Narratives are currently in beta

How have these above catalysts been quantified?

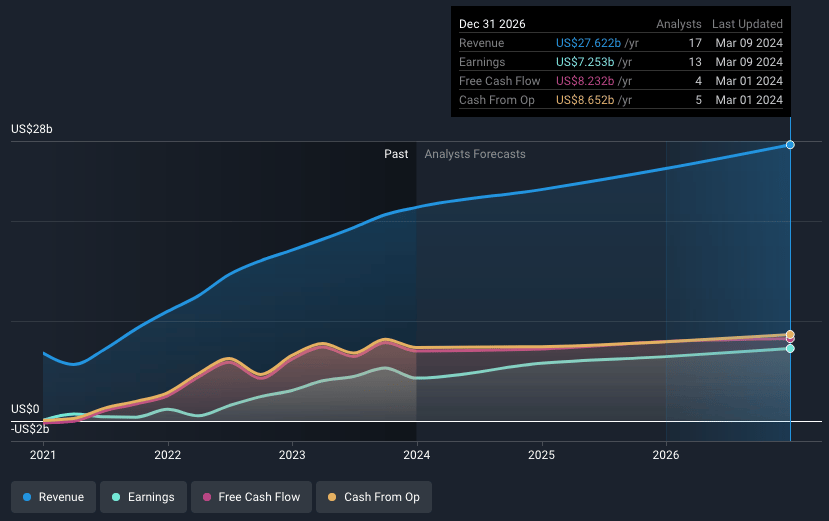

- Analysts are assuming Booking Holdings's revenue will grow by 8.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 20.1% today to 26.3% in 3 years time.

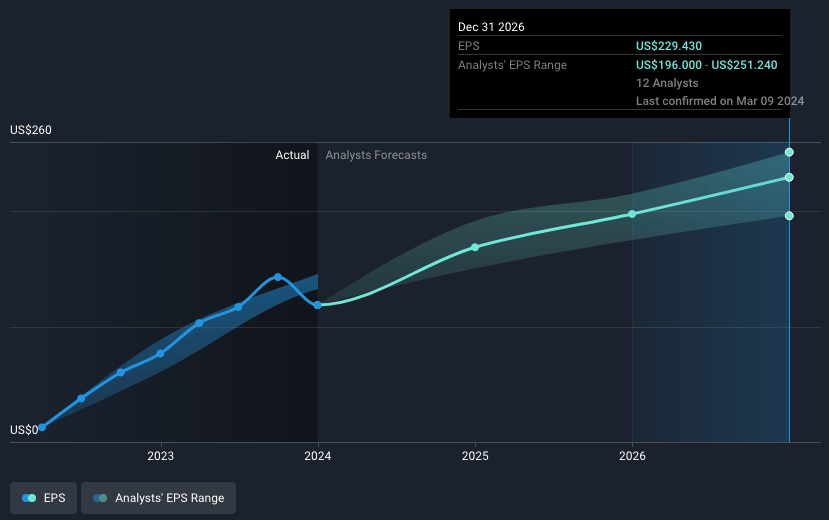

- Analysts expect EPS to reach $229.43 ($7.3 billion in earnings) by about March 2027, up from $125.52 today.

- Expansion and innovation in the Genius loyalty program and strategic AI investments are set to drive revenue, enhance customer retention, and improve operational efficiency.

- The company's focus on alternative accommodations in the U.S. and shareholder value initiatives like share repurchases and dividends signals strong financial health and market share growth.

- High reliance on cancellable bookings, geopolitical tensions, regulatory challenges, intense competition, and technological execution risk threaten Booking Holdings' revenue and market position.

What are the underlying business or industry changes driving this perspective?

- Record-setting 2023 results signal a stronger business model, with further growth projected for 2024, supporting revenue and EPS enhancements through increased bookings and efficient scaling.

- Expansion of the Genius loyalty program across all travel verticals marks an innovative forward-looking approach to enhance customer retention and stimulate repeat bookings, positively impacting revenue.

- Strategic investments in AI and technology for enhancing customer service and operational efficiency are expected to drive lower customer service contact rates and increase developer productivity, improving net margins and earnings.

- Strengthening of alternative accommodations offerings, especially in the U.S., by increasing supply choices opens pathways for market share growth and higher revenue from a diversifying accommodations segment.

- Share repurchase program and the initiation of a quarterly dividend demonstrate strong cash flow and financial health, aiming to deliver value back to shareholders, which is likely to support EPS growth and investor confidence.

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $3942.4 for Booking Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $27.6 billion, earnings will come to $7.3 billion, and it would be trading on a PE ratio of 19.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of $3502.74, the analyst's price target of $3942.4 is 11.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

What could happen that would invalidate this narrative?

- The high reliance on future bookings being cancellable poses a risk to revenue stability, potentially impacting Booking Holdings' anticipated revenue growth.

- Global geopolitical tensions or economic downturns could affect leisure travel demand, directly influencing Booking Holdings' gross bookings and overall financial performance.

- Regulatory challenges, as highlighted by the pending fine from the Spanish competition authority, could lead to operational restrictions or significant financial penalties, impacting net margins and earnings.

- Intense competition in the travel bookings sector could pressure Booking Holdings to increase marketing spend or lower prices, negatively impacting profit margins and earnings.

- Technological advancements and AI integration present an execution risk; failing to effectively innovate or keep pace with competitors could hinder Booking Holdings' ability to attract and retain users, affecting revenue and market position.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

Consensus Narrative from 37 Analysts

Connected Trip Vision And AI Investments Will Drive Future Operational Efficiency

Key Takeaways Expansion in merchant capabilities and AI investments may drive revenue and operational efficiency, improving net margins and supporting the connected trip vision. Strong growth in Asia and a capital return program are expected to enhance revenue growth and boost adjusted earnings per share.

View narrativeUS$5.28k

FV

6.7% undervalued intrinsic discount8.52%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

20users have followed this narrative

13 days ago author updated this narrative