Key Takeaways

- Expanding the multi-price format and completing acquisitions indicate potential revenue growth and market share gains for Dollar Tree.

- Strategic actions and supply chain investments hint at improved efficiencies, cost reductions, and enhanced margins.

- Strategic uncertainties, tariff impacts, and pressure on low-income consumers may constrain profitability, while investments and store format shifts risk short-term net margin impacts.

Catalysts

About Dollar Tree- Operates retail discount stores.

- Dollar Tree is expanding its multi-price 3.0 format, which has shown improved sales productivity and market share gains, signaling potential future revenue growth as more stores are converted.

- The integration of the acquired 99 Cents Only stores is nearly complete, with strong initial sales performance, hinting at potential revenue increases as more locations benefit from the conversion.

- Strategic actions at Family Dollar, including a pricing strategy shift and store renovation programs, have already shown positive impacts on traffic and sales, indicating potential improvements in revenue and profitability.

- Despite supply chain challenges, Dollar Tree is investing in new distribution capacity and improved efficiencies, which could reduce costs and enhance net margins as the supply chain stabilizes.

- Proactive efforts to reduce shrink and manage inventory more effectively across both banners suggest potential improvements in gross margins and overall earnings.

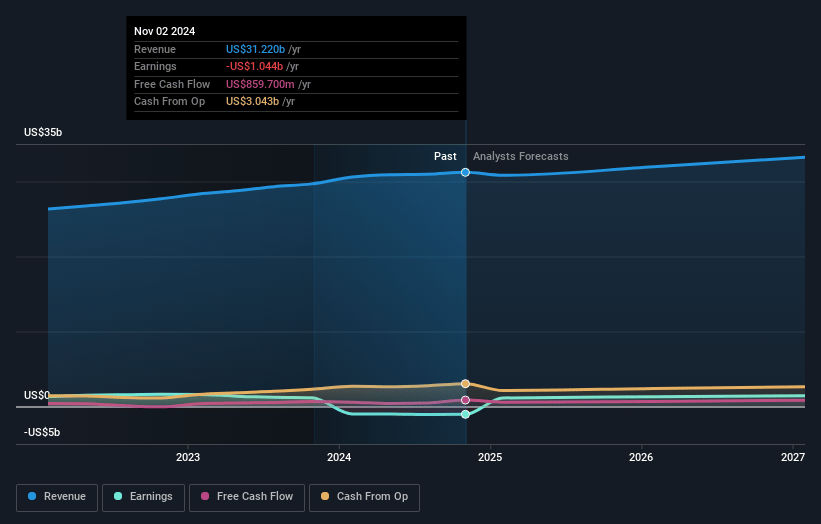

Dollar Tree Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Dollar Tree's revenue will grow by 3.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -3.3% today to 4.5% in 3 years time.

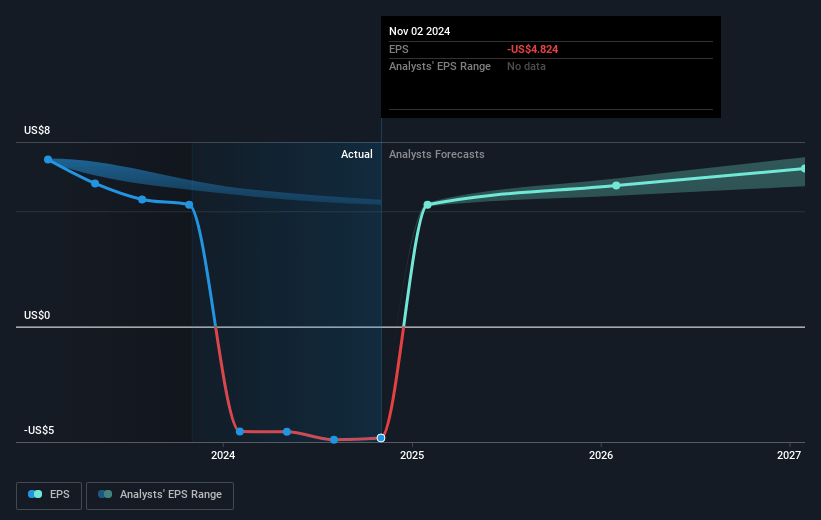

- Analysts expect earnings to reach $1.5 billion (and earnings per share of $7.45) by about January 2028, up from $-1.0 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, up from -15.4x today. This future PE is lower than the current PE for the US Consumer Retailing industry at 27.1x.

- Analysts expect the number of shares outstanding to decline by 1.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.65%, as per the Simply Wall St company report.

Dollar Tree Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The strategic review of Family Dollar, including a potential sale or disposition, introduces uncertainty that may affect long-term stability and projections, potentially impacting future earnings.

- Proposals for new tariffs may affect operational costs, although the company has strategies in place to mitigate impact, further tariffs could squeeze margins, affecting profitability.

- The pressure on low-income consumers, a key customer base, limits discretionary spending, which may affect sales growth and lead to a heightened reliance on consumables, impacting revenue and gross margins.

- The pace and effectiveness of the store conversion to the multi-price 3.0 format need careful management; if execution falters, it could lead to operational inefficiencies or missed financial targets, affecting net margins.

- Elevated costs due to planned strategic investments, such as in supply chain and store formats, may not yield expected results immediately, which could impair net margins in the short term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $84.13 for Dollar Tree based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $34.1 billion, earnings will come to $1.5 billion, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 6.6%.

- Given the current share price of $74.95, the analyst's price target of $84.13 is 10.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives