Key Takeaways

- The acquisition of Cheney Brothers will boost growth, enhance route efficiency, and increase revenues with improved margins in the Southeast region.

- Investment in technology and facilities, along with share repurchase efforts, aims to enhance revenue streams, EPS, and cost efficiencies.

- Operational challenges from hurricanes, acquisition integration uncertainty, and cost inflation could pressure margins and earnings, while increasing leverage may limit financial flexibility.

Catalysts

About Performance Food Group- Through its subsidiaries, engages in the marketing and distribution of food and food-related products in North America.

- The acquisition of Cheney Brothers, with its high-quality distribution facilities and excess capacity, is expected to accelerate growth, build scale, and improve route density across the Southeast region, contributing to increased revenues and improved net margins.

- The integration of private brand offerings from acquisitions such as Cheney Brothers presents an opportunity to enhance top-line growth and increase margins due to higher profit per case and improved EBITDA margins.

- The company's growth strategy emphasizes cross-segment collaboration and the adoption of technology, such as the customer-first digital ordering application, which is expected to create cross-selling opportunities and increase customer engagement, ultimately enhancing revenue streams.

- Planned investments in new building projects and state-of-the-art warehouse facilities over the next 12 months aim to support consistent top-line growth and incorporate cost efficiencies, which could positively impact net margins and earnings.

- Active share repurchase activities reflect the company's focus on shareholder value, which, in combination with leverage reduction and reinvestment plans, is expected to enhance earnings per share (EPS) in the long run.

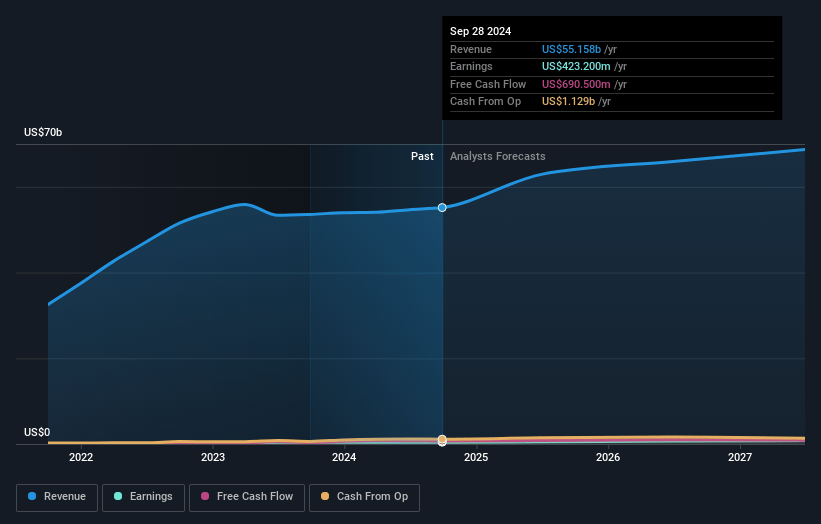

Performance Food Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Performance Food Group's revenue will grow by 8.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.8% today to 1.2% in 3 years time.

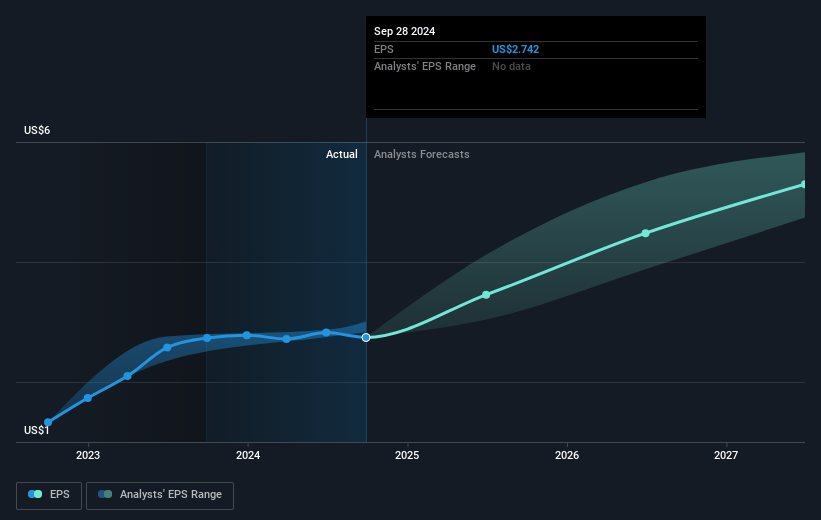

- Analysts expect earnings to reach $846.6 million (and earnings per share of $5.52) by about January 2028, up from $423.2 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $711.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.5x on those 2028 earnings, down from 33.1x today. This future PE is lower than the current PE for the US Consumer Retailing industry at 27.1x.

- Analysts expect the number of shares outstanding to decline by 0.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.31%, as per the Simply Wall St company report.

Performance Food Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Southeast region, where Cheney Brothers operates, has faced challenges due to hurricane activity, which could disrupt operations and impact revenue and margins in the short term.

- There is uncertainty regarding the full integration and synergy realization of the Cheney Brothers and Jose Santiago acquisitions, which could affect net margins and expected earnings growth if not executed properly.

- Vistar continues to experience lower foot traffic and challenges in theater and retail channels, potentially impacting the segment's revenue and EBITDA performance.

- The company's net leverage is expected to rise above the targeted range temporarily due to the Cheney acquisition, which could limit financial flexibility and increase interest expenses.

- While foodservice operations have shown resilience, ongoing cost inflation in foodservice and convenience segments, especially in poultry and cheese, may pressure net margins and earnings if not managed adequately.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $98.92 for Performance Food Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $110.0, and the most bearish reporting a price target of just $84.98.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $70.9 billion, earnings will come to $846.6 million, and it would be trading on a PE ratio of 21.5x, assuming you use a discount rate of 6.3%.

- Given the current share price of $90.04, the analyst's price target of $98.92 is 9.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives