Key Takeaways

- Rising price sensitivity and competition from direct-to-consumer brands threaten YETI's ability to maintain growth and premium margins.

- Slowed innovation, environmental regulation pressures, and changing consumer preferences risk shrinking YETI's market and compressing earnings.

- A multifaceted strategy of international expansion, supply chain overhaul, product innovation, omnichannel growth, and brand strengthening is driving sustainable revenue, margin, and earnings growth.

Catalysts

About YETI Holdings- Designs, retails, and distributes outdoor products under the YETI brand name.

- Ongoing consumer price sensitivity and increasing trade-down behavior amid persistent inflation are expected to undermine demand for YETI's premium, discretionary products, directly suppressing top-line revenue growth as large segments of the market shift to more affordable alternatives.

- The rapid acceleration of direct-to-consumer competitors and e-commerce titans is anticipated to intensify pricing pressure and erode YETI’s ability to acquire customers cost-effectively, leading to increased churn rates and long-term pressure on both gross and operating margins.

- Continued heavy reliance on new product innovation faces the dual threat of a slowing innovation cycle, core market saturation in key categories like coolers and drinkware, and execution risk exacerbated by ongoing supply chain disruptions—setting up for potential stagnation in new customer acquisition and a plateau in overall revenue.

- Increasingly stringent environmental regulations and the global push for sustainability are likely to drive up compliance and material costs for non-biodegradable, plastic-heavy products, accelerating margin compression and making YETI’s current gross margin structure unsustainable in the next three to five years.

- Shifting consumer recreation patterns and potential reduction in outdoor activity participation are poised to shrink the total addressable market for high-end outdoor goods, which, combined with escalating competition from mass-market and private label brands, will likely result in lower average selling prices and a material contraction in both revenue and earnings over the long term.

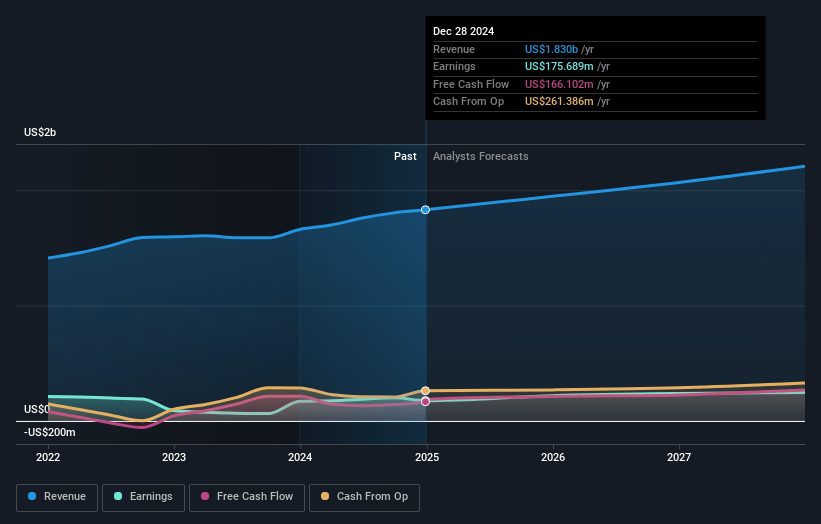

YETI Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on YETI Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming YETI Holdings's revenue will grow by 4.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 9.6% today to 9.2% in 3 years time.

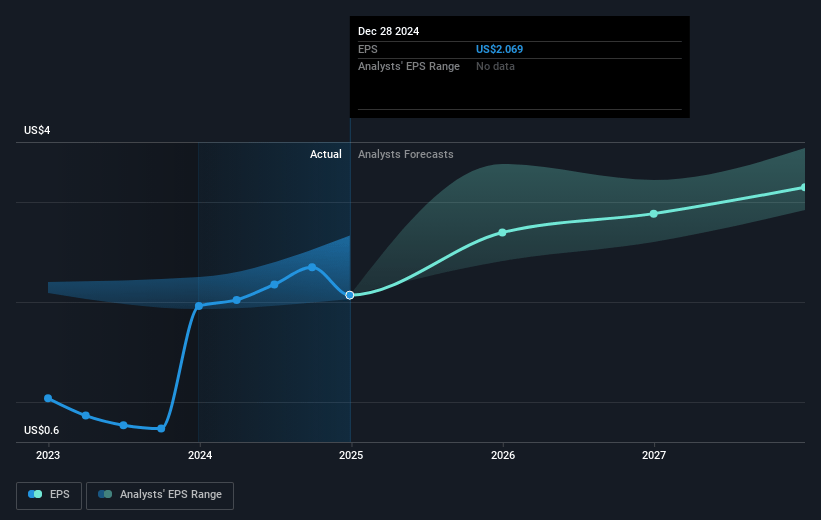

- The bearish analysts expect earnings to reach $190.7 million (and earnings per share of $2.3) by about July 2028, up from $176.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, down from 15.8x today. This future PE is lower than the current PE for the US Leisure industry at 20.1x.

- Analysts expect the number of shares outstanding to decline by 2.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.51%, as per the Simply Wall St company report.

YETI Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- YETI is executing a robust international expansion strategy, with strong double-digit sales growth in Europe, Australia, and Canada, and is entering Japan to build a beachhead for future Asia growth; this broadening geographic footprint supports top-line revenue growth and reduces reliance on the U.S. market.

- The company is aggressively accelerating its supply chain transformation, dramatically reducing its cost of goods exposure to China from levels that triggered major tariffs to less than five percent by the end of 2025; this move is likely to restore gross and operating margins starting in 2026 as tariff-related costs abate.

- YETI is materially increasing its pace of product innovation, targeting a record number of new product launches in 2025 and beyond, with investments in global R&D centers and a nimble development process; this innovation pipeline drives continued consumer demand, higher average selling prices, and long-term revenue and earnings growth.

- The company’s omnichannel strategy, with significant direct-to-consumer, e-commerce, Amazon Marketplace, and corporate sales expansion, alongside strong wholesale partnerships, provides resilience and higher margin opportunities, supporting net margin improvement over time.

- Deepening brand equity—evidenced by high-profile activations, partnerships (e.g., Chicago Cubs, major festivals), ambassador programs, and increasing CRM engagement rates—is fostering higher customer lifetime value and repeat purchasing, likely to have a compounding positive effect on long-term earnings and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for YETI Holdings is $28.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of YETI Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $53.0, and the most bearish reporting a price target of just $28.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $190.7 million, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 6.5%.

- Given the current share price of $33.76, the bearish analyst price target of $28.0 is 20.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.