Narratives are currently in beta

Key Takeaways

- Airbnb's market expansion and Cohost network initiatives are poised to drive revenue growth and potentially improve net margins through increased bookings and cost reductions.

- Enhancements in quality and AI-driven customer service are expected to improve customer satisfaction, reduce costs, and increase rebooking and user engagement, supporting earnings growth.

- Regulatory challenges, rising costs, and competition could impact Airbnb's growth, profitability, and market share amid macroeconomic uncertainties.

Catalysts

About Airbnb- Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

- Airbnb's expansion into underpenetrated markets presents a significant growth opportunity, as demonstrated by their recent success in regions like Brazil and Japan. This expansion is expected to drive revenue growth as they capture more first-time users in new geographical areas.

- The introduction of the Cohost network aims to unlock additional high-quality supply by connecting experienced hosts with individuals who have homes but lack the time to manage them. This initiative could increase average booking numbers, impacting overall revenue and potentially stabilizing or reducing costs associated with acquiring new supply, thereby supporting net margins.

- Enhanced reliability and quality through initiatives such as the removal of low-quality listings and the introduction of guest favorites are expected to improve customer satisfaction and increase rebooking rates. This focus on quality is likely to boost net margins by reducing customer service costs and increasing the likelihood of repeat bookings.

- Airbnb's plan to expand beyond its core accommodations business by launching new products, such as reimagined experiences, could open new revenue streams. By capturing a larger share of travelers' expenditures and potentially increasing user engagement frequency, these new initiatives are anticipated to bolster overall earnings growth.

- Technological advancements in AI-driven customer service are poised to improve operational efficiency and reduce costs, contributing positively to net margins. This transformation promises faster and more personalized customer support, potentially lowering service-related expenses and increasing user satisfaction and retention.

Airbnb Future Earnings and Revenue Growth

Assumptions

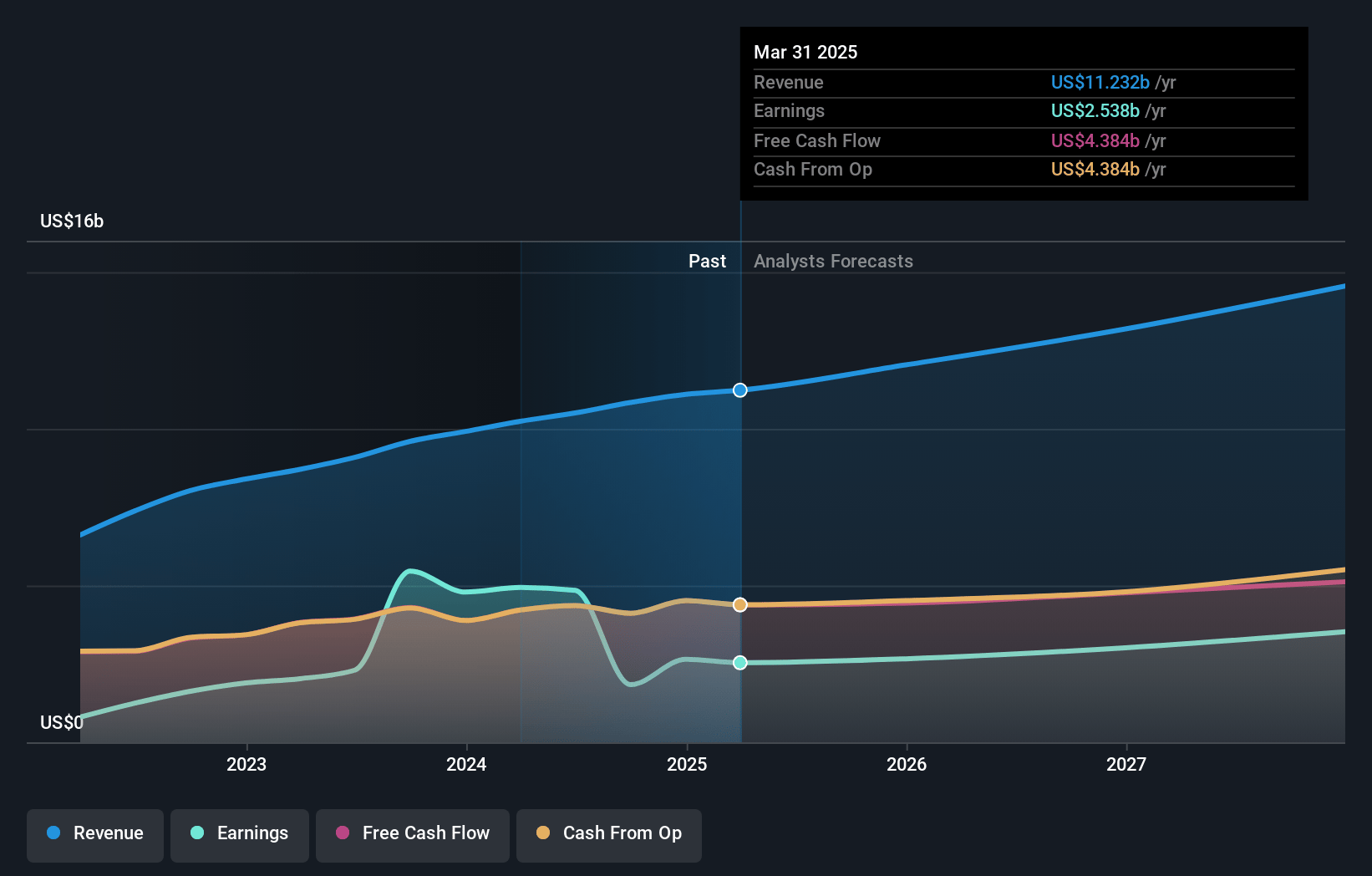

How have these above catalysts been quantified?- Analysts are assuming Airbnb's revenue will grow by 10.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.0% today to 24.9% in 3 years time.

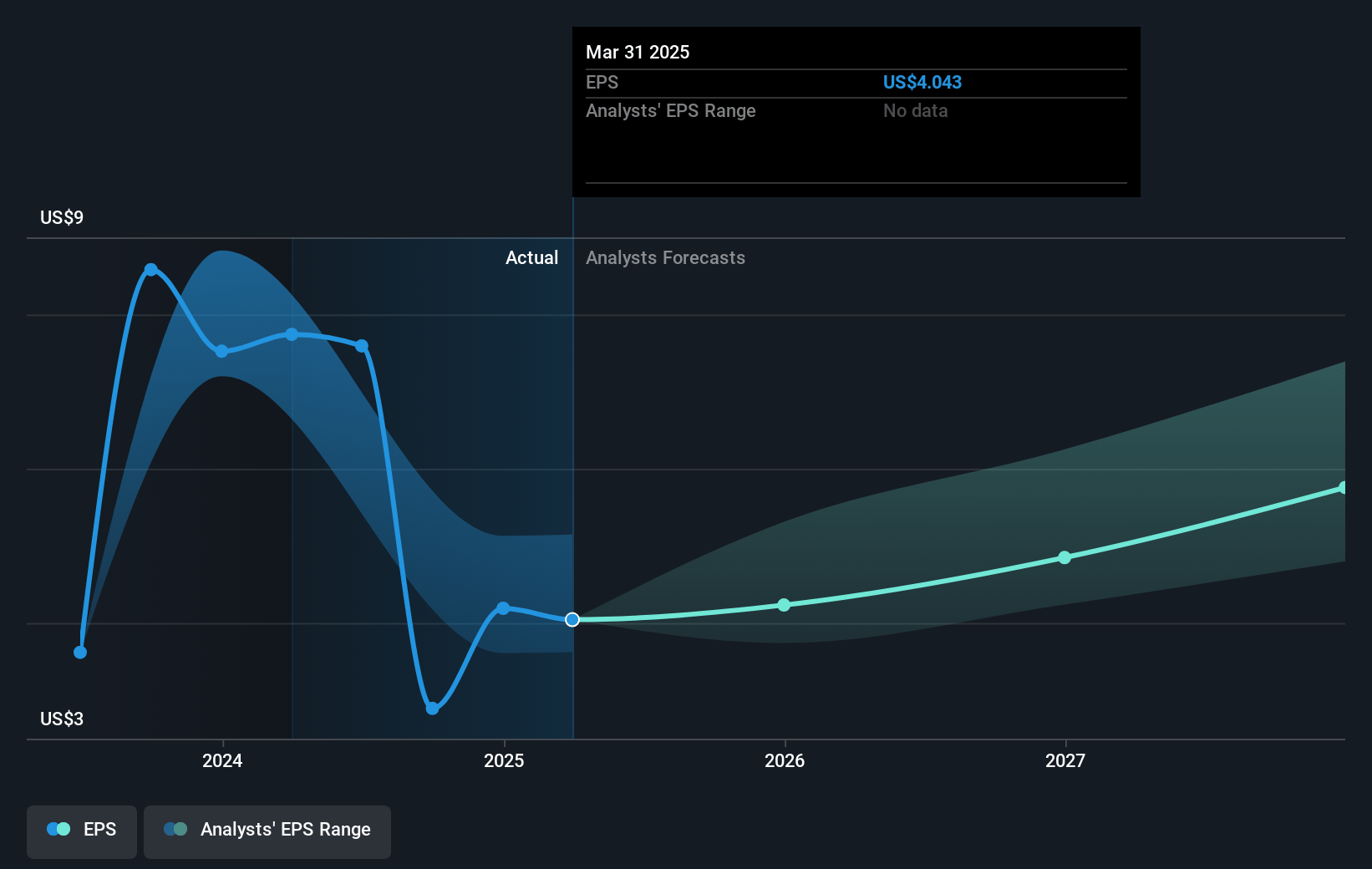

- Analysts expect earnings to reach $3.6 billion (and earnings per share of $5.74) by about January 2028, up from $1.8 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $2.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.5x on those 2028 earnings, down from 44.5x today. This future PE is greater than the current PE for the US Hospitality industry at 24.3x.

- Analysts expect the number of shares outstanding to grow by 0.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.36%, as per the Simply Wall St company report.

Airbnb Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regulatory challenges, such as those faced in New York, may impede growth and restrict Airbnb's market accessibility, potentially affecting overall revenue.

- Intense focus on expansion into underpenetrated markets involves execution risks and could divert resources without immediate revenue returns, impacting earnings and net margins.

- Rising operating costs, including increased marketing and product development, could suppress EBITDA margins and reduce profitability.

- Competition from both traditional hotels and similar platforms could affect Airbnb's ability to capture market share, thereby impacting future revenue growth.

- Reliance on global travel recovery means that macroeconomic uncertainties or travel restrictions could adversely influence revenue projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $136.68 for Airbnb based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $170.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $14.6 billion, earnings will come to $3.6 billion, and it would be trading on a PE ratio of 29.5x, assuming you use a discount rate of 7.4%.

- Given the current share price of $131.05, the analyst's price target of $136.68 is 4.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

WallStreetWontons

Community Contributor

ABNB: Steady Ascent and Prudent Projections

Catalysts Millennial and Gen Z Preferences : The growing preferences of Millennial and Gen Z travelers favor Airbnb over traditional hotels. Airbnb’s unique listings appeal to these demographics’ desires for authentic, local stays and memorable experiences.

View narrativeUS$127.49

FV

2.9% overvalued intrinsic discount10.74%

Revenue growth p.a.

15users have liked this narrative

0users have commented on this narrative

5users have followed this narrative

5 months ago author updated this narrative