue and adversely impact earnings from their legitimate gaming properties in affected regions.

- Economic factors, such as inflation and shifts in consumer spending behavior, could impact the performance of regional gaming properties, potentially affecting revenue and net margins if economic conditions weaken consumer discretionary spending.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $159.745 for Churchill Downs based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.2 billion, earnings will come to $642.0 million, and it would be trading on a PE ratio of 23.7x, assuming you use a discount rate of 9.3%.

- Given the current share price of $110.39, the analyst price target of $159.75 is 30.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.