Key Takeaways

- Flexible travel trends and emerging market growth are expanding Airbnb’s market share and providing a foundation for sustained global revenue acceleration.

- Investments in technology, user experience, and service diversification are driving higher customer loyalty, improved margins, and broader revenue streams.

- Stricter regulations, community pushback, operational challenges, rising costs, and intense competition threaten Airbnb’s revenue growth, profitability, market access, and customer retention.

Catalysts

About Airbnb- Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

- Airbnb is poised to capture a much larger share of the accommodation market as remote and hybrid work continue to enable flexible travel and longer stays, greatly expanding their addressable market and supporting sustained double-digit growth in nights booked, which should directly flow through to higher top-line revenue.

- Rapid international expansion, particularly in emerging markets with rising middle classes, younger populations, and increasing urbanization, is already yielding growth rates in these regions that are more than double those seen in core markets, which is likely to drive meaningful global revenue acceleration and network effect-driven scale advantages over time.

- Ongoing investment in enhancing the guest and host experience—including AI-powered search, dynamic pricing, and user interface improvements—will further close the gap with traditional hotels in reliability and usability, improving conversion rates and customer loyalty, thereby boosting both gross bookings and, ultimately, net margins.

- The platform’s asset-light, highly scalable model, combined with increasing operating leverage as revenues scale, positions Airbnb to continue expanding margins and cash flow generation, with management expecting strong adjusted EBITDA margins even while investing substantially in new initiatives.

- The upcoming expansion of Airbnb’s ecosystem beyond accommodations—including new service launches such as experiences, hotels, and concierge offerings—will diversify revenue streams, increase take rates, and drive both higher revenue and potential net margin improvement over the medium to long term.

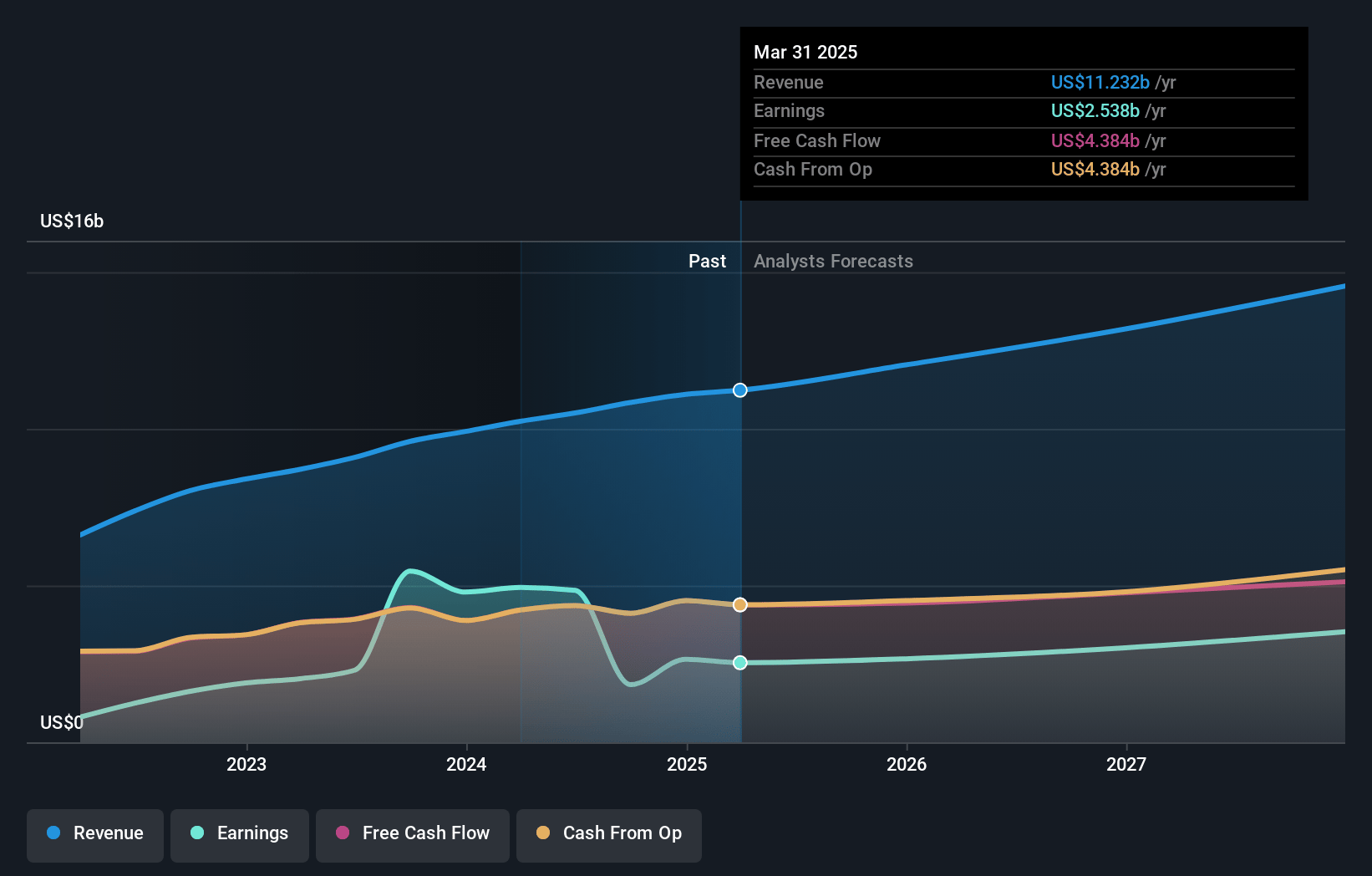

Airbnb Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Airbnb compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Airbnb's revenue will grow by 13.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 22.6% today to 29.9% in 3 years time.

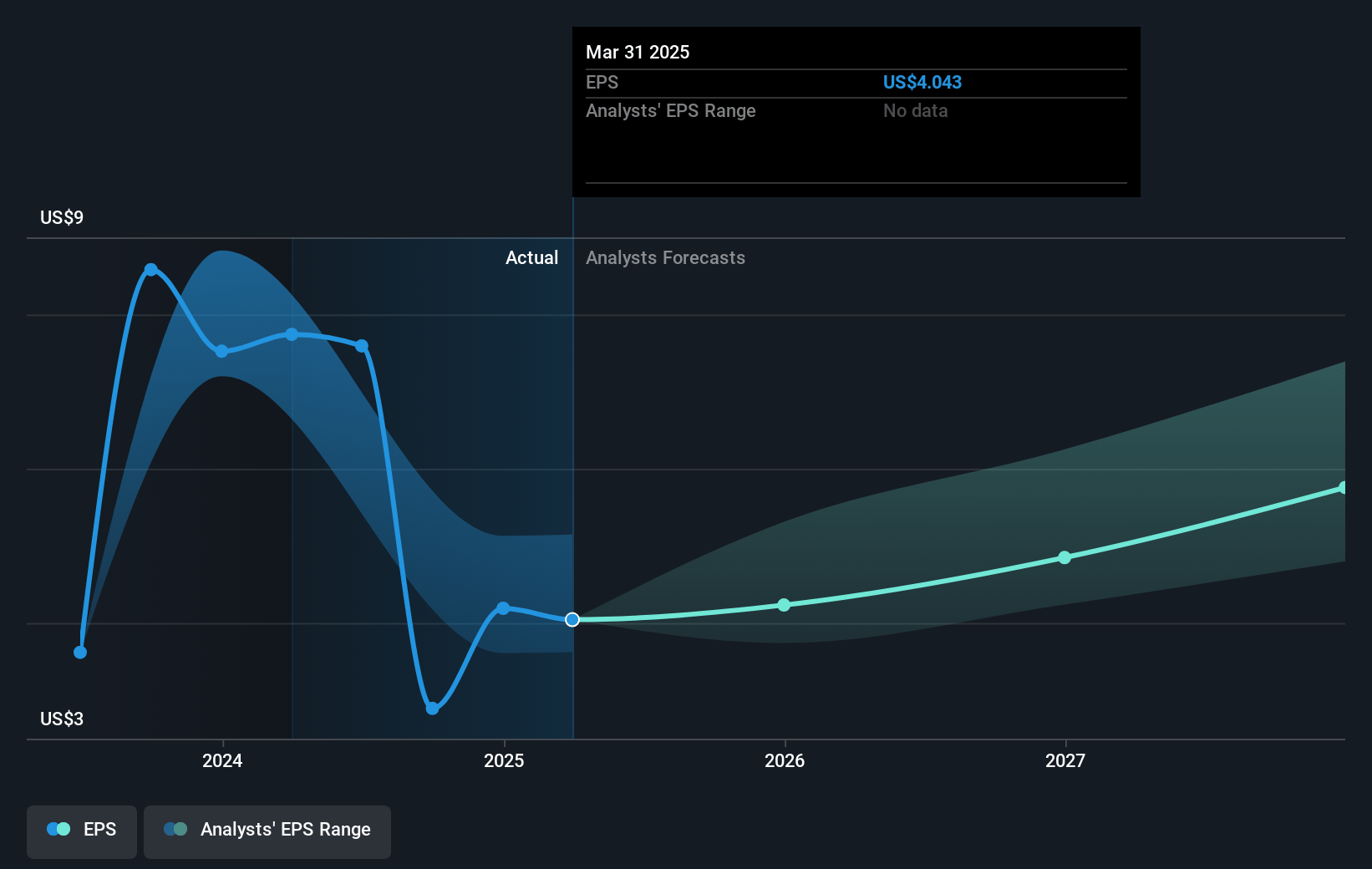

- The bullish analysts expect earnings to reach $4.9 billion (and earnings per share of $7.92) by about July 2028, up from $2.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 26.9x on those 2028 earnings, down from 33.9x today. This future PE is greater than the current PE for the US Hospitality industry at 24.5x.

- Analysts expect the number of shares outstanding to decline by 2.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.92%, as per the Simply Wall St company report.

Airbnb Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent regulatory scrutiny and ongoing government interventions in global short-term rental markets threaten to restrict Airbnb’s listing supply and increase compliance obligations, which can constrain revenue growth and raise operating costs, pressuring long-term net margins.

- Rising anti-tourism sentiment and mounting community backlash in key urban centers risk the imposition of stricter zoning and rental limits, potentially leading to market access reductions in profitable regions and a negative impact on future revenue and earnings.

- Ongoing challenges with maintaining consistent quality and reliability across the growing global platform may undermine customer trust and satisfaction, resulting in increased churn, reduced repeat bookings, and a headwind to sustainable top-line revenue expansion.

- Management’s expectation of rising marketing and operational expenses—especially to penetrate expansion markets and support new business initiatives—could squeeze profit margins and create headwinds for near-term and potentially long-term earnings.

- Intensifying competition from consolidated hotel groups, technology-driven travel platforms, and alternative, professionally-managed accommodations may erode Airbnb’s pricing power and share of demand, limiting growth in both revenue and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Airbnb is $184.53, which represents two standard deviations above the consensus price target of $139.07. This valuation is based on what can be assumed as the expectations of Airbnb's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $200.0, and the most bearish reporting a price target of just $96.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $16.5 billion, earnings will come to $4.9 billion, and it would be trading on a PE ratio of 26.9x, assuming you use a discount rate of 7.9%.

- Given the current share price of $139.43, the bullish analyst price target of $184.53 is 24.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives