Narratives are currently in beta

Key Takeaways

- Transition to SAP systems enhances operations, positively impacting revenue, earnings, and reducing inefficiencies to improve margins.

- Expansion of stores and focus on delivering extreme value items is expected to drive customer traffic and revenue growth.

- Operational and leadership challenges, along with increased costs and pricing issues, have negatively impacted sales, margins, and strategic decision-making at Grocery Outlet Holding.

Catalysts

About Grocery Outlet Holding- Operates as a retailer of consumables and fresh products sold through independently operated stores in the United States.

- Enhanced execution following the transition to SAP systems, including improved data visibility and functionality, is expected to optimize operations, which could positively impact revenue and earnings by enabling more efficient purchase orders, inventory management, and customer service.

- The company's focus on sharpening its value proposition by delivering extreme value items could drive an increase in customer traffic and revenue growth, as well as potentially enhance margins if executed effectively against competition.

- Grocery Outlet plans to continue expanding its store count, aiming for 66 net new stores in fiscal 2024, which is expected to provide a boost to top-line sales growth. This expanded footprint should help in increasing overall revenue.

- The completion of systems transition work will reduce inefficiencies and operational frictions, potentially lowering SG&A costs and improving net margins and EBITDA as process bottlenecks are alleviated, and automation increases.

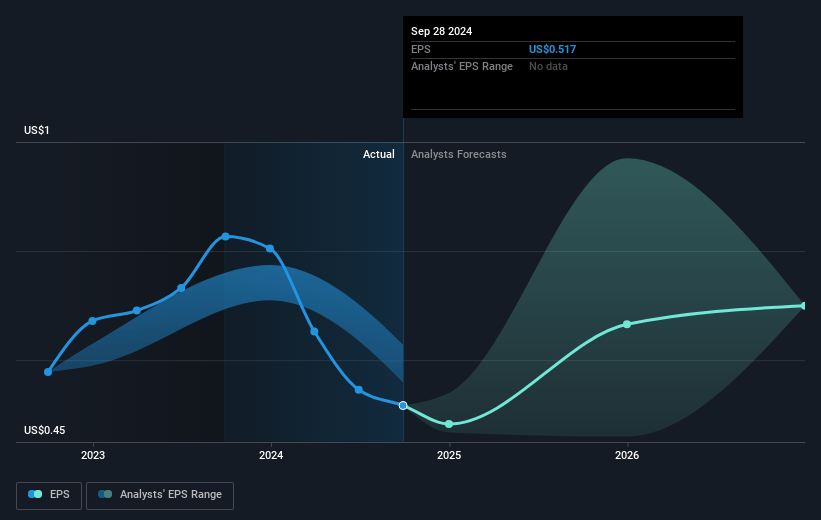

- The announcement of a new share repurchase authorization program of up to $100 million may serve as a catalyst for earnings per share (EPS) growth by reducing the share count, thereby increasing EPS through buybacks.

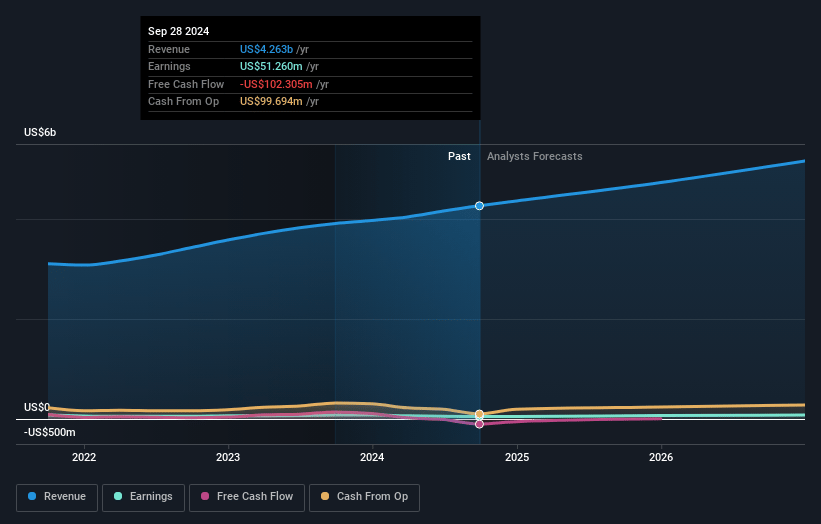

Grocery Outlet Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Grocery Outlet Holding's revenue will grow by 9.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.3% today to 1.5% in 3 years time.

- Analysts expect earnings to reach $83.4 million (and earnings per share of $0.74) by about November 2027, up from $54.2 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $67.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.7x on those 2027 earnings, up from 26.3x today. This future PE is greater than the current PE for the US Consumer Retailing industry at 22.3x.

- Analysts expect the number of shares outstanding to grow by 4.79% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 7.02%, as per the Simply Wall St company report.

Grocery Outlet Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The transition to the SAP system has caused significant issues, including poor data visibility and slow system speeds, affecting inventory management and purchasing efficiency. This impacts revenue and operational costs.

- Recent execution challenges, particularly in pricing and maintaining their value proposition, have resulted in weaker-than-expected comparable store sales and could impact future revenues.

- The departure of key leadership, including the CEO, during a period of operational strain could lead to organizational uncertainty and affect strategic decision-making, impacting long-term earnings.

- Increased SG&A expenses and higher costs associated with system enhancements and additional resources have led to a reduction in guidance for adjusted EBITDA, impacting net margins.

- Competitive pricing actions earlier in the year affected the perceived value by consumers, risking market share and impacting gross profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.86 for Grocery Outlet Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $29.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $5.4 billion, earnings will come to $83.4 million, and it would be trading on a PE ratio of 32.7x, assuming you use a discount rate of 7.0%.

- Given the current share price of $14.56, the analyst's price target of $19.86 is 26.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives