Key Takeaways

- Positive long-term outlook and revenue growth expected due to strong demand in the luxury home market and stable affluent customer base.

- Strategic land acquisitions and a flexible balance sheet protect margins and support selective investment, enhancing profitability and market presence.

- Mixed demand, rising inventories, and joint venture delays could pressure sales, revenues, and margins, impacting Toll Brothers' earnings and growth prospects.

Catalysts

About Toll Brothers- Designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States.

- Toll Brothers anticipates positive long-term outlook for the luxury home market, primarily driven by their affluent customer base with over 70% of their business in luxury move-up and empty nester segments. This supports potential revenue growth due to higher sales prices and demand stability even if broader market conditions fluctuate.

- The company is seeing strategic opportunities in land acquisitions, like converting underutilized suburban office spaces into residential communities, allowing them to maintain low land cost inflation and protecting gross margins.

- Toll Brothers has a relatively flexible balance sheet with a healthy land position and a strong optioned lot portfolio, enabling the company to be selective and disciplined in new land investments, impacting future gross margins positively.

- The company plans to grow its community count by 8% to 10% in fiscal 2025, aimed at increasing revenue through expanded market presence and leveraging demand from a strong backlog.

- Toll Brothers expects to maintain its adjusted gross margin guidance of 27.25% for the full fiscal year due to a favorable mix shift towards more luxury and North/Pacific region homes which typically yield higher margins.

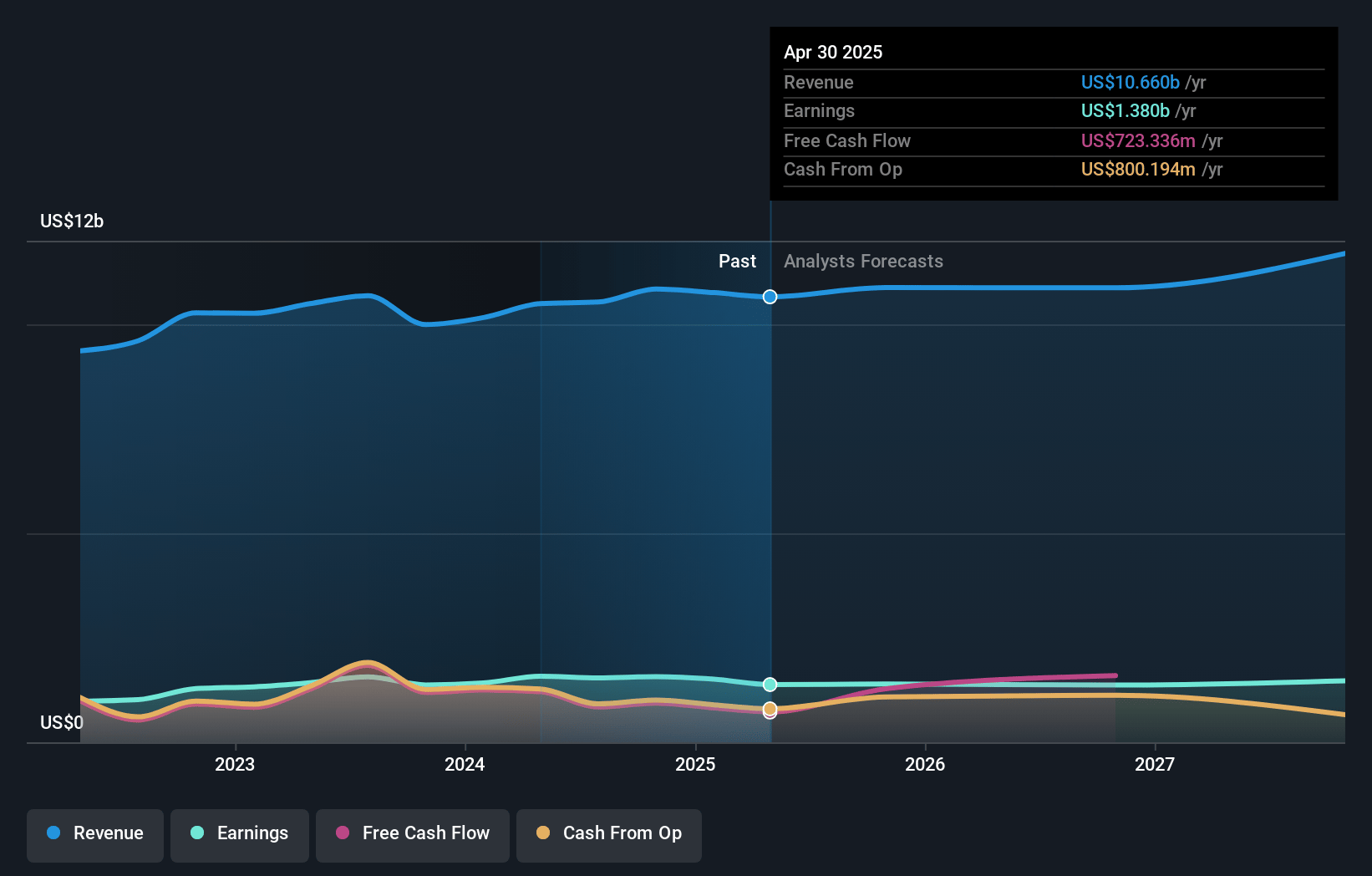

Toll Brothers Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Toll Brothers's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.0% today to 13.1% in 3 years time.

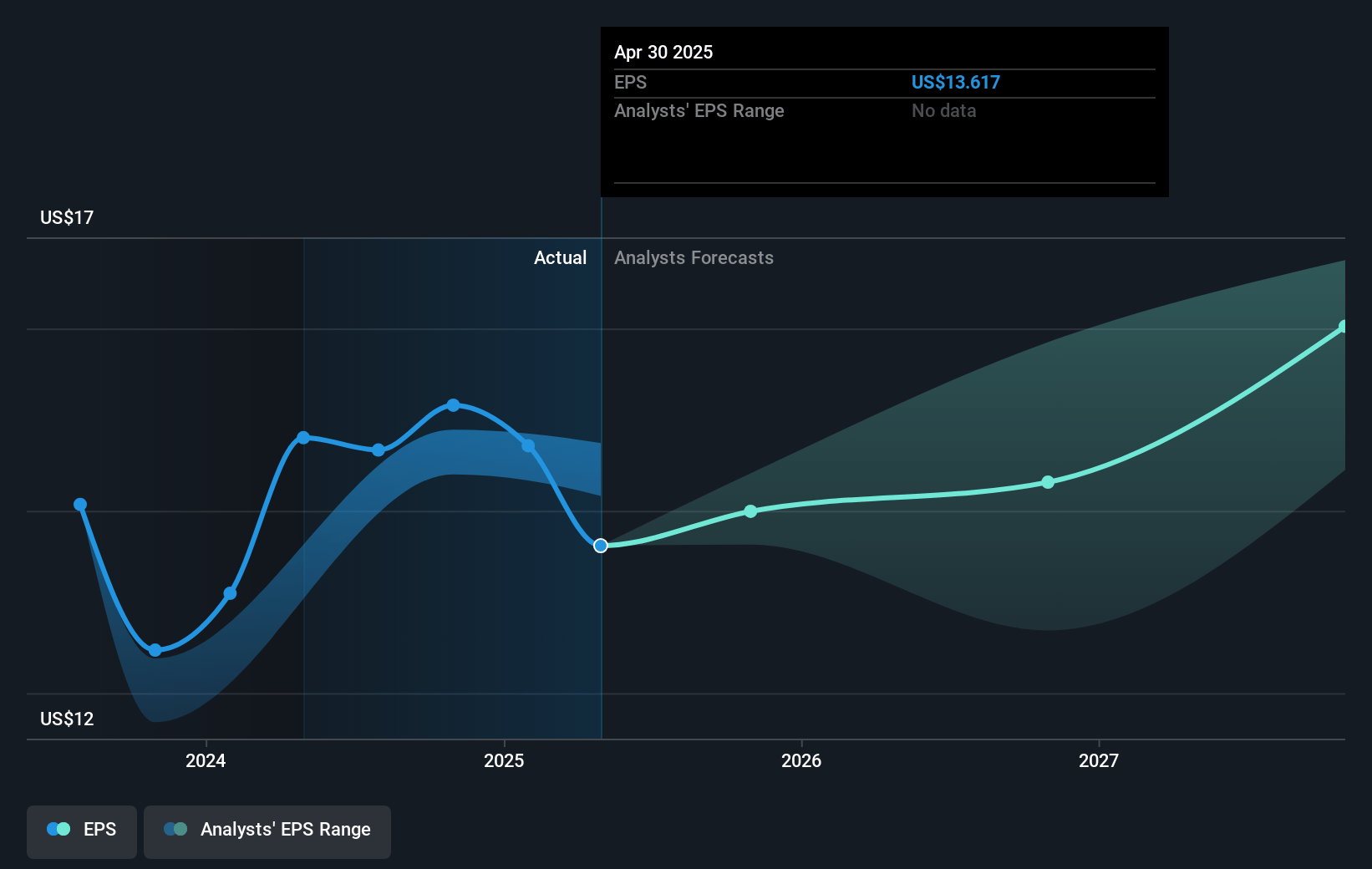

- Analysts expect earnings to reach $1.7 billion (and earnings per share of $17.74) by about March 2028, up from $1.5 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $1.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.8x on those 2028 earnings, up from 7.2x today. This future PE is lower than the current PE for the US Consumer Durables industry at 10.9x.

- Analysts expect the number of shares outstanding to decline by 4.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.98%, as per the Simply Wall St company report.

Toll Brothers Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's net income and earnings per share came in below expectations, primarily due to impairments and a delay in the sale of a stabilized apartment property in one of its joint ventures, which could impact overall earnings.

- There is mixed demand so far in the spring selling season, with affordability constraints and growing inventories in certain markets pressuring sales, especially at the lower end, potentially impacting future revenue growth.

- The inventory rise, particularly in construction in progress, raises concerns about the company's ability to efficiently manage and sell new starts, potentially impacting future net margins if demand falters.

- The first quarter SG&A expense as a percentage of revenue came in above the company's guidance, which, combined with lower-than-anticipated homebuilding revenues, may lead to reduced operating margins.

- There are delays in the closing of significant sales in joint ventures, such as the stabilization of apartment projects, that could affect anticipated cash flows and full-year earnings targets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $146.632 for Toll Brothers based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $183.0, and the most bearish reporting a price target of just $101.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $12.7 billion, earnings will come to $1.7 billion, and it would be trading on a PE ratio of 9.8x, assuming you use a discount rate of 9.0%.

- Given the current share price of $109.27, the analyst price target of $146.63 is 25.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.