Narratives are currently in beta

Key Takeaways

- New U.S. product launch and consumer-focused innovations target growth, improving revenue and margins in the bedding market segment.

- International expansion and strategic acquisitions boost growth and profitability, enhancing operational efficiency and market positioning.

- Potential regulatory challenges and integration costs from Mattress Firm acquisition could impact earnings amidst weak bedding industry volumes.

Catalysts

About Tempur Sealy International- Designs, manufactures, distributes, and retails bedding products in the United States and internationally.

- The launch of the all-new U.S. Sealy Posturepedic products in 2025 is expected to ignite growth in the U.S. bedding market, potentially increasing revenue as it targets a weak mid-to-entry level market.

- The company's focus on consumer-centric innovation, including the introduction of AI-driven sleep insights and industry-leading cooling technology, could lead to increased average transaction values, positively impacting revenue and margins.

- Expansion of international operations, including the successful performance of the Dreams acquisition and new product launches in key markets, is driving double-digit growth, which can enhance overall international operating margins and revenue.

- The proposed acquisition of Mattress Firm could allow Tempur Sealy to leverage its scale and optimize distribution, which is expected to enhance earnings and profitability once acquisition-related efficiencies are realized.

- Continued investments in manufacturing and advertising, paired with a strategic product and brand refresh, are positioned to increase sales and operating leverage, potentially improving net margins and earnings as the market normalizes.

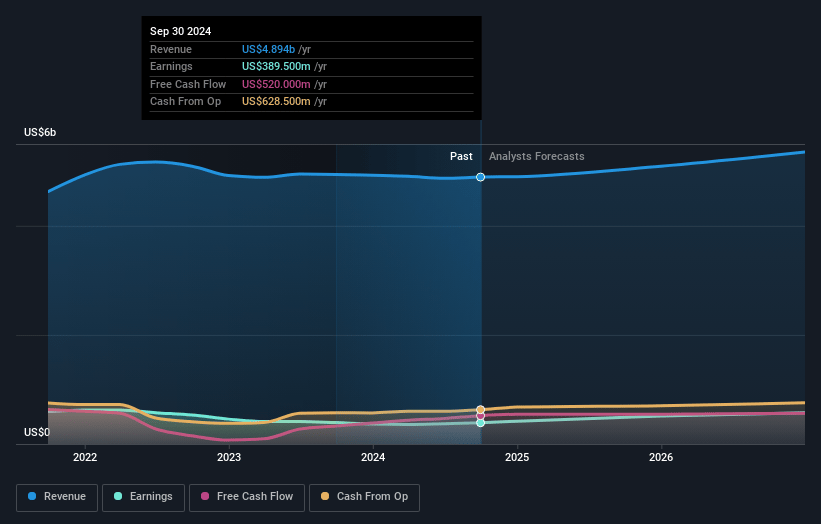

Tempur Sealy International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tempur Sealy International's revenue will grow by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.0% today to 10.9% in 3 years time.

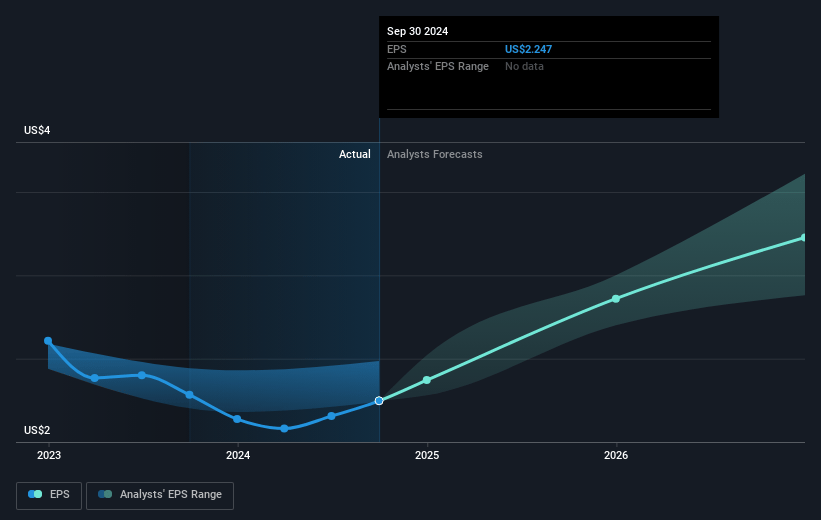

- Analysts expect earnings to reach $605.2 million (and earnings per share of $3.44) by about January 2028, up from $389.5 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $521.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.9x on those 2028 earnings, down from 24.5x today. This future PE is greater than the current PE for the US Consumer Durables industry at 10.3x.

- Analysts expect the number of shares outstanding to grow by 0.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.6%, as per the Simply Wall St company report.

Tempur Sealy International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Although Tempur Sealy's U.S. business is performing well compared to the broader market, the overall bedding industry remains significantly below historical volumes. This prolonged market weakness could impact future revenue growth if conditions don't improve as expected.

- The planned acquisition of Mattress Firm introduces uncertainties, including regulatory challenges with the FTC and the need for divestitures, which could affect earnings if the integration or related legal processes incur unforeseen costs or delays.

- The company's guidance reflects a high single-digit decline in 2024 U.S. bedding industry unit volumes, which could impact revenue if industry recovery is delayed beyond expected timeframes.

- International growth is strong, but relies heavily on new products and distribution expansions; any disruptions or underperformance in these areas could impact international revenue and operating margins.

- The new Sealy Posturepedic launch is expected to drive growth; however, the significant investment in advertising and potential early-stage expenses may put pressure on net margins and bottom-line performance in 2025.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $61.75 for Tempur Sealy International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $67.0, and the most bearish reporting a price target of just $55.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.5 billion, earnings will come to $605.2 million, and it would be trading on a PE ratio of 22.9x, assuming you use a discount rate of 8.6%.

- Given the current share price of $54.98, the analyst's price target of $61.75 is 11.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives